Accounting ICAEW CFAB

In this blog post, I present you a comprehensive summary of each chapter covered in my study of Accounting from the ICAEW CFAB 2018 syllabus. Consider this my notes for understanding the fundamentals of Accounting.

Here's a bit of context: I kicked off my journey into the 2018 Accounting syllabus of CFAB in February 2024, starting from ground zero. I must say, the study manual does an adequate job of covering the fundamentals of Accounting for someone completely new to the field.

Disclaimer: I want to acknowledge upfront that I might have overlooked certain content or concepts inadvertently ;-;

Now, without any more delay, let's dive right into the content.

Chapter 1

Introduction

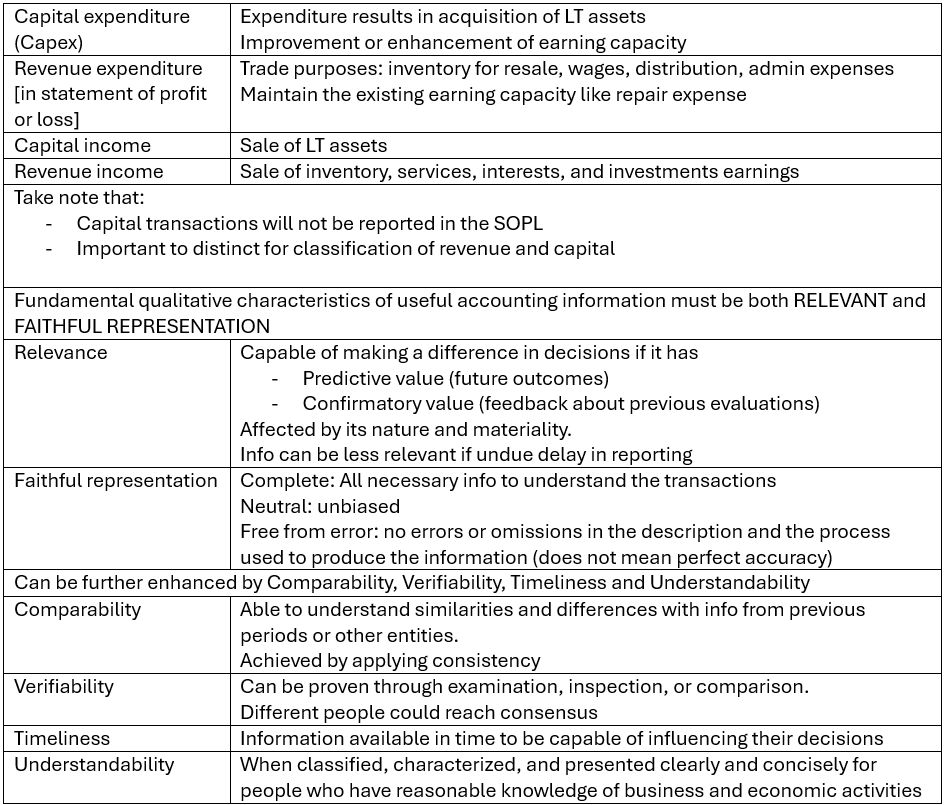

The purpose of accounting information

To record, analyse and summarise transactions of an entity

- Records in books of original entry

- Analysed and posted to ledgers

- Summarise in financial statements

Types of business entity

- Sole traders: owns the business

- Partnerships: two people decide to share risks and rewards

- General

- Limited liability

- Limited liability companies: owners are only responsible for the amount to be paid for their shares

Objective of Financial Statements

- To make economic decisions

- Shows result of management's stewardship

- Predict the entity's future cash flows

Who needs financial information?

- Managers: make decisions about pricing, output, employment and financing

- Owners/shareholders: assess profitability via dividend

- Trade contacts like suppliers and customers: debts and secure source of supply

- Finance providers like banks: ensure can pay bank loans [may ask for cash flow forecast as a pre condition of granting overdraft]

- HM Revenue and Customs (HMRC): tax liabilities [will receive other info for tax assessments]

- Employees: careers and remuneration

- Financial analysts and advisers

- Government agencies: interested in activities of enterprises and basis for statistics

- The public: employment and effect on natural environment like pollution

- Bodies like Financial Conduct Authority (FCA): compliance with laws

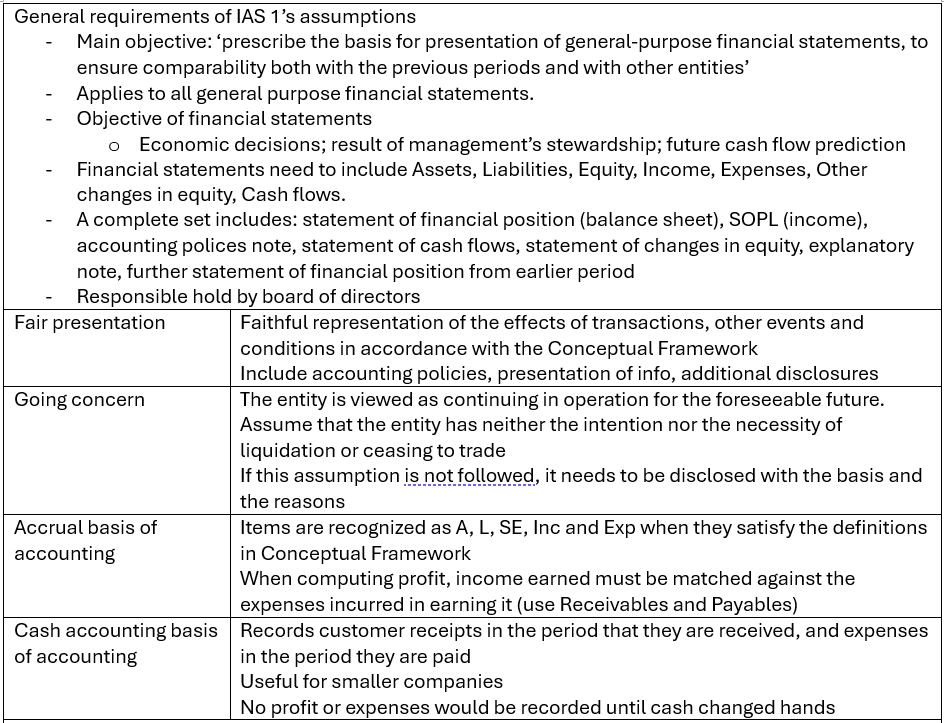

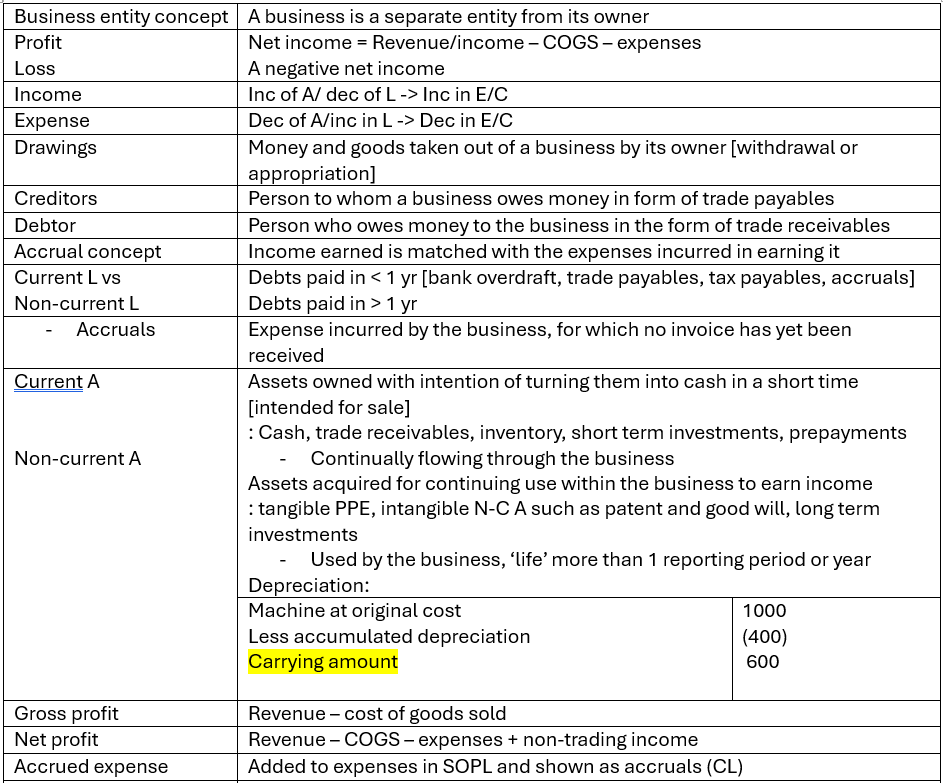

The regulation of accounting

- Generally accepted accounting practice (GAAP): A term to cover all rules, which govern accounting in various jurisdictions

- Legislation: for limited liability companies

- Listed company: comply with IAS and IFRS

- Non-listed: UK accounting standards

- Certain entities are exempted under s394 of Companies act

- Accounting standards: developed by IASB (International Accounting Standard Board), UK level of ASB, Accounting Council of FRC (Financial Reporting Council)

- IASB: responsible for setting

- IFRS (international financial reporting standards)

- IAS (international Accounting standards)

- IFRS interpretations committee

- Standard Industrial Classification (SIC) interpretation

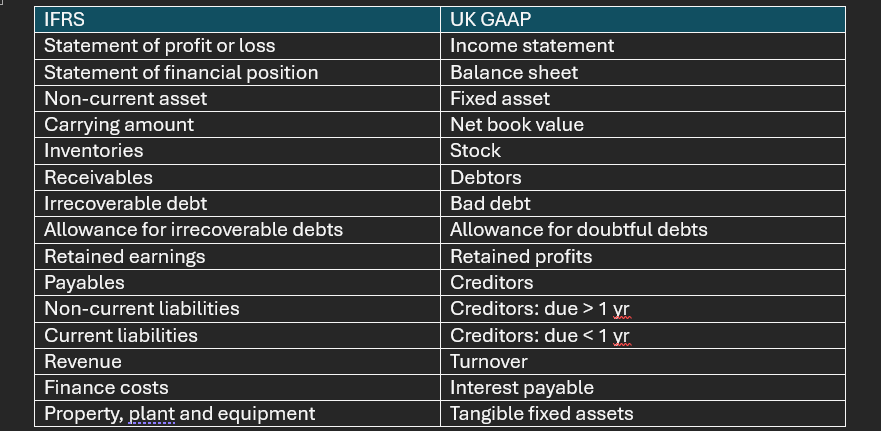

- UK GAAP: for non-listed companies in UK

- IASB: responsible for setting

- True and fair view

- The Conceptual Framework: If financial information is to be useful, it must be relevant and faithfully represent what it purports to represent

- The Companies Act: Financial statements should give a true and fair view of financial position of the entity at a particular point in time

- IAS 1: Financial statements should present fairly the financial position and performance, and the cash flows. [faithful representations of effects of transactions]

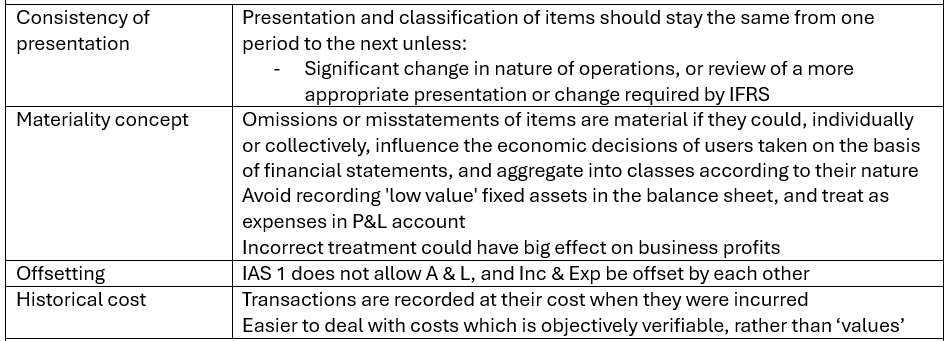

- Accounting concepts and individual judgement

What are the main Financial Statements (FS) of IFRS?

- Statement of Financial Positions (SOFP) or Balance sheet

- Consists of Assets, Liabilities and Shareholder Equity: A=L+SE

- It is a snapshot of financial position

- Factors causing changes:

- Economic resources: Cash, labour, material, machinery, skills

- Financial structure: Funded by owners, lenders, suppliers

- Liquidity and solvency

- Adaptability

- Able to predict entity's ability to generate cash in future

- Financial structure: Future borrowing needs, future profits and cash flows distribution and ability to raise future finance

- Liquidity/solvency: Ability to meet financial commitments

- Statement of Profit or Loss (SOPL) or Income statement

- Consists of Revenue and expenses

- Understand the return its economic resources, how well responsibilities are discharged, and predict future returns

- Related to cash flows and changes in equit

- Statement of Cash Flows

- Summary of Accounting Policies note

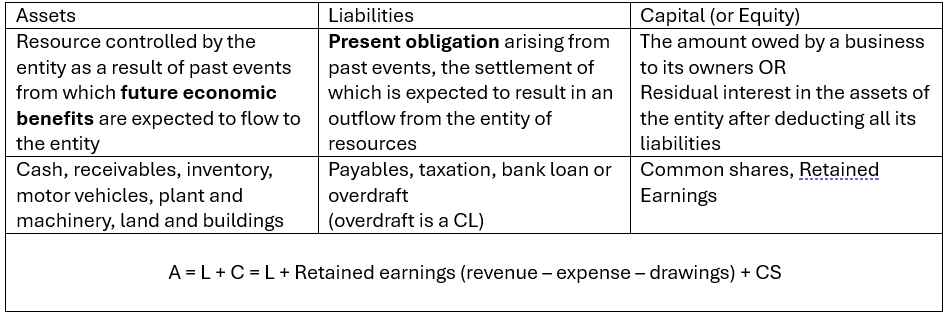

Definitions and other concepts

Chapter 2

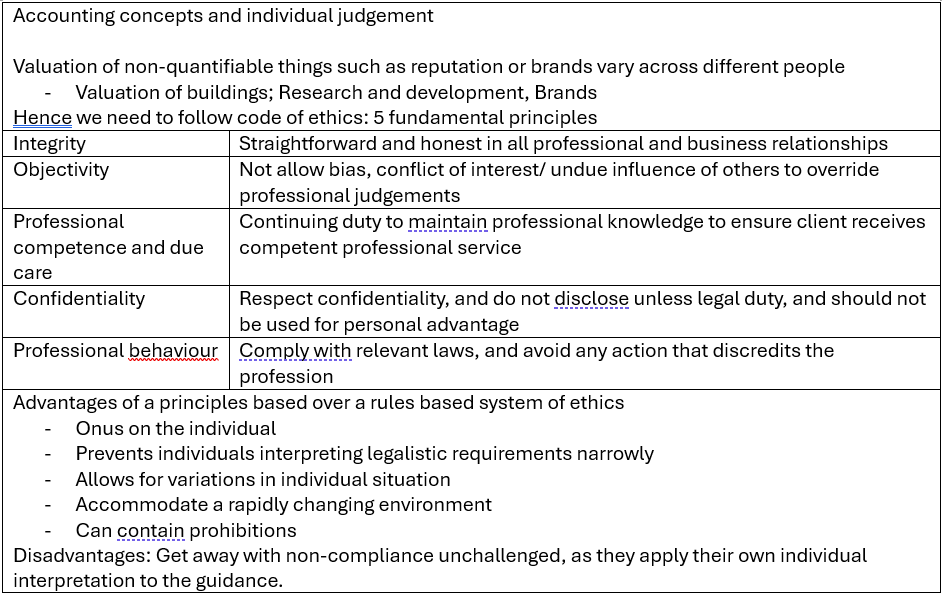

The Accounting Equation

After learning all the necessary definitions, now let's hop on to the ultimate basic of accounting equation:

Assets = Liabilities + Capital (or Equity)

Definitions

The key takeaways from this chapter are

- Assets = future economic benefits; Liabilities = economic obligations;

Capital = Assets less Liabilities - The definitions of income, expense, current and non-current assets and liabilities.

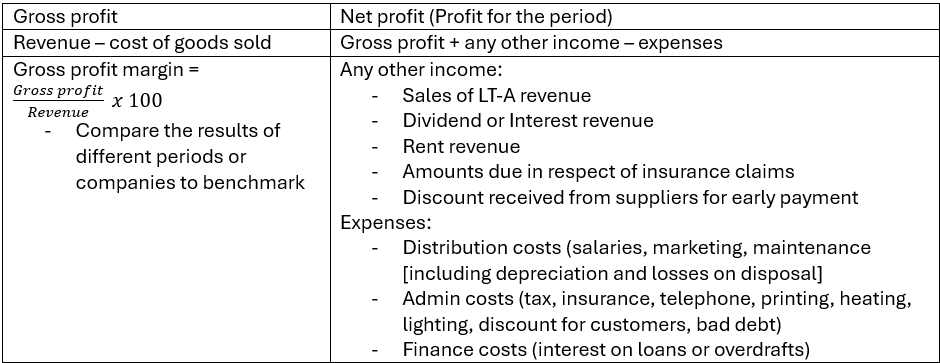

- Differences between gross profit and net profit

Chapter 3

Recording Financial Transactions

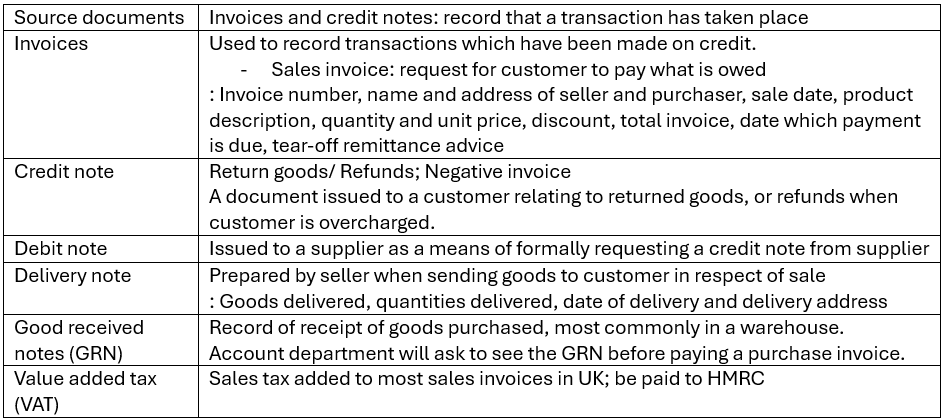

Source documents for recording financial transactions

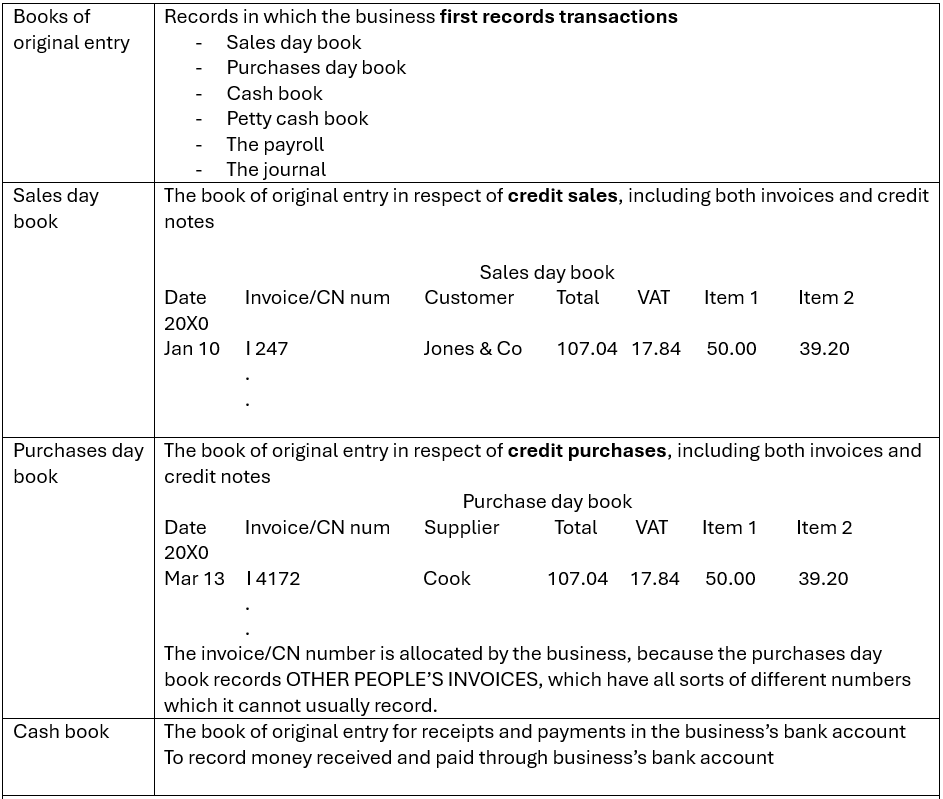

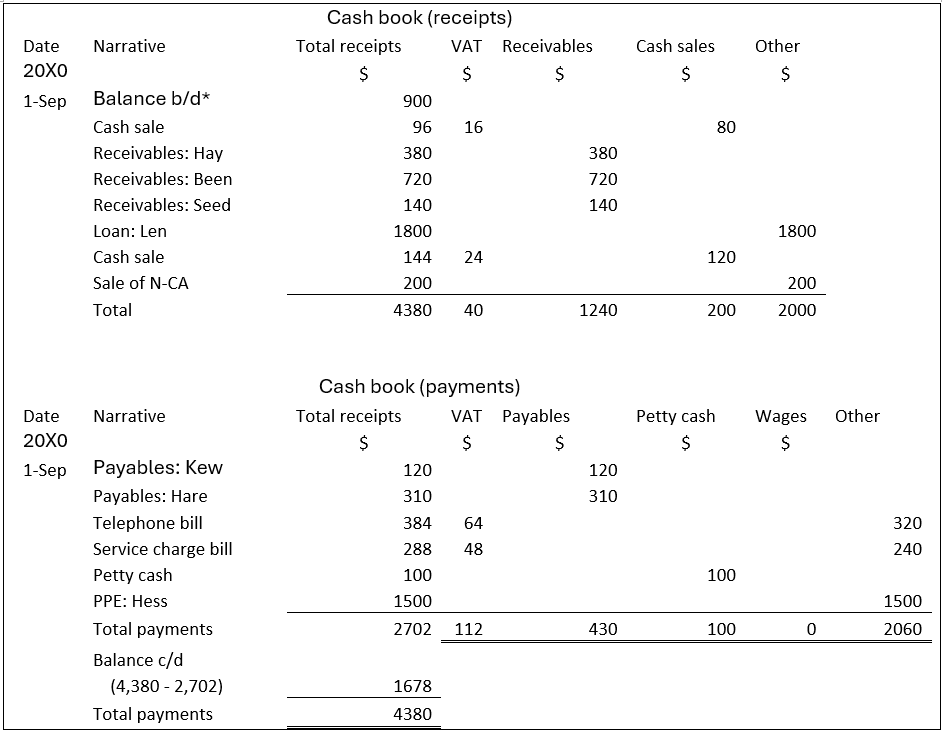

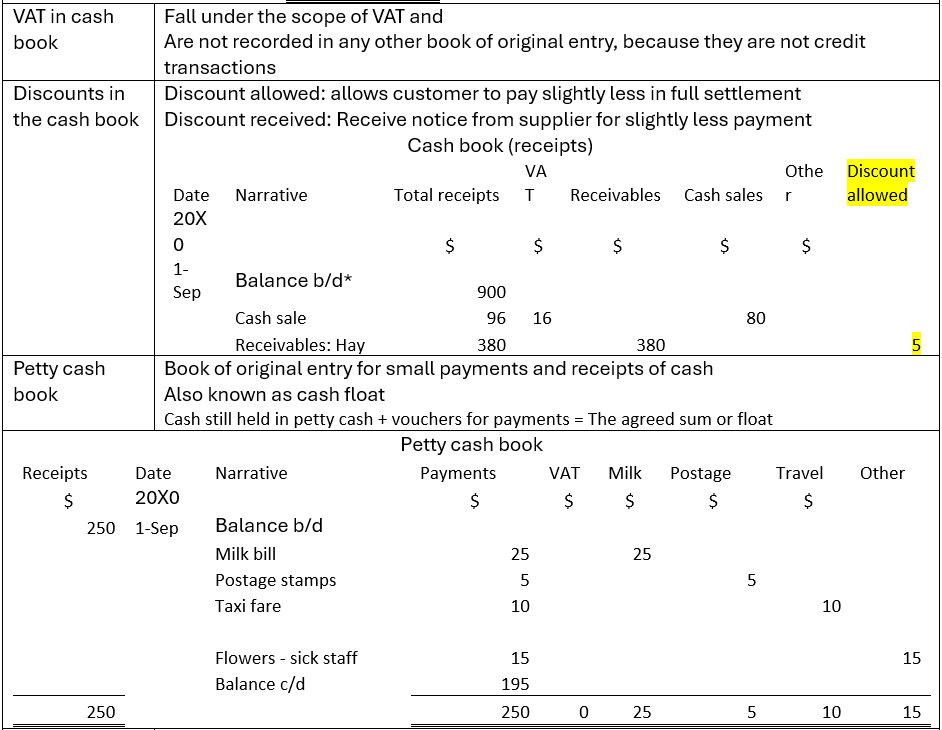

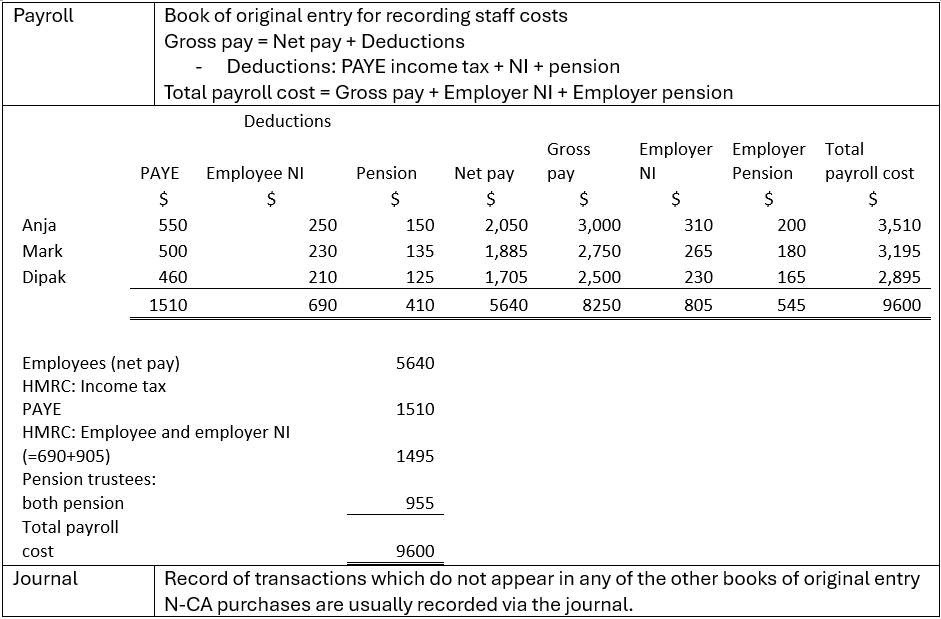

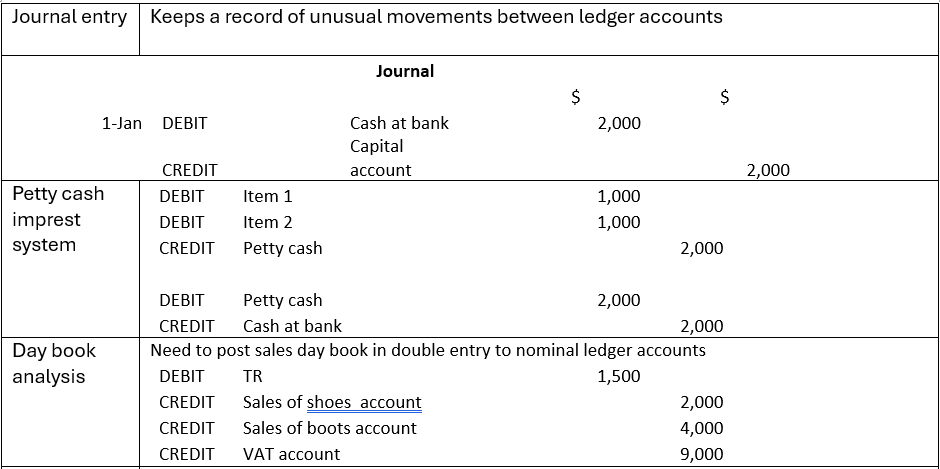

Books of Original Entry

It's crucial to remember that if an entry gets left out of the original books, it won't show up in the trial balance or financial statements. That's why having another system, like receivables or payables ledger accounts (individual personal accounts), to spot any errors is essential.

Chapter 4

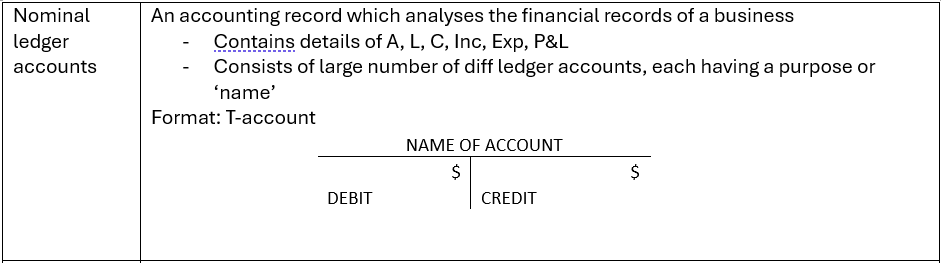

Ledger accounting and Double entry

Ledger accounts

Ledger accounts summarise all the individual transactions listed in the books of original entry.

Why do we need this?

- To keep records of transactions, assets and liabilities in chronological order, and dated to particular period of time

- And build up in cumulative totals

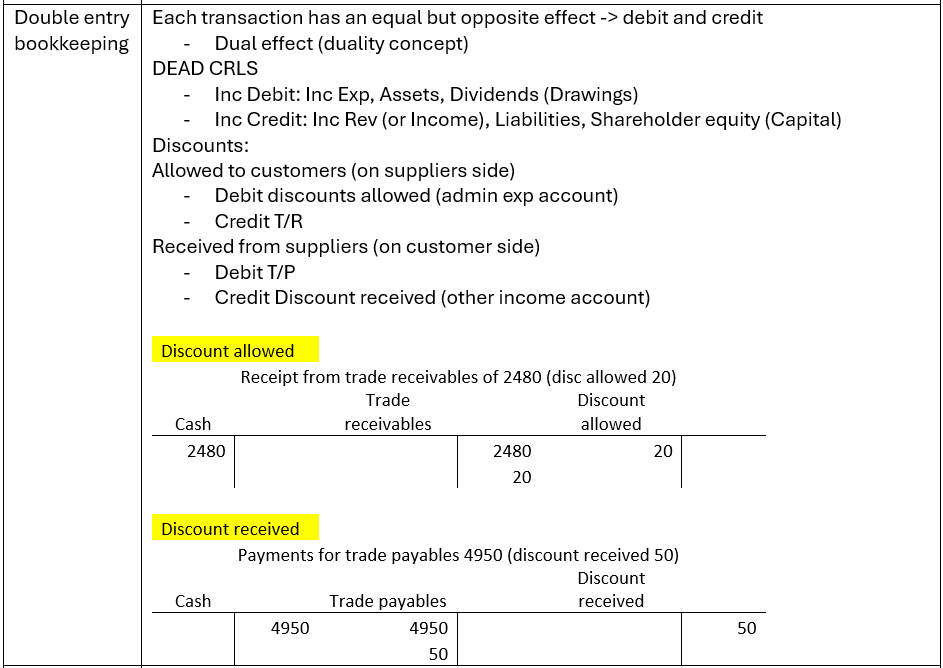

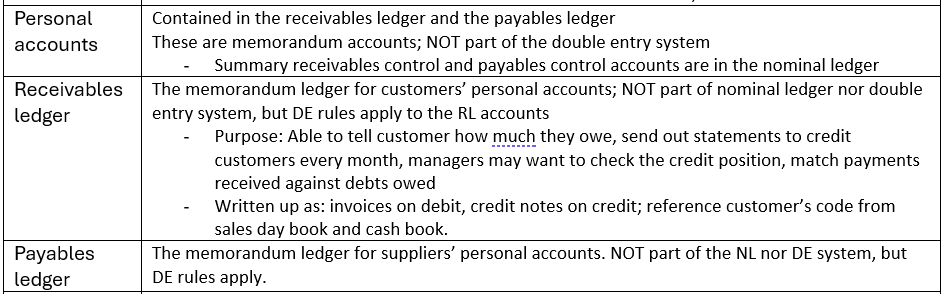

Double entry

In addition to nominal ledger accounts, we also maintain receivables and payables ledgers to keep track of individual customer transactions.

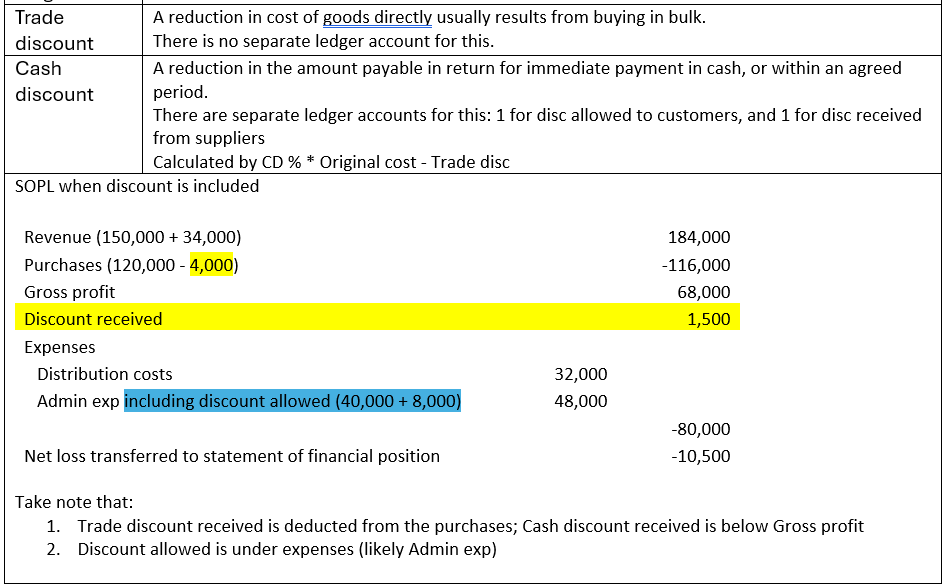

Next up, let's dive into two common types of discounts: Trade discount and Cash discount.

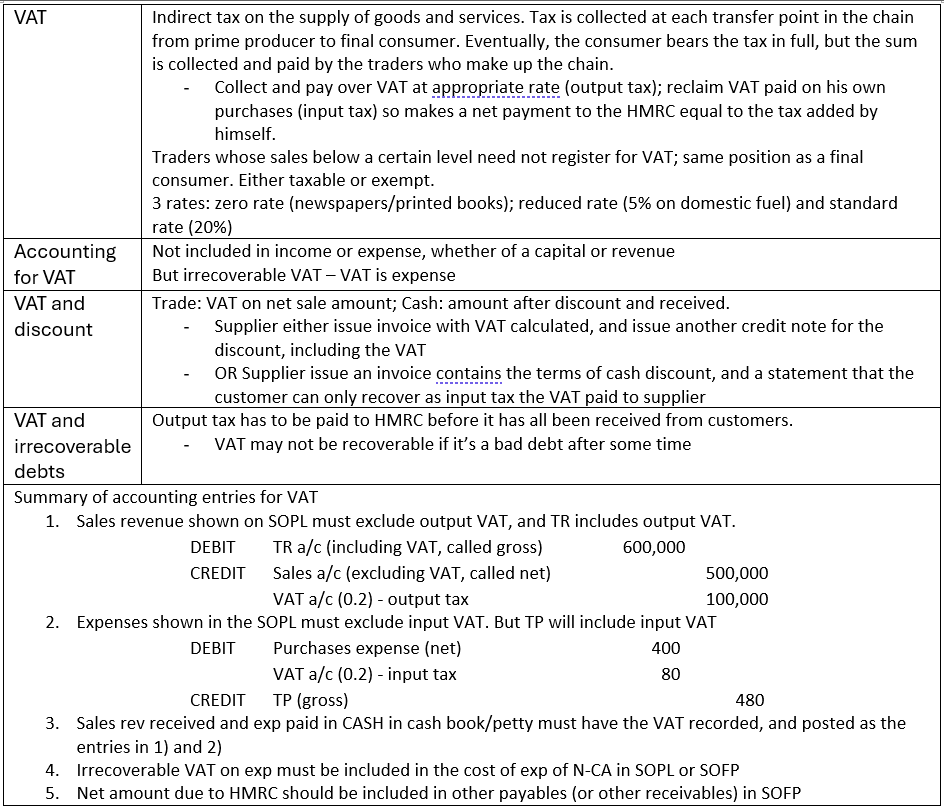

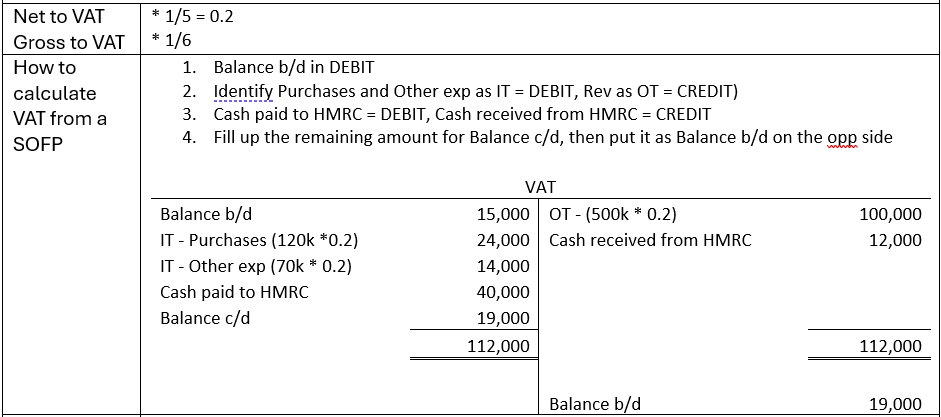

Followed by this is the topic on tax, specifically Value Added Tax (VAT)

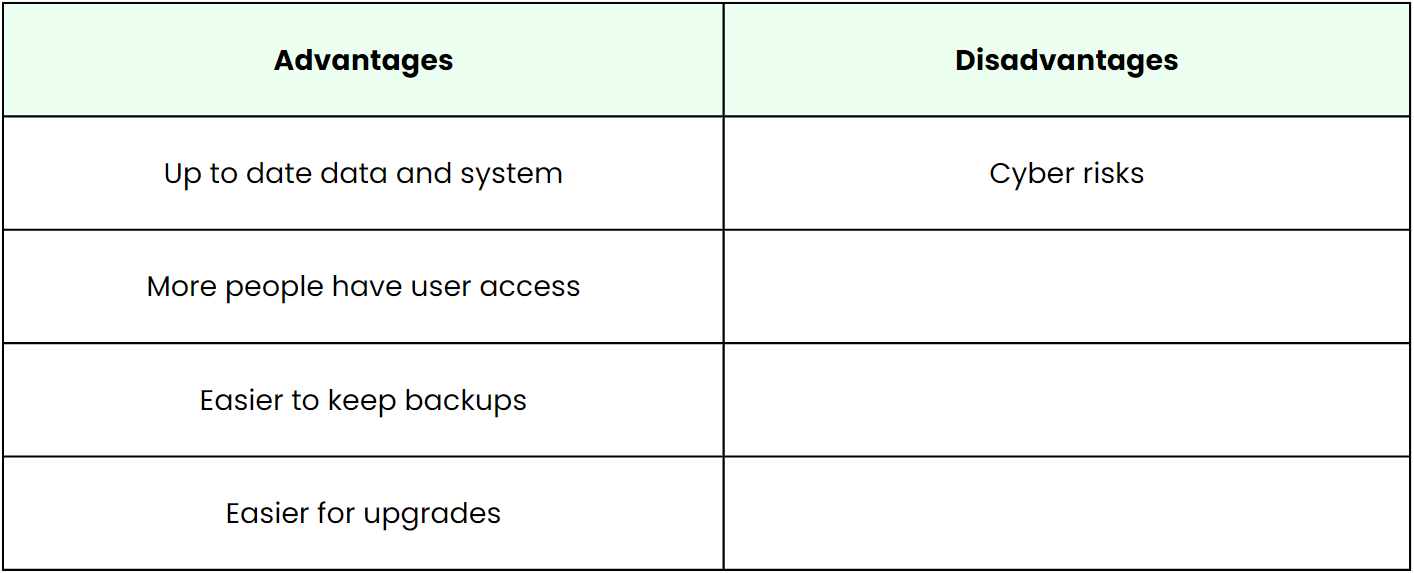

Lastly, this chapter ends off with the introduction to Cloud Accounting

One application of cloud computing, where the accountancy software is provided in the cloud by a service provider, and the user accesses this software to process their accounting transactions and run reports on the cloud.

Chapter 5

Preparing basic financial statements

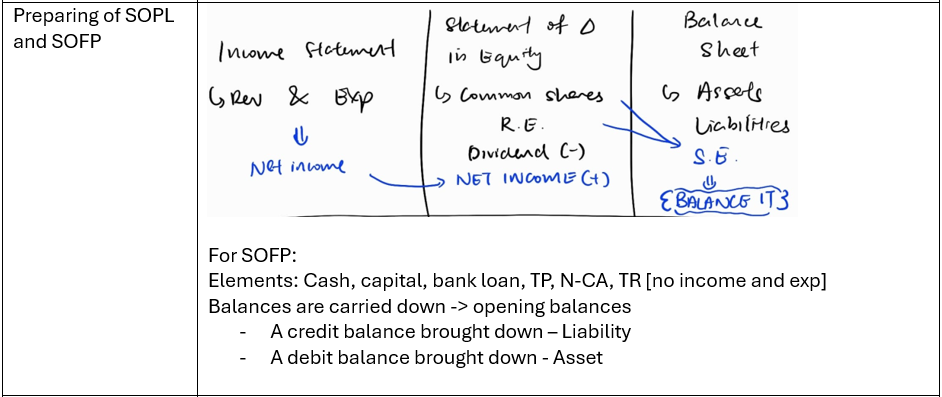

Finally, after learning all the concepts, we are ready to prepare the statement of profit & loss and the statement of financial positions.

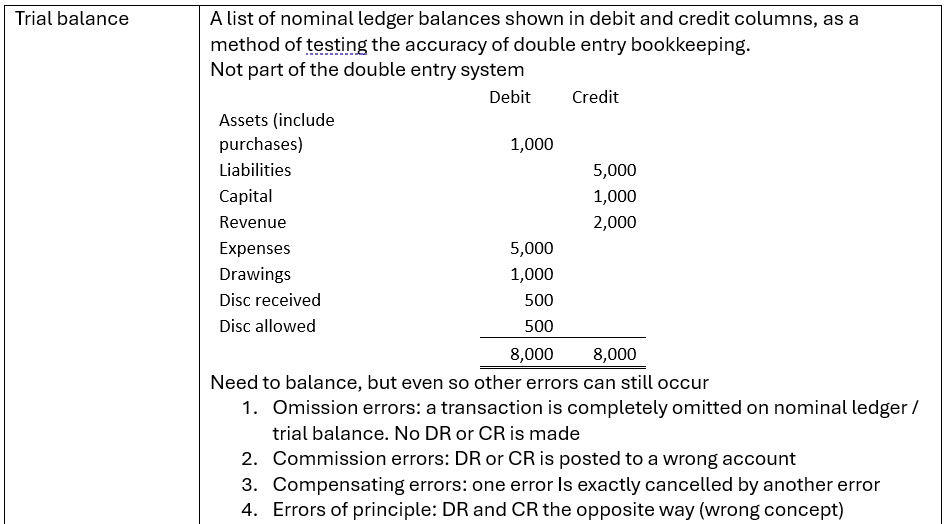

But first, let us understand what is a Trial Balance

A quick overview on the process and elements required to prepare SOPL and SOFP:

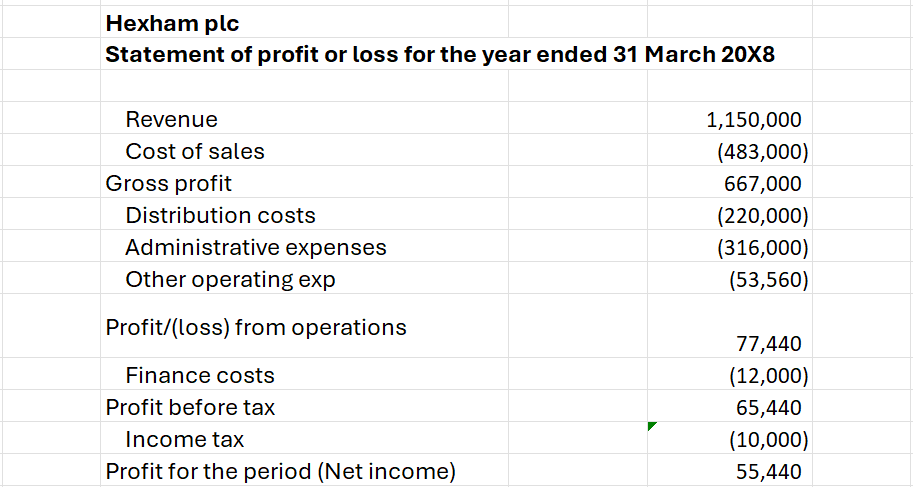

An example of Statement of Profit & Loss

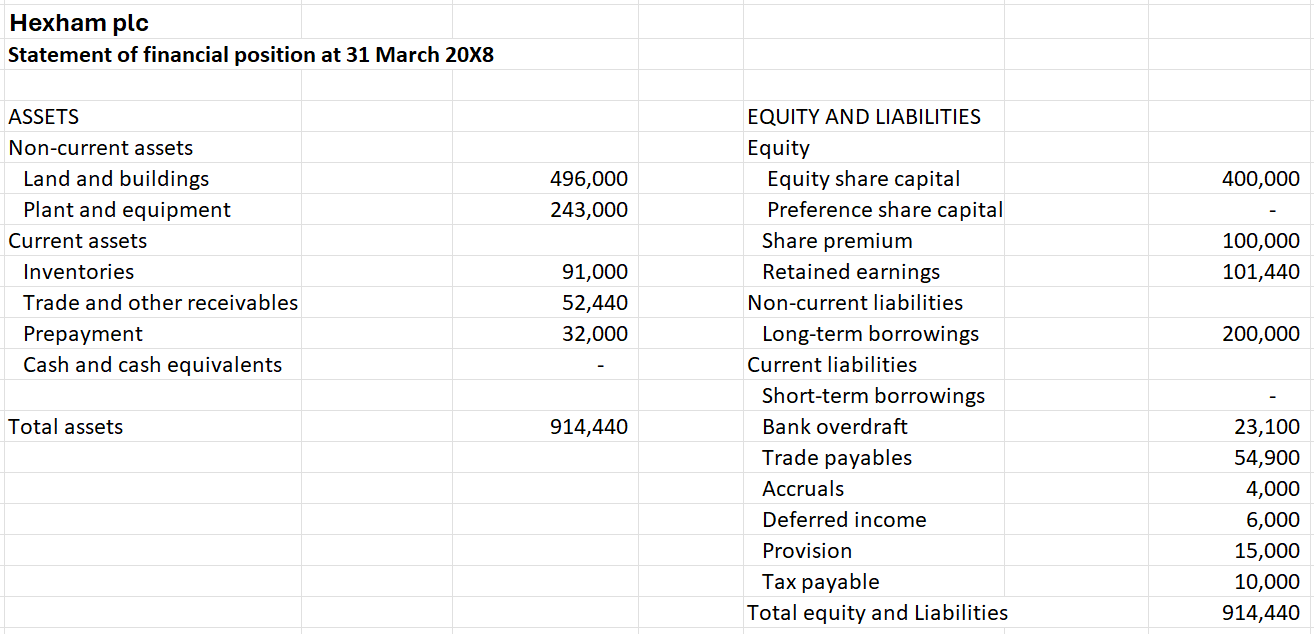

An example of Statement of Financial Position

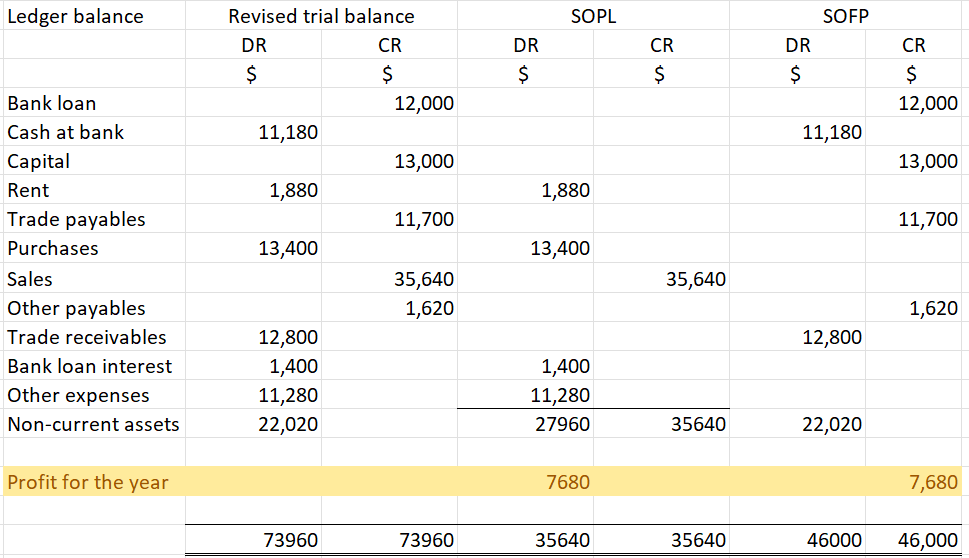

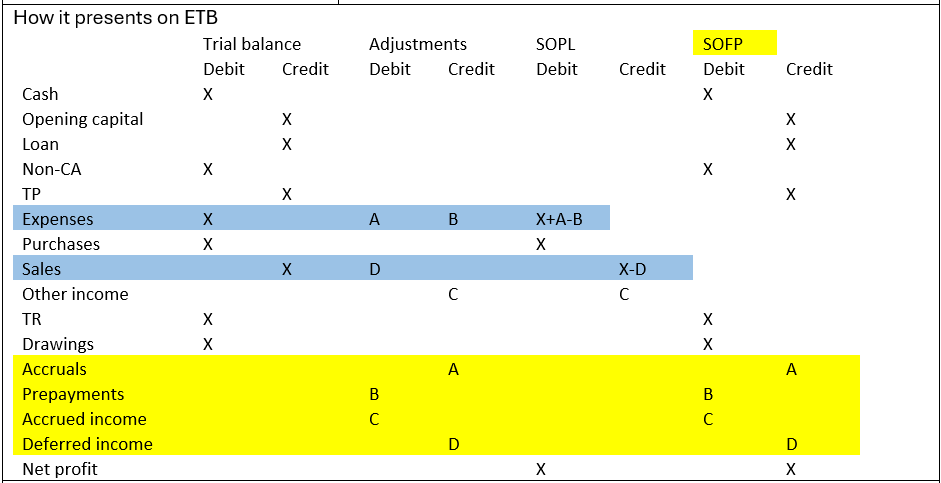

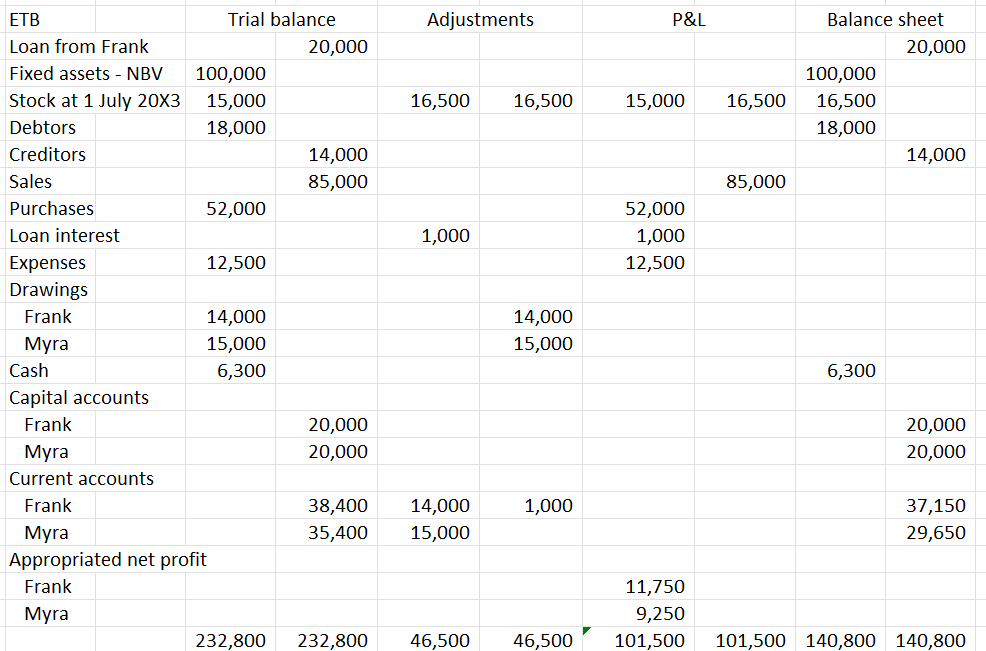

Extended trial balance:

- To help us draw up at SOPL and SOFP, without the need to create a P&L ledger account

- All the income and expenses are taken into the appropriate DR and CR columns of SOPL

- Profit of the year is caluclated in the DEBIT of SOPL

Chapter 6

Control accounts, Errors, Suspense accounts

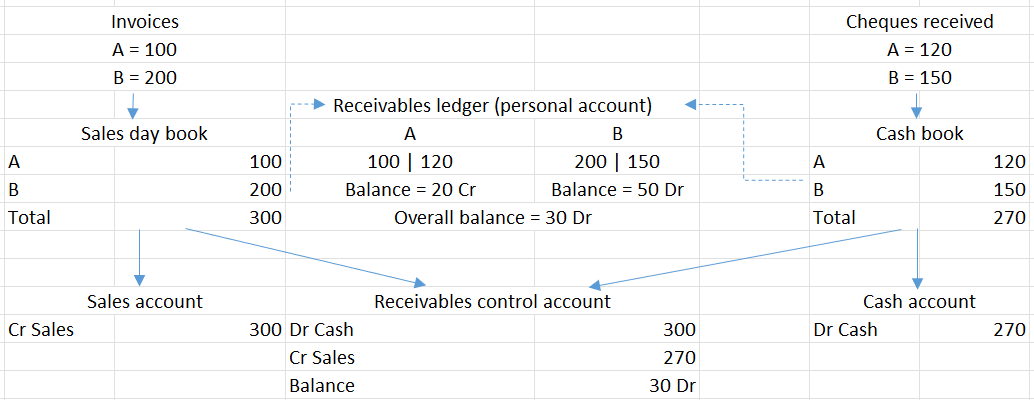

Before learning the definition of Control account, let's understand the flowchart below thoroughly.

- Either invoices or cheques received are posted to the books of original entry.

- The individual records in books of original entry are posted to personal accounts.

- The total of the records in books of original entry is posted to control accounts

- After calculations, comparison is done between the overall balance of personal accounts and control accounts.

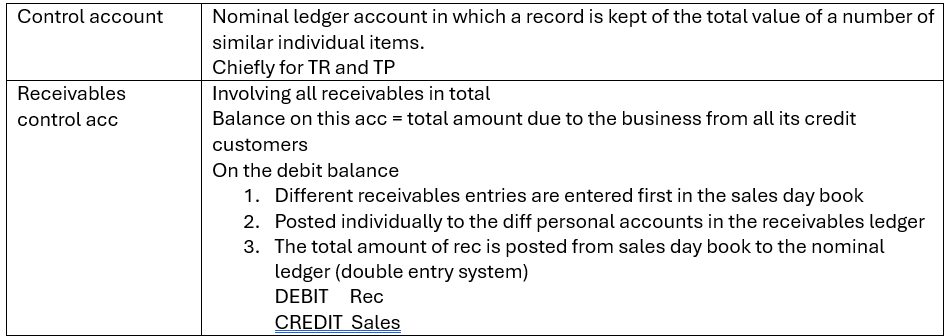

A greater understanding of control account and receivables control account is displayed below.

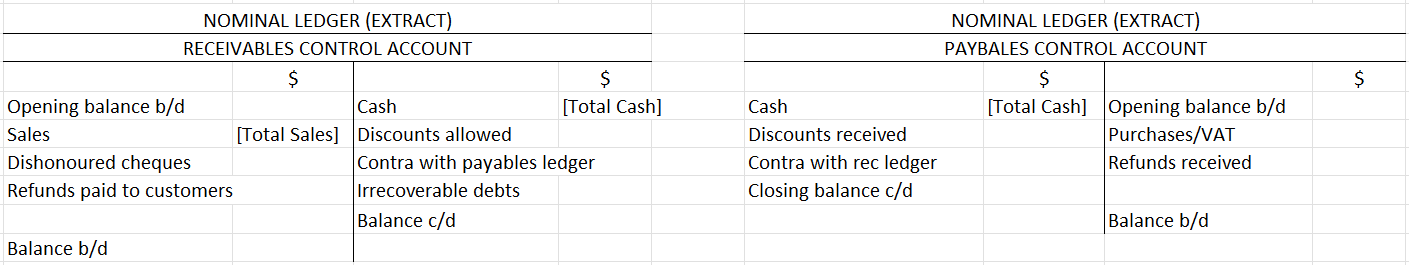

Below shows how the receivables and payables control account are constructed, and the different causes to increase or decrease in receivables and payables respectively.

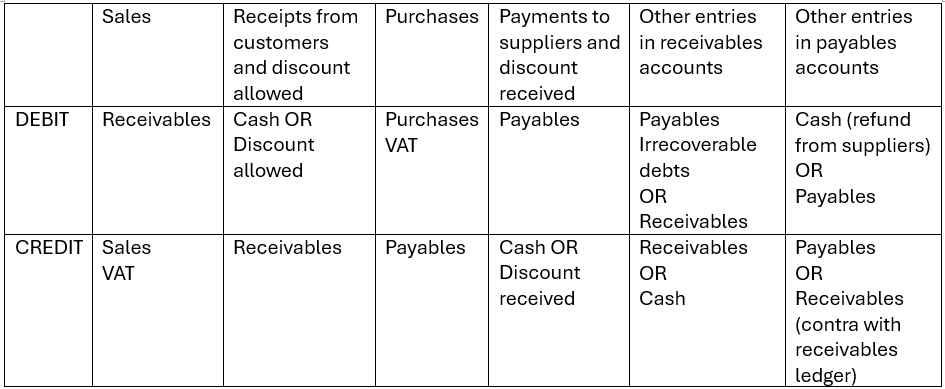

Below is a summary of the effects of different transactions on receivables and payables.

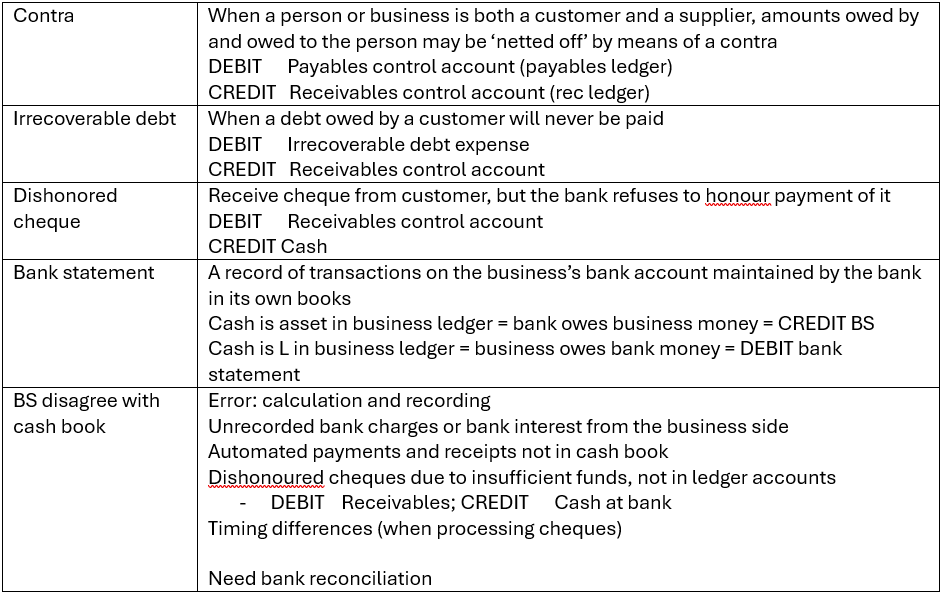

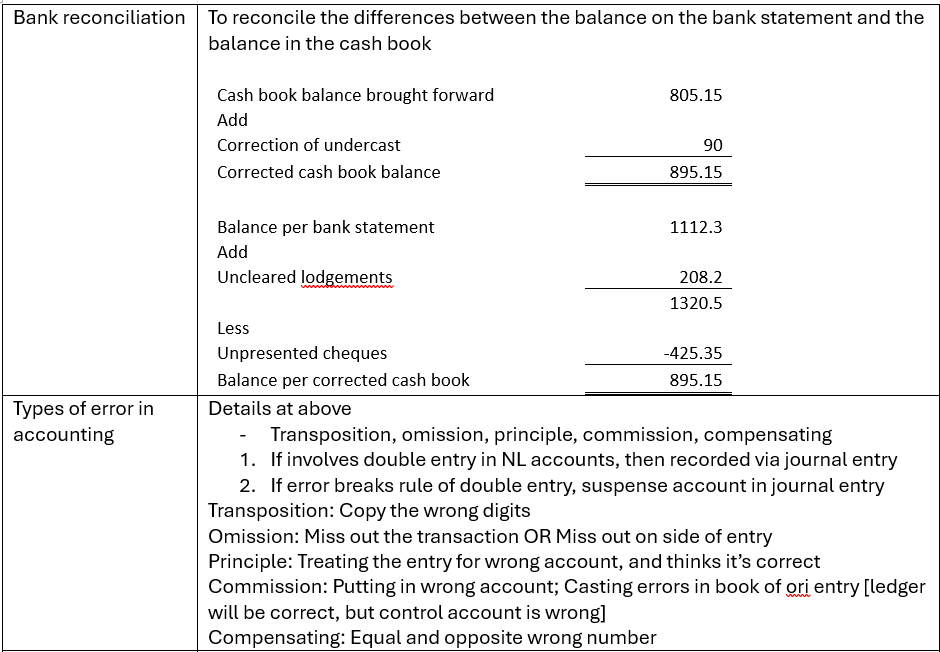

Contra accounts, Irrecoverable debts, Bank statement and Bank reconciliation:

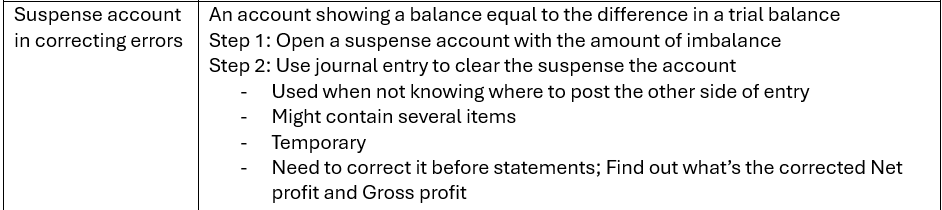

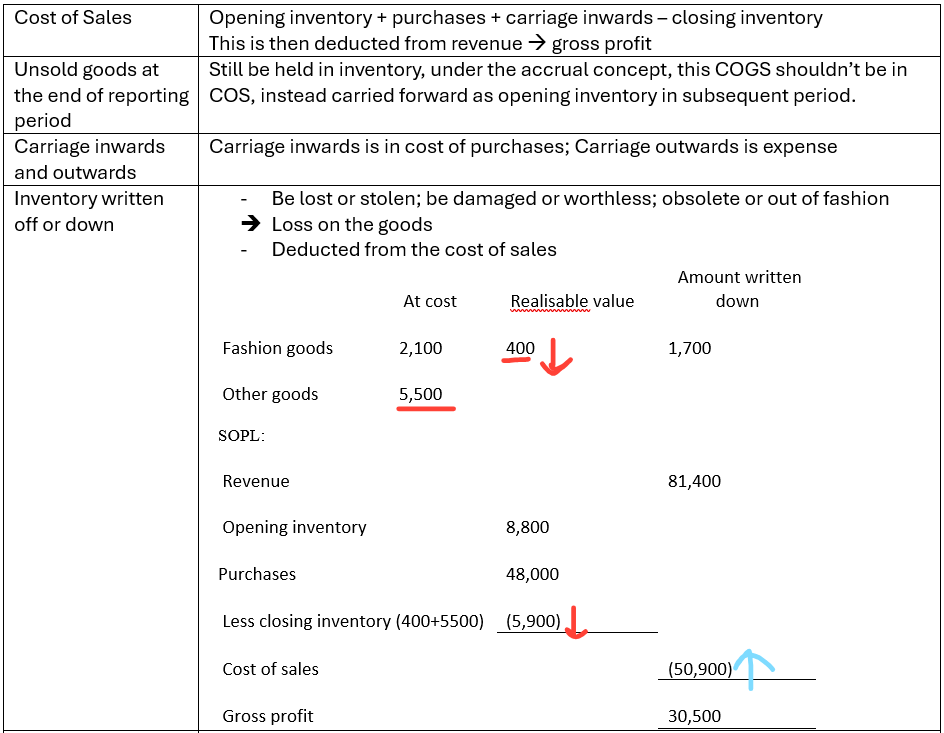

When there is an imbalance in the trial balance, i.e. Debit is greater than Credit by £1000, we create a suspense account of DR £1000. From there, unaccounted journal entry is used to clear the suspense account.

Chapter 7

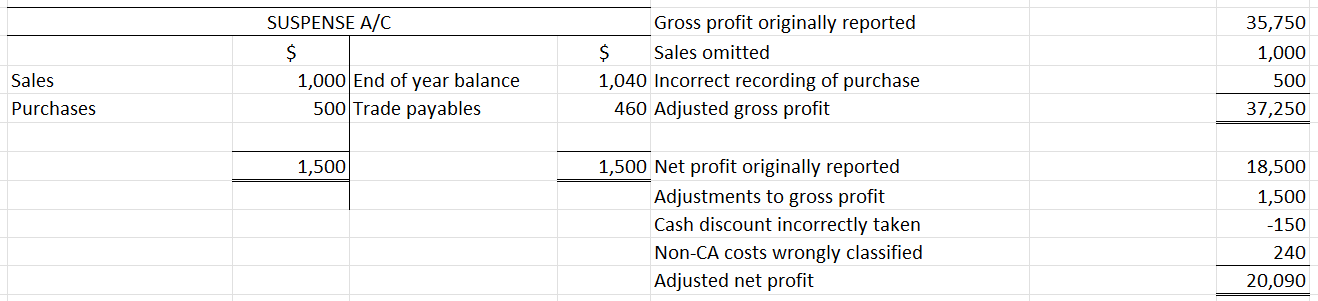

Cost of sales and Inventories

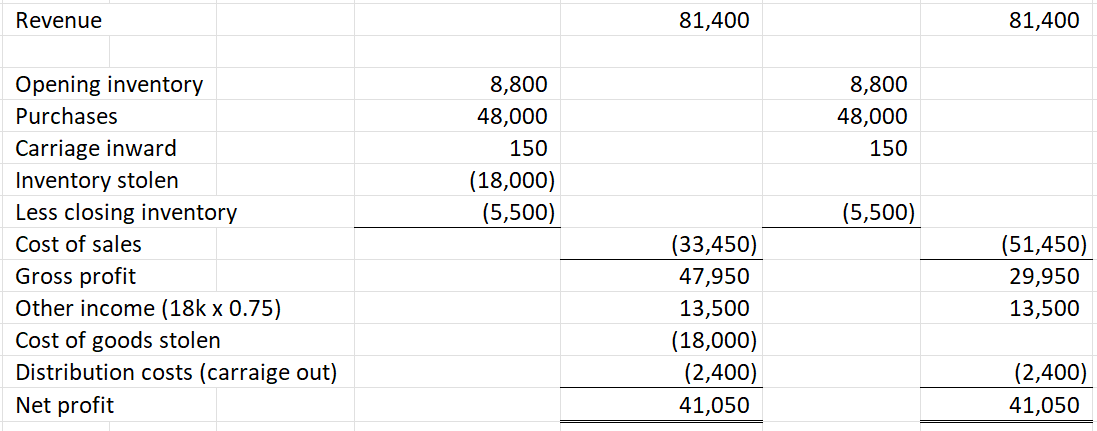

When there is less closing inventory, lost or stolen, this causes cost of sales to increase.

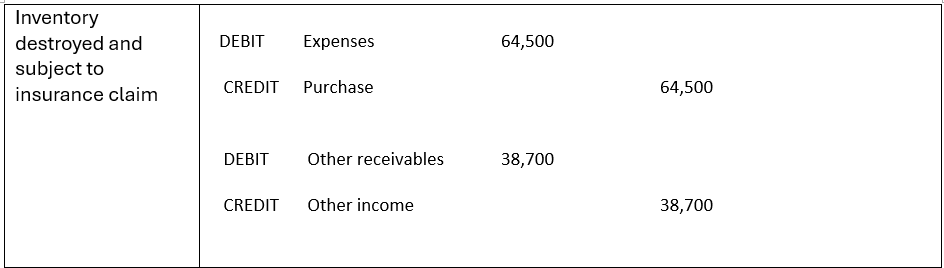

How about when some inventory is destroyed and insurance can be claimed? The destroyed inventory is treated as 'expense', and insurance received is treated as asset, can be cash or receivables.

There are two ways to account for the destroyed inventory and the insurance claimed in the SOPL:

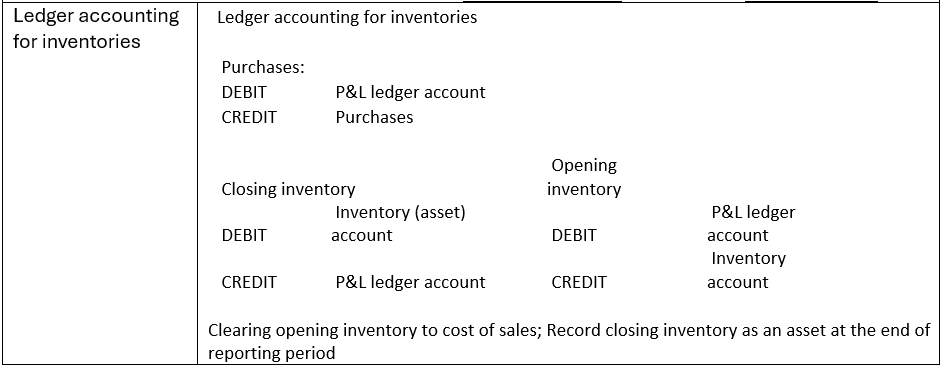

The journal entry for inventories:

Rules of thumb:

- Purchases = expense = debit in P&L (to increase)

- Inventory = asset = debit in SOFP (to increase)

- Opening inventory reverse the normal journal etnry

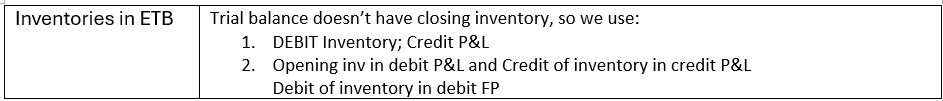

Lastly, we can use an extended trial balance to include closing inventory by making changes to inventory and P&L

Chapter 8

Irrecoverable debts and Allowances

Imagine this scenario: Company A extends credit to Customer B for a product purchase. A year later, Customer B faces liquidation and can't fulfill the payment to Company A. How does Company A account for this?

Answer: Company A debits its irrecoverable debts expense to remove the trade receivables.

While that's a straightforward example, there are other possibilities. For instance, if Customer B settles a portion of the debt, Company A would debit cash and credit irrecoverable debts expense.

Now, consider the same scenario, but three months after Company A sold products to Customer B. Company A anticipates that Customer B won't pay and views it as an irrecoverable debt. What action can Company A take on its account?

Answer: Company A can establish an allowance for irrecoverable debt, treating it as a liability. This reflects the economic obligation of Company A to forego the receivables it expected to collect.

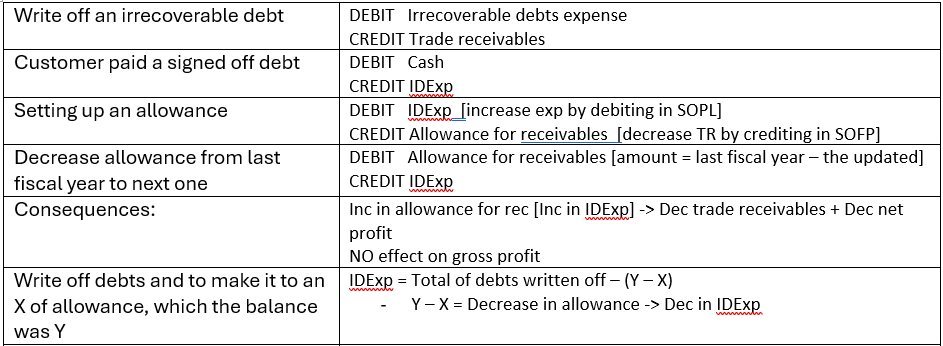

Below shows the corresponding journal entries for these scenarios and other possibilities.

In the world of accounting, we encounter the concept of irrecoverable debts and allowances, which comes into play when customers fail to pay for goods or services received on credit. It's crucial for businesses to account for these instances as expenses or liabilities. Remember:

- Allowances for receivables represent amounts expected to be lost, resulting in reduced receivables when credited.

- An increase in allowances leads to an increase in irrecoverable debt expenses and a decrease in net profit.

Chapter 9

Accruals and Prepayments

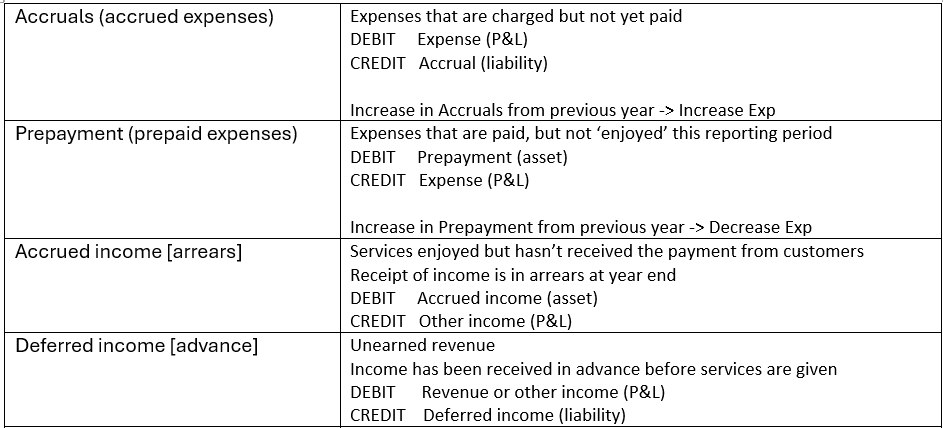

Definitions of accruals, prepayment, accrued income and deferred income

Here's a handy way to recall the corresponding journal entries:

- Services that are enjoyed but not yet paid serves as a future obligations to pay them back, hence it is a liability, which is termed 'Accrual'.

- 'Prepayment' works on the reverse of the same concept, hence it is an asset.

- Credit 'Accrual' increases it.

- Debit 'Prepayment' increases it.

- Services that are provided to customers but not yet receive payment serves as a future economic benefits, as the company anticipate a payment from the customer, hence it is an asset, which is termed 'Accrued income'.

- 'Deferred income' acts upon the reverse of the same concept, and it is a liability.

- Debit 'Accrued income' increases it.

- Credit 'Deferred income' increases it.

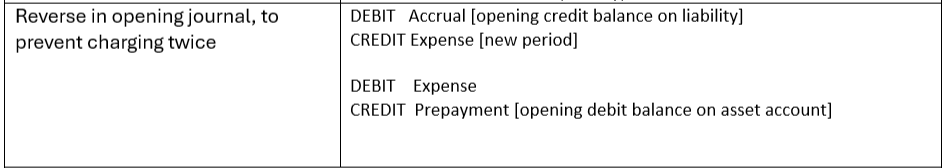

Opening journal

Extended trial balance

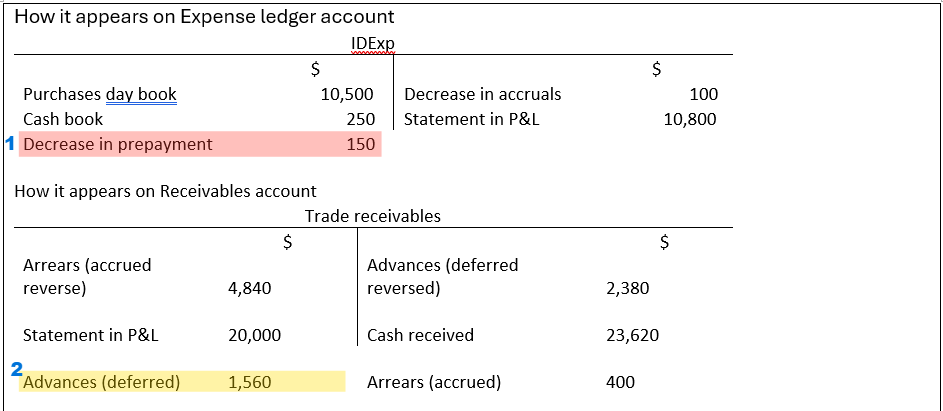

Expense and Receivables ledger account

- If prepayments decrease, it means we've lost an asset, so there should be a credit entry of prepayment, leading to a debit for irrecoverable debt expenses.

- Similarly, if we have deferred income at the end of the year, it's a liability recorded, so there should be a credit entry of deferred income, which results in a debit for receivables.

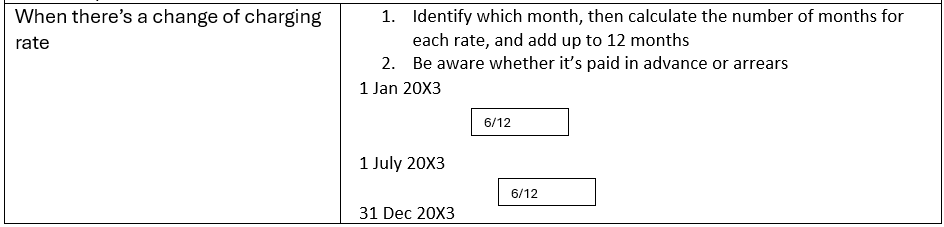

Learnt from mistakes during practice questions:

Chapter 10

Non-current assets and Depreciation

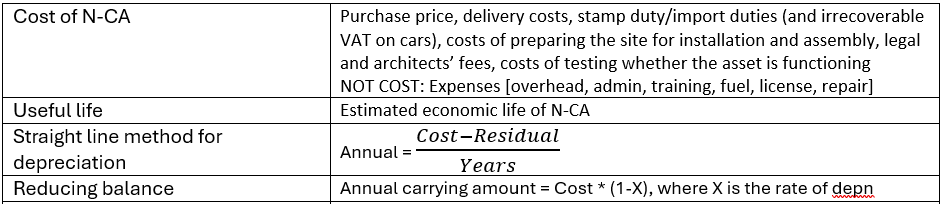

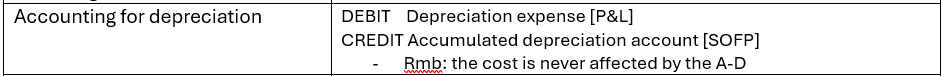

Definitions of cost of N-CA, useful life, depreciation method

When a non-current asset, such as a car, loses value over time, the company must factor in depreciation as both an expense and liability.

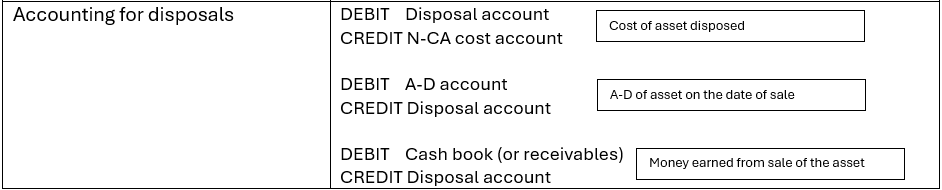

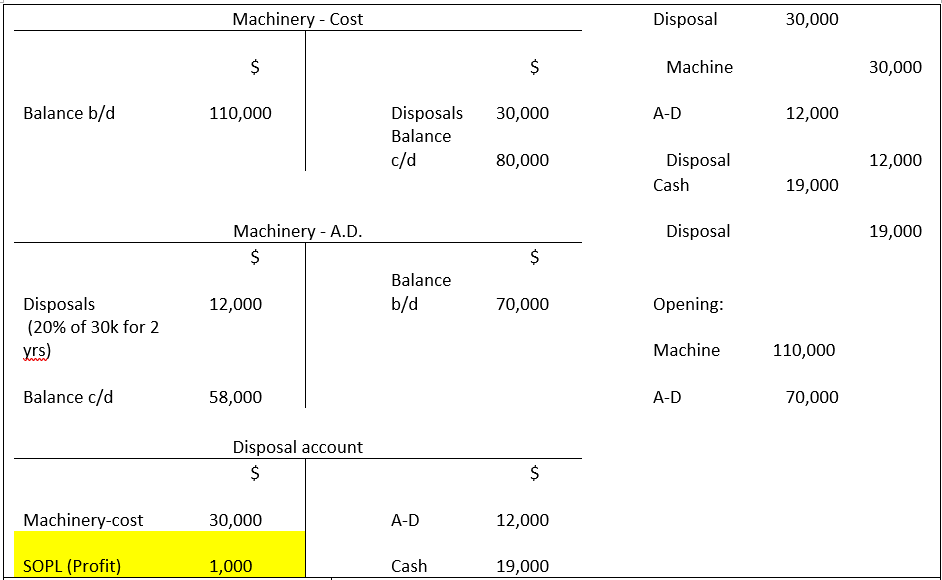

But what happens if the company sells the car before it's fully utilized? In such a scenario, the accounting team must address the loss of the car's value, any income earned from its sale (whether in cash or receivables), and the corresponding reduction in accumulated depreciation. As a result, specific journal entries are necessary to accurately reflect these transactions.

The profit for the sale can be derived from:

- Cash received - Carrying amount of the car = Cash - (Cost of the car - AD)

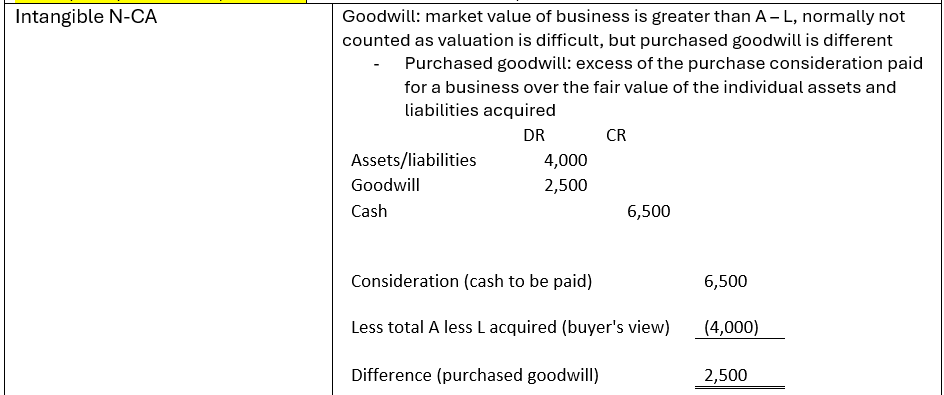

Intangible non-current asset (like goodwill)

Learning points from practice questions

- VAT on vehicles, except for cars, is treated as input tax, hence need to be removed from the cost

- However, when cars are purchased as inventory by car dealer, VAT is treated as input tax

- When calculating the depreciation charge for fluctuating amount of non-current assets

- Addition at cost: count the number of months until the EOY and multiply by the rate of depreciation

- Disposal: count the number of months from start of the year until the month during the sale and multiply by the rate of depreciation

- Remaining (Those that maintained as non-current asset for the whole year): multiply by the rate of depreciation

- Add the value from a to c.

- When calculating the expense for depreciation of non-current asset, include

- Depreciation charge

- Profit/loss of selling of asset

Chapter 11

Company financial statements

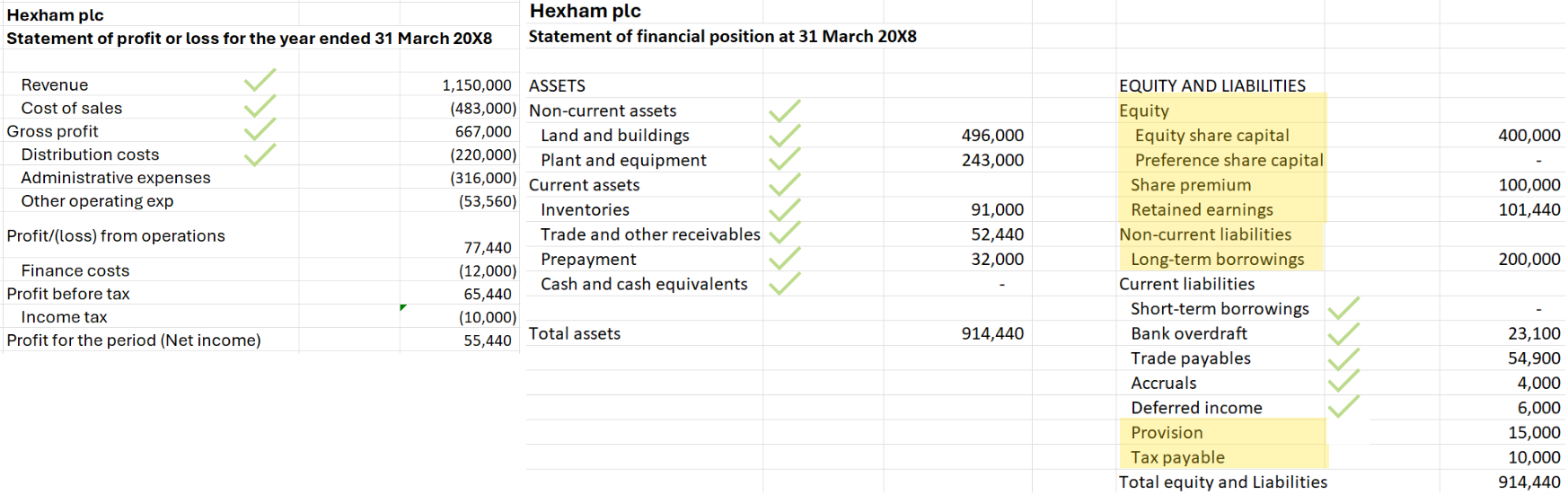

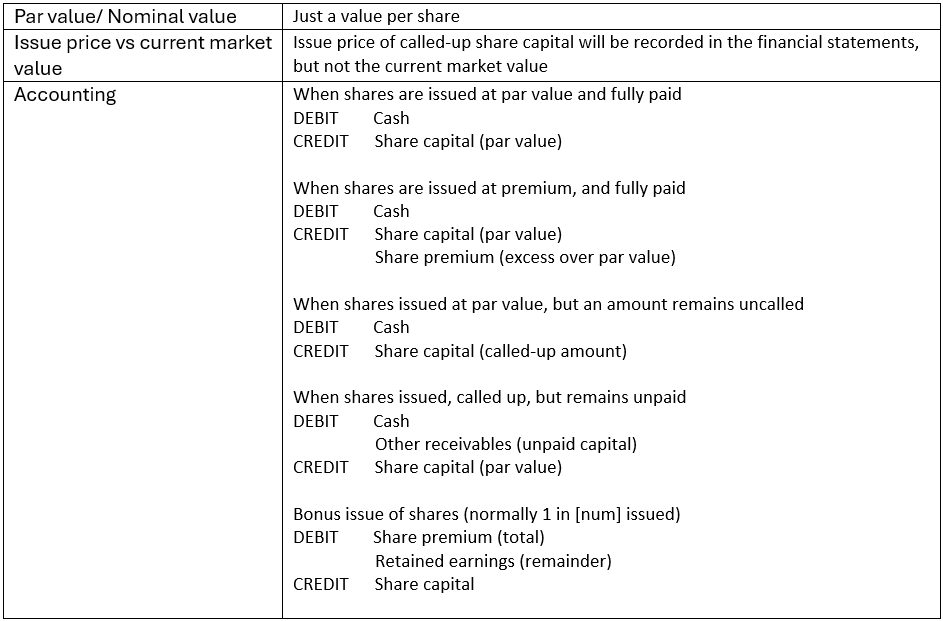

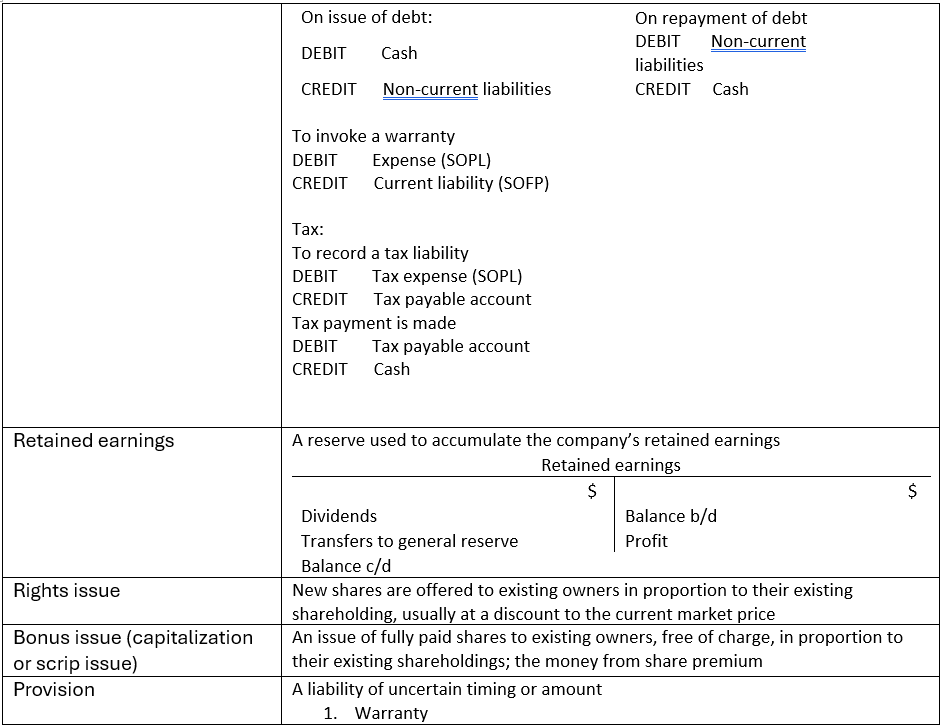

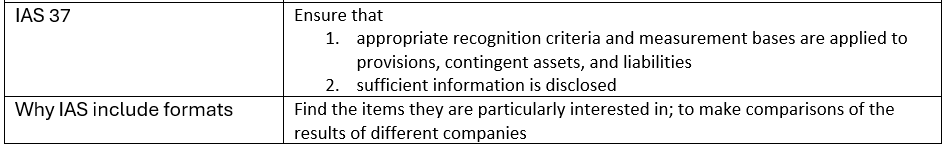

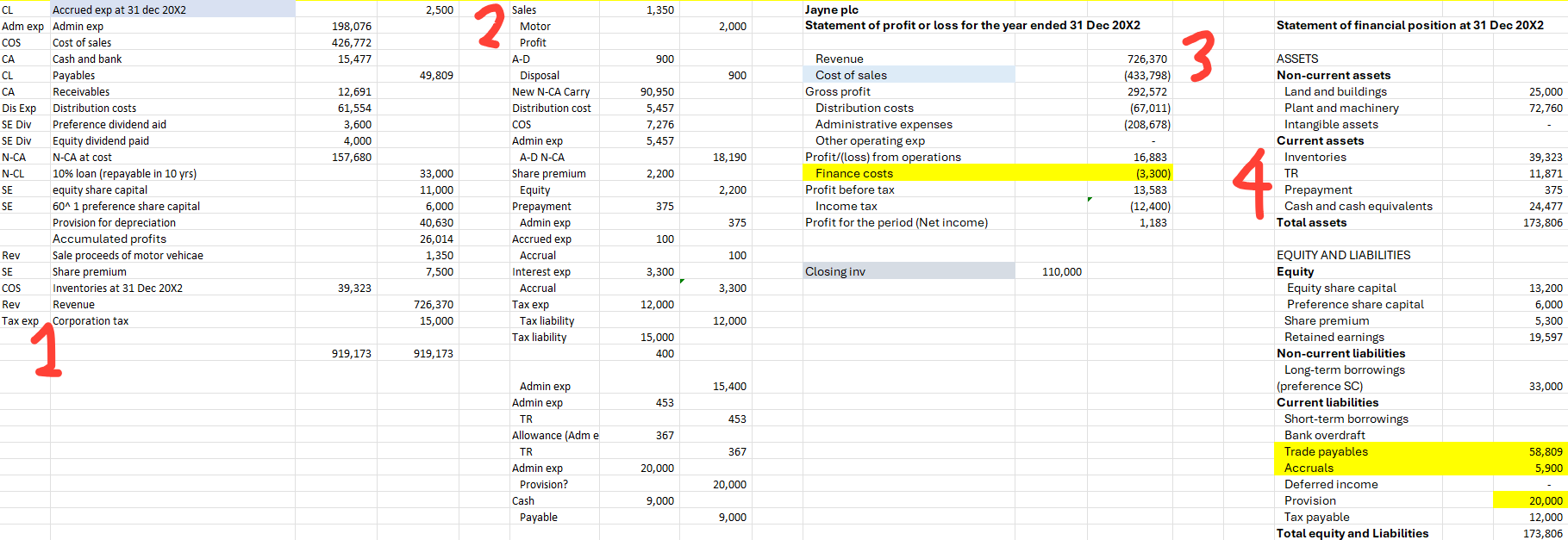

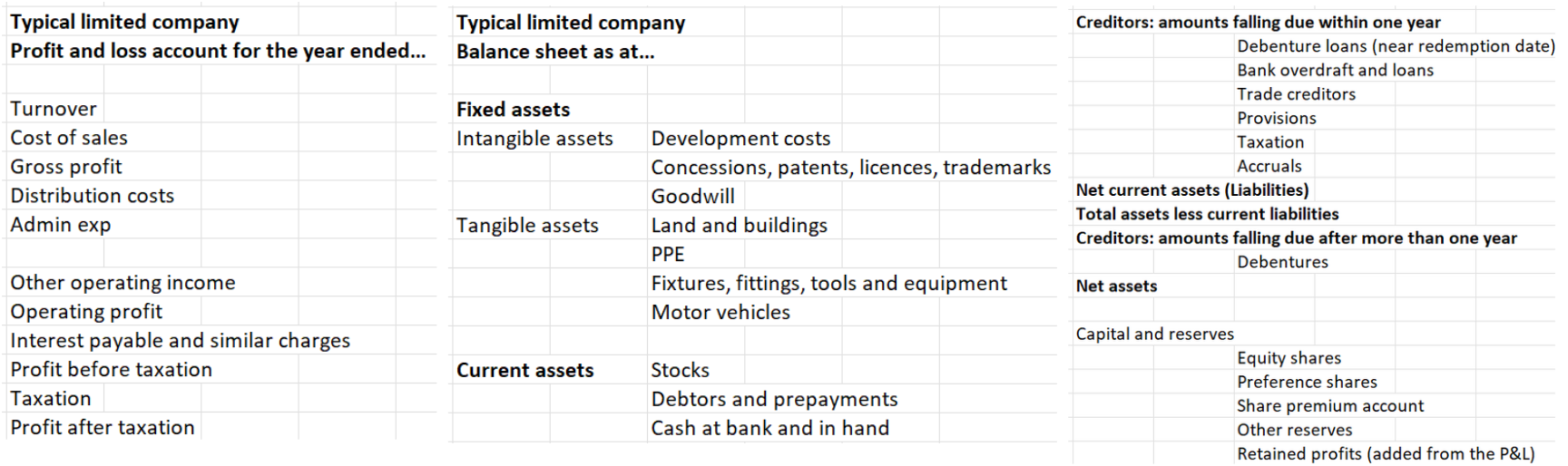

Thus far, we have talked about most elements of statement of P&L, and the assets and liabilities column of statement of financial position. Hence in this chapter, we are going to look into the remaining elements (highlighted in yellow).

Definitions and Journal entries

Reasons for the existence of formatting in accounting

Chapter 12

Company financial statements under IFRS

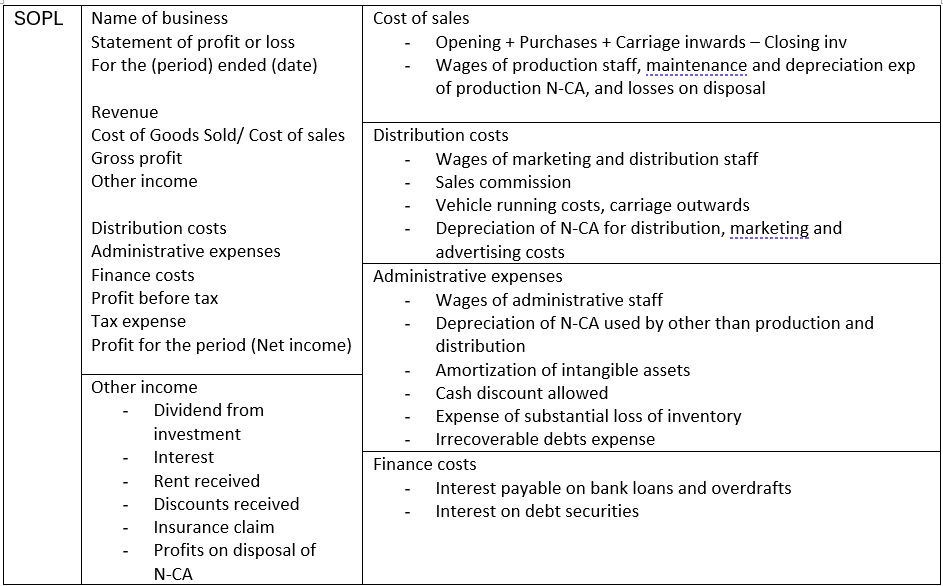

During my study of the 2 financial statements: statement of profit & loss (SOPL) and statement of financial position (SOFP), I have discovered that SOFP is a lot more straightforward in terms of classification, whereas SOPL is more complicated.

Hence, I have summarised what each of the different expenses usually entail and other relevant information of SOPL below.

How I Approach Financial Statement Questions

When faced with practice questions involving financial statements, the typical scenario involves starting with a trial balance, followed by a list of transactions necessitating additional journal entries and adjustments to the trial balance.

Here's my strategy for handling these questions:

- Categorize Each Trial Balance Item: Begin by identifying and categorizing each item in the trial balance, such as current liabilities, administrative expenses, cost of sales, and so on.

- Process Transactions: Review the list of transactions provided and input the necessary journal entries based on the information given.

- Gather Information: Scan through both the trial balance and the journal entries to gather information for each element required for the Statement of Profit and Loss (SOPL).

- Repeat for the Statement of Financial Position (SOFP).

P.S.: If you have alternative approaches or tips for tackling these questions, I'm all ears!

Lessons from Practice Questions

- When accounting for Cost of Sales, the work in progress increment is deducted from COS.

- 5% Preference share capital (redeemable) is treated like a long term loan

- Long term borrowings [liability]

- Interest charged = Accrued interest [accruals]

- An anticipated loss of a lawsuit needs the following journal entry:

- Debit Admin expenses

- Credit Provision

Chapter 13

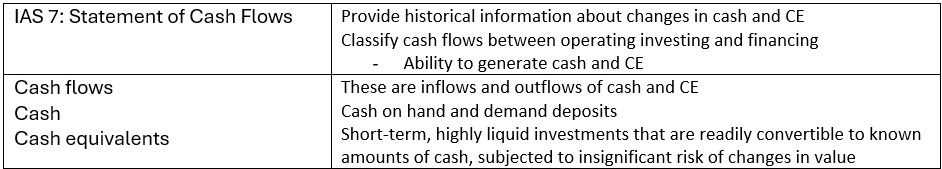

Statement of Cash Flows

Definitions

Breaking Down the Statement of Cash Flows

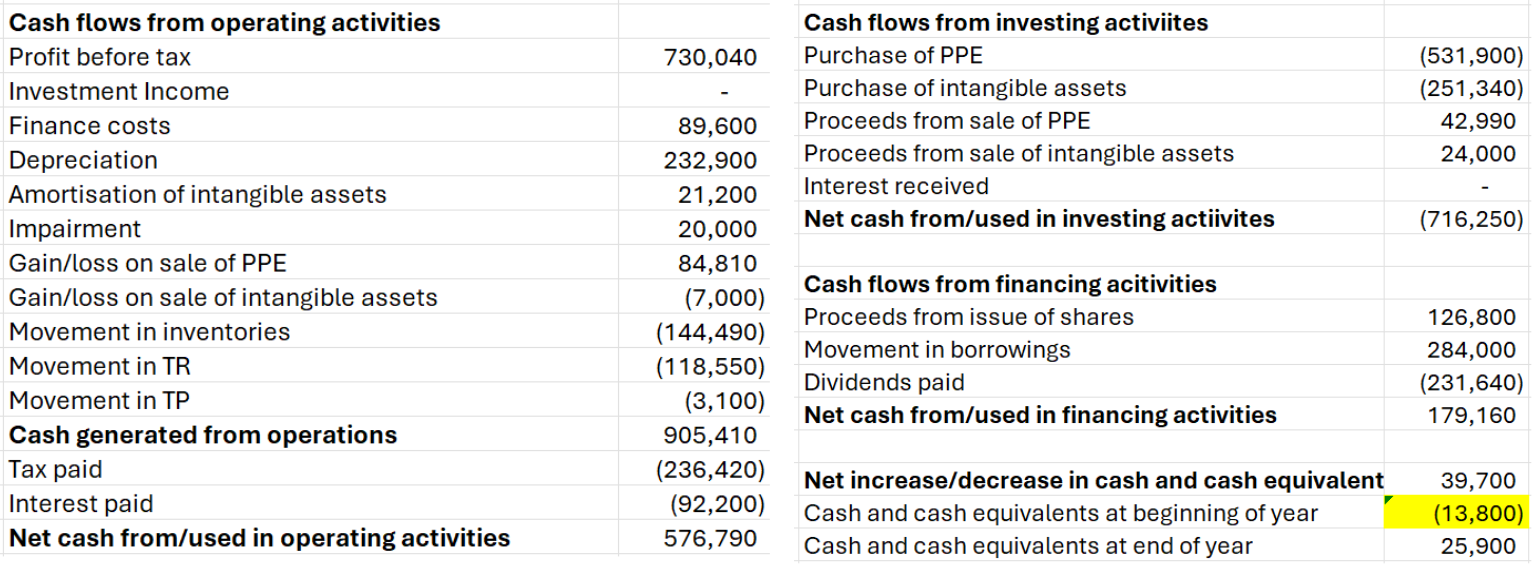

The statement of cash flows categorizes cash flows into three main sections:

- Operating Activities: These are the primary revenue-generating activities.

- Investing Activities: Involves the acquisition and disposal of non-current assets and other investments.

- Financing Activities: Result in changes in equity capital and borrowings.

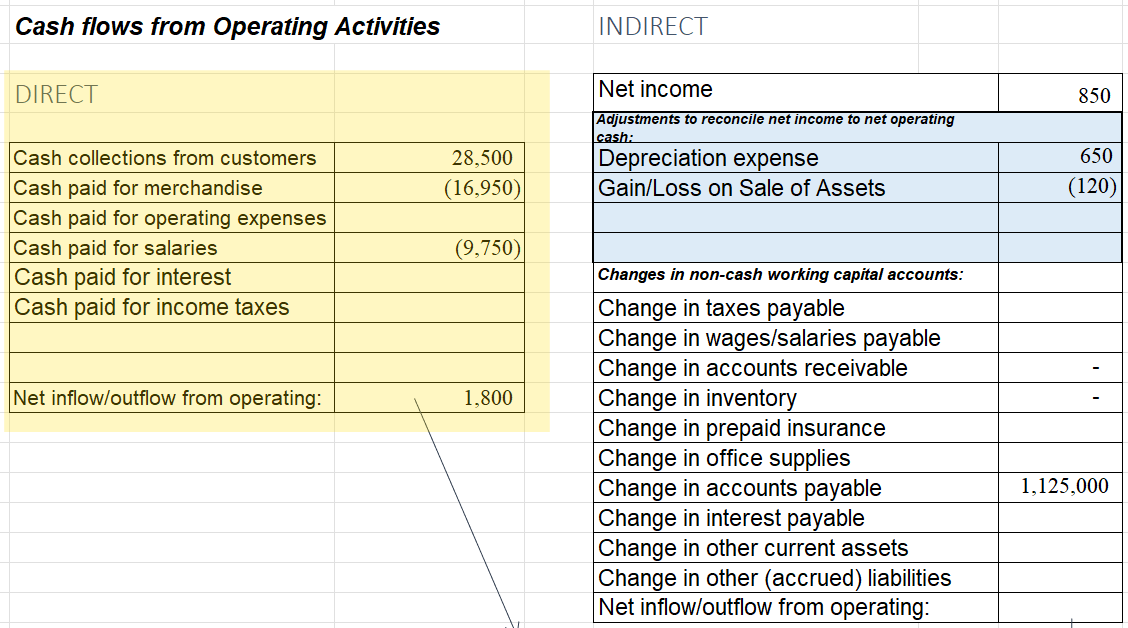

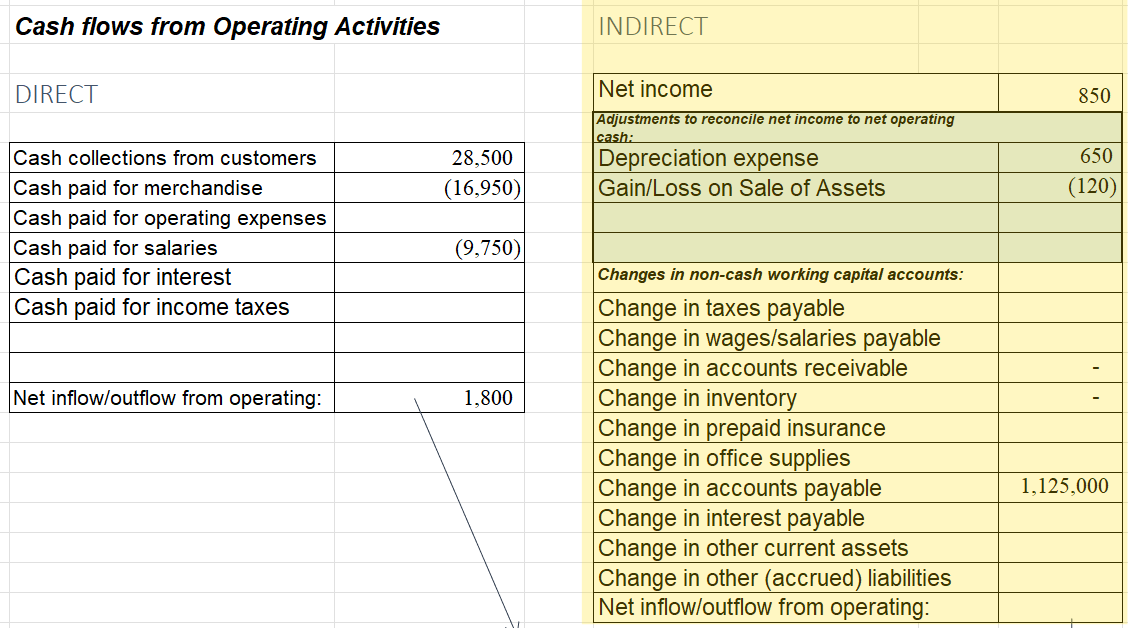

Operating Activities

Cash flows from operating activities can be presented in two formats: indirect and direct.

While the direct method is preferred according to IAS 7, it's not mandatory. However, it's generally recommended to use the indirect method unless specified otherwise.

Let's briefly outline how each element is derived under the direct method:

- Cash collection from customers: Sales + Decrease in Trade Receivables

- Cash paid for merchandise: Cost of Sales + Increase in Inventory + Decrease in Trade Payables

- Cash paid for operating expenses: These typically include various operating expenses not classified elsewhere, with 'other operating expenses' often falling into this category.

- Cash paid for salaries: Salary expense + Decrease in Salary Payables

- Cash paid for interest: Interest expense + Decrease in Interest Payables

- Cash paid for income taxes: Income tax expense + Decrease in Tax Payables

For a more detailed explanation, you can check out this video: Link to Video Tutorial

Indirect method

The second technique is more akin to "plugging in the data."

- We start off by net income, and add back the depreciation expense and deduct the profit on sale of assets (or add the loss on sale of assets).

- Depreciation is not a cash expense, but is deducted in arriving the net income.

- By the same logic, a loss on a disposal of assets (arising through underprovision of depreciation) needs to be added back and a profit needs to be deducted.

- When assets increase, cash decreases (-). For instance:

- Inventory: Cash is expended on purchases.

- Trade receivables: Cash remains uncollected.

- Conversely, an increase in liabilities translates to more cash (+), such as:

- Payables: No cash is disbursed for settling payables.

- Finally, summing up all components yields the net cash flow from operating activities. This figure should align with what would be obtained using the direct method.

Investing activities

Include:

- Cash payments to acquire tangible or intangible non-current assets (-)

- Cash receipts from sale of tangible or intangible non-current assets (+)

- Interest and divdends received (+)

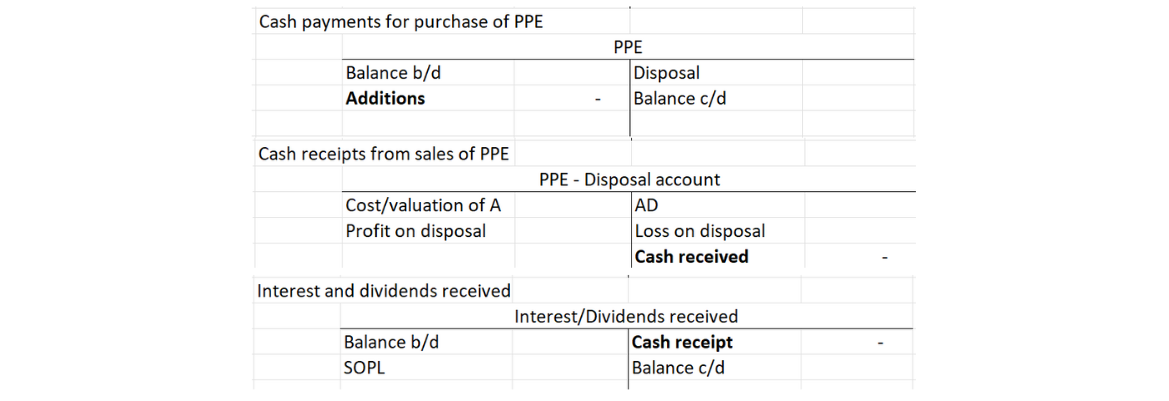

To track these, we can use a T-account. The bold figure in this account helps balance the statement of cash flows.

Financing activities

This section is an indicator of likely future interest and dividend payments.

Include:

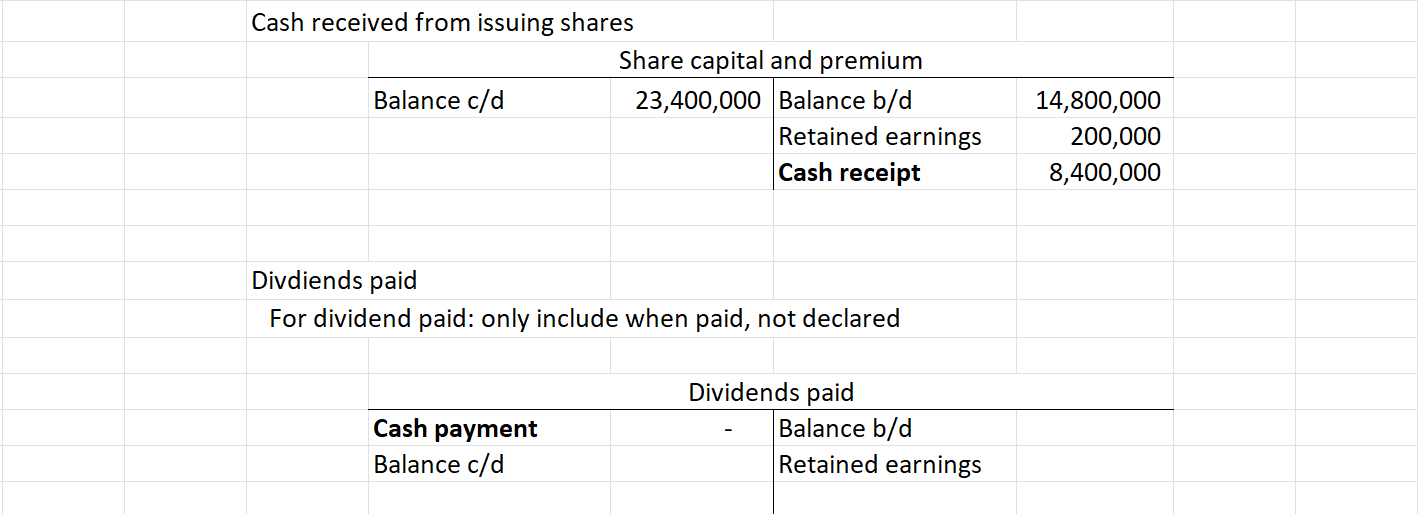

- Proceeds from issue of shares (+)

- Movements in borrowings (+ if loan is raised)

- Dividends paid (-)

Same as investing activities, T-accounts can be utilized.

Preparing the Statement of Cash Flows

- Set out the pro-forma statement of cash flows with all the headings required by IAS 7 (as below).

- Proceed to fill in the cash flows from operating, investing, and financing activities to the best of your ability.

- In cases where the profit figure is absent, open a separate Statement of Profit and Loss (SOPL).

- Conclude by verifying that the net increase in cash, when subtracted from the cash at the beginning of the year, equals the cash at the end of the year as stated in the question.

- This serves as a solid validation that your cash flow statement is accurately prepared, although the possibility of a compensation error should still be considered.

Chapter 14

Company financial statements under UK GAAP

Definition

Format

Note that the turnover figure is net of trade discount, refunds and VAT, as the revenue figure under IFRS.

Reminder from mistakes in practice questions

- Debenture interest paid is not accounted in retained profits

- Net assets = Assets - Liabilities = share capital + share premium + retained profits + general reserves

Chapter 15

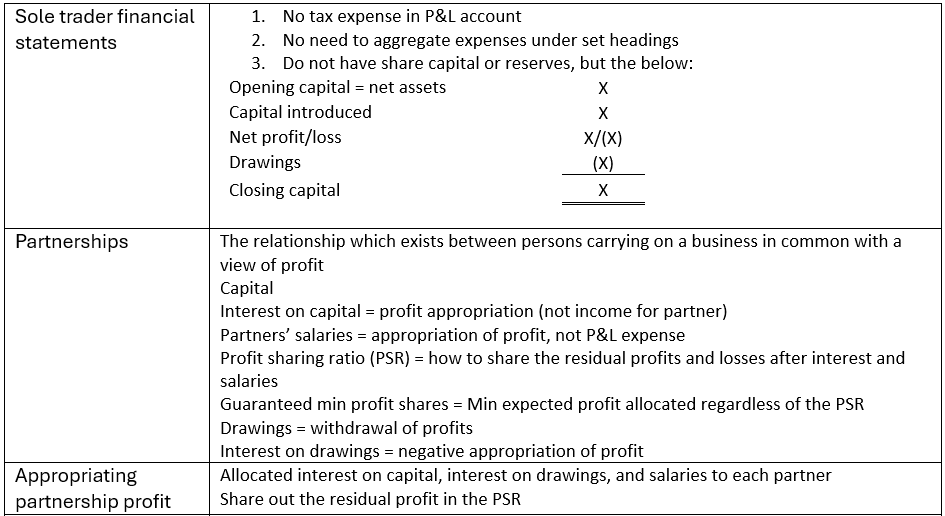

Sole trader and partnership financial statements under UK GAAP

Definitions

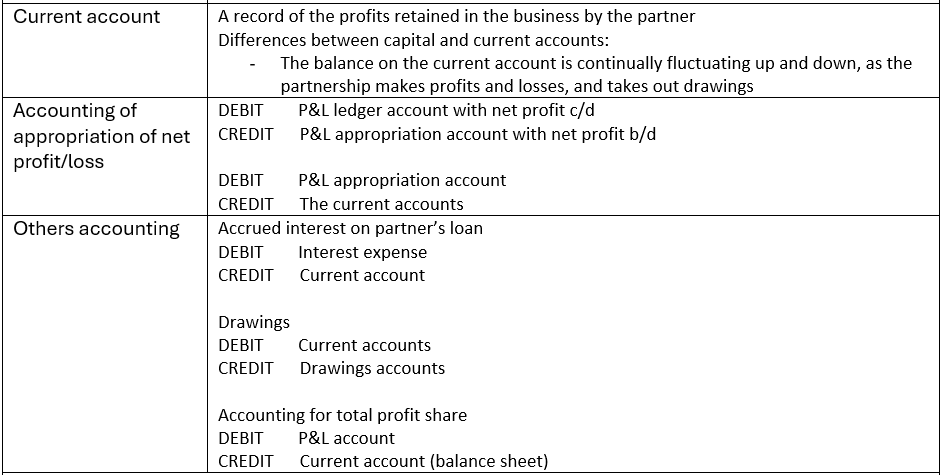

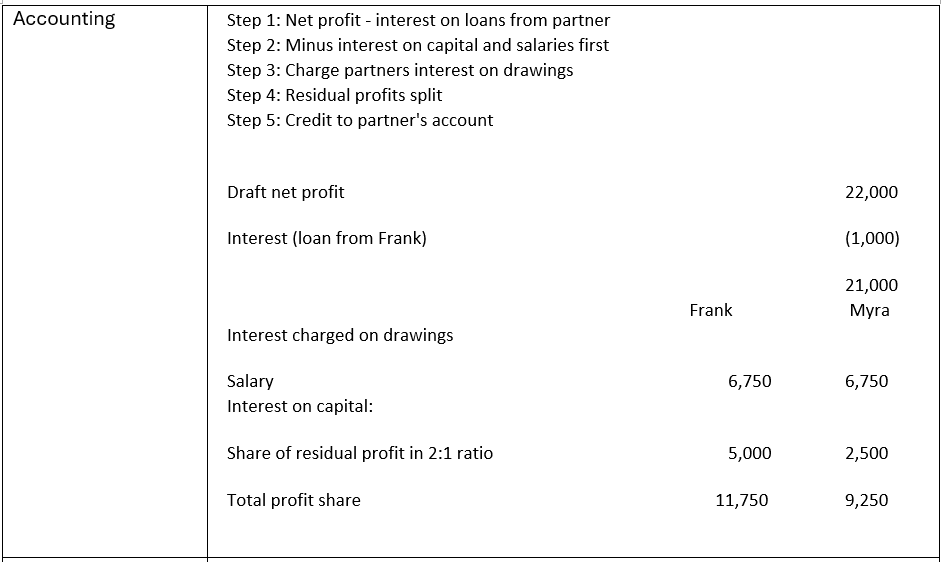

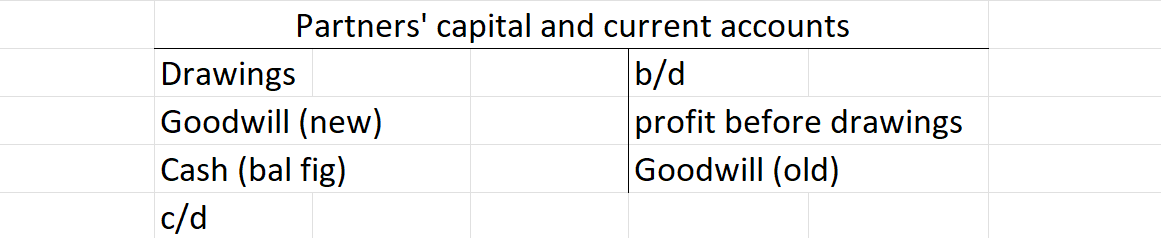

Preparing Partnership Account

Partnership accounts on the ETB

Accounting for changes in partnership structure

- Retirement or death of a partner:

- Split the accounting year into two sections, ensuring precise month counting.

- Compute the interest charged on drawings (+), subtract salary (-), and deduct interest on capital (-) using various ratios. Then, determine the share of residual profit and total profit share.

- Goodwill in the partnership accounts: Typically, the partnership's goodwill share is settled in cash or alternative assets.

T-account used:

- Assume partner A, B and C. Partner A quits in the middle of the year. The goodwill will for B will be accounted by

- Credit the 'old' ratio (during A's existent) of goodwill

- Debit the 'new' ratio (after A quits) of goodwill

- The 'Cash (bal fig)' is the amount of cash A will receive as exchange of his share of capital, profit and goodwill.

- Bal b/d consists of the personal account of A, B and C; while bal c/d only consist of balances on the remaining B and C's accounts.

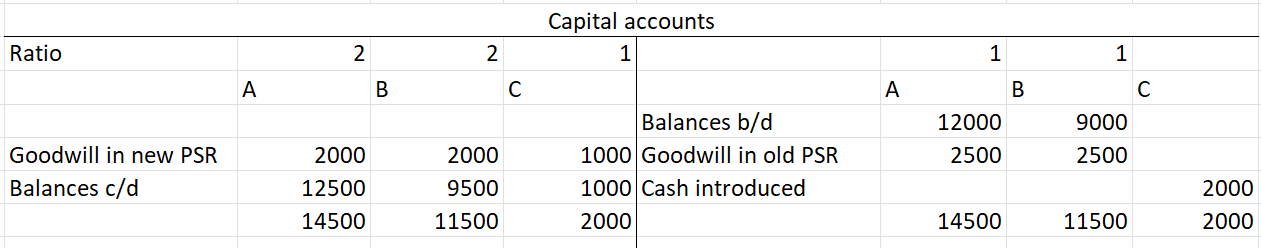

- Admission of a partner

- If the new partner introduces additional capital into the partnership, it needs to be credited to their capital account

As shown above, £1000 of capital introduced by new partner C has been paid in equal shares to A and B in respect of their shares of the business's goodwill.

Reminder from mistakes in practice questions

- Look carefully on whether the question is asking the 'total share of profits' or 'closing balance on current account'

- Count accurately for how many months to be accounted for different PSR.

- Interest charged on partners' drawings is added to profit during the profit allocation

- When there is an expense allocated to only the upper half of the year, calculate the profit for the upper half by:

- Upper half = X - (X + expense)/2

- Lower half = (X + expense)/2

- Result: profit of the upper half of the year will be less than the lower half of the year

- In partnership, interest on partners drawings affects netiher net profit available for appropriation nor the cash position.

The End

Finally

I hope you enjoy this summary of the 400-page Accounting CFAB study manual and my learning points from the practice questions. Once again, a disclaimer that some information may have been omitted, and if any professionals spot any errors, feel free to let me know. Happy studying~