Business, Technology and Finance ICAEW CFAB

In this blog post, I present you a comprehensive summary of each chapter covered in my study of Business, Technology and Finance (BTF) from the ICAEW CFAB 2018 syllabus. Consider this my notes for understanding the fundamentals of BTF.

Disclaimer: I want to acknowledge upfront that I might have overlooked certain content or concepts inadvertently ;-;

Now, without any more delay, let's dive right into the content.

Chapter 1

Introduction to Business

What is an Organisation?

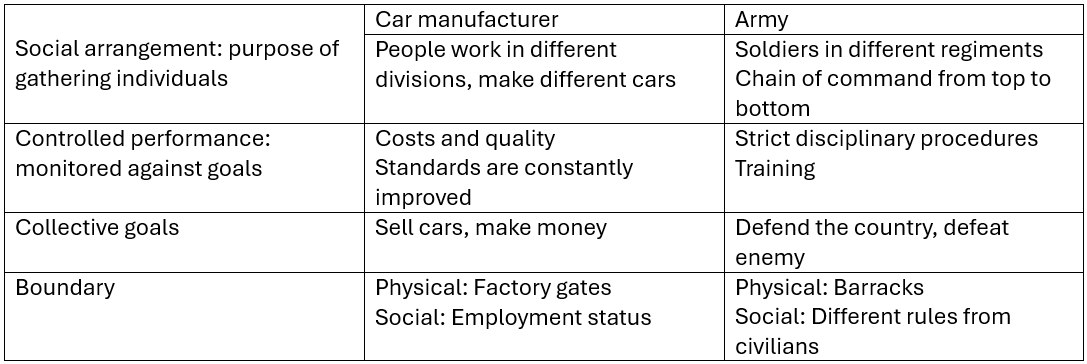

A social arrangement for the controlled performance of collective goals, which has a boundary separating it from its environment.

Reasons of existence of organization: Be more productive

- Overcome people’s individual limitations

- Specialization in best

- Save time

- Accumulate and share knowledge

- Pool their expertise

- Enable synergy: the combined output of two or more exceeds individual output

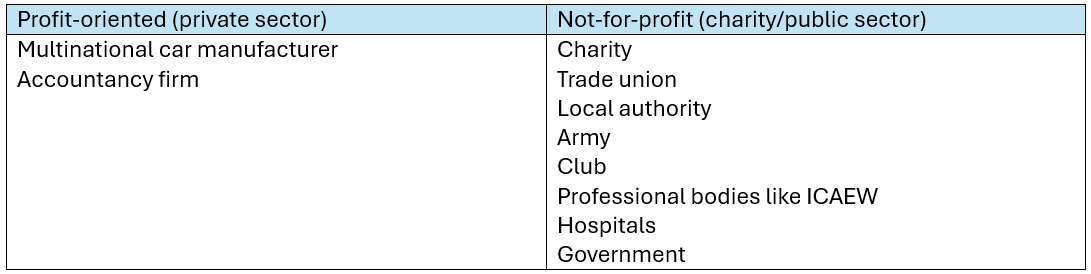

Examples:

Differences between organisations:

- Ownership, Control, Activity, Orientation (profit/non-profit), Size, Legal status, Finances, Technology

- Activities: Agriculture, Manufacturing, Extractive/raw materials, Energy, Distribution, Intellectual production, Technology, Service Industries

- Easy way to remember: 'What do humans in the current era need?'

- Activities: Agriculture, Manufacturing, Extractive/raw materials, Energy, Distribution, Intellectual production, Technology, Service Industries

What is a Business?

An organization that is oriented towards making a profit for its owners to maximise their wealth and that can be regarded as an entity separate from its owners.

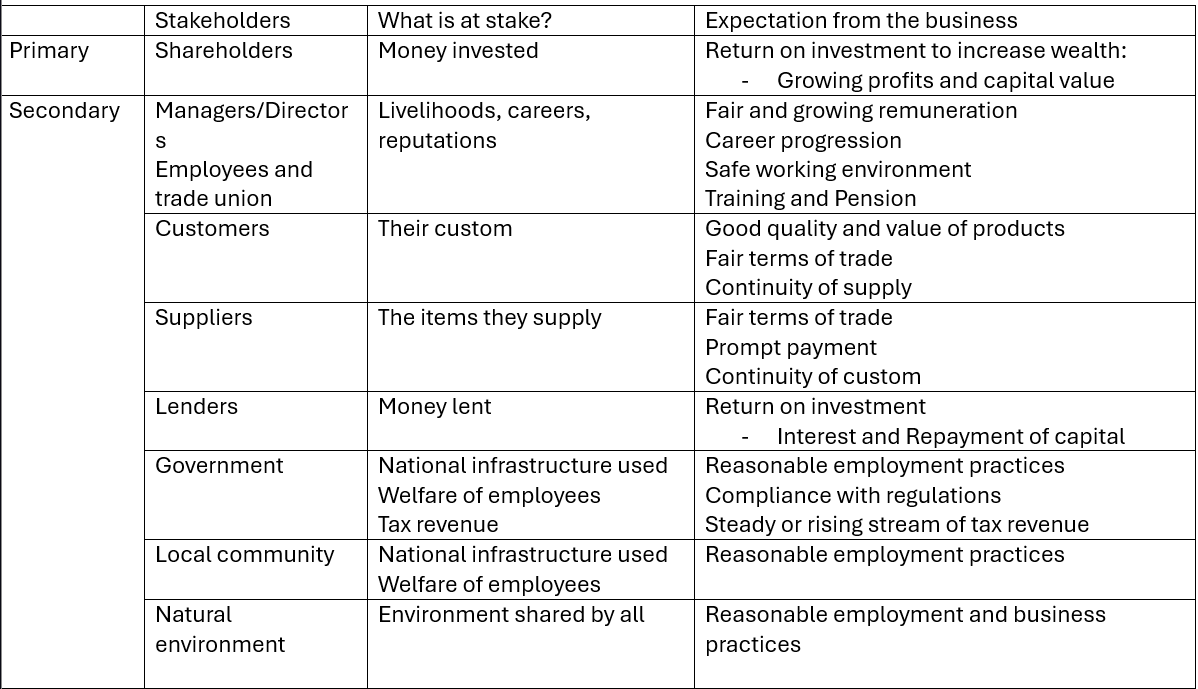

Stakeholders in the business

Stakeholders: A person or more have an interest to protect in respect of what the organization does and how it performs

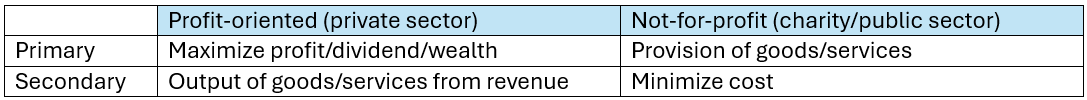

Primary vs Secondary

Responsibilities

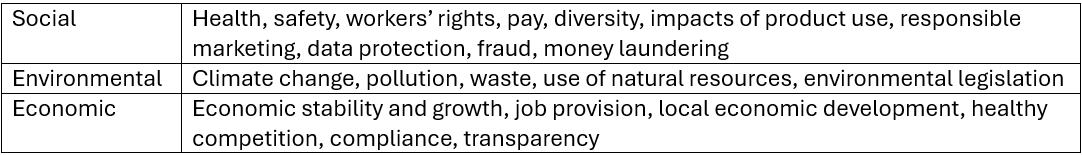

Business must take wider corporate responsibility such as its impact on:

- Natural environment

- Sustainable strategy in resources

- Management of human resources

- Management of risks

- Extent of charitable support

- How far it goes beyond bare minimum of laws and regulations

Definitions

- Sustainability: Ability to meet the needs of the present without compromising the ability of future generations to meet their own needs

- Business sustainability: How far a business can operate in a sustainable way, and how it interacts with individuals and governments.

- Corporate responsibility: Commitment the business makes to its stakeholders to increase its positive impacts and decrease its negative ones

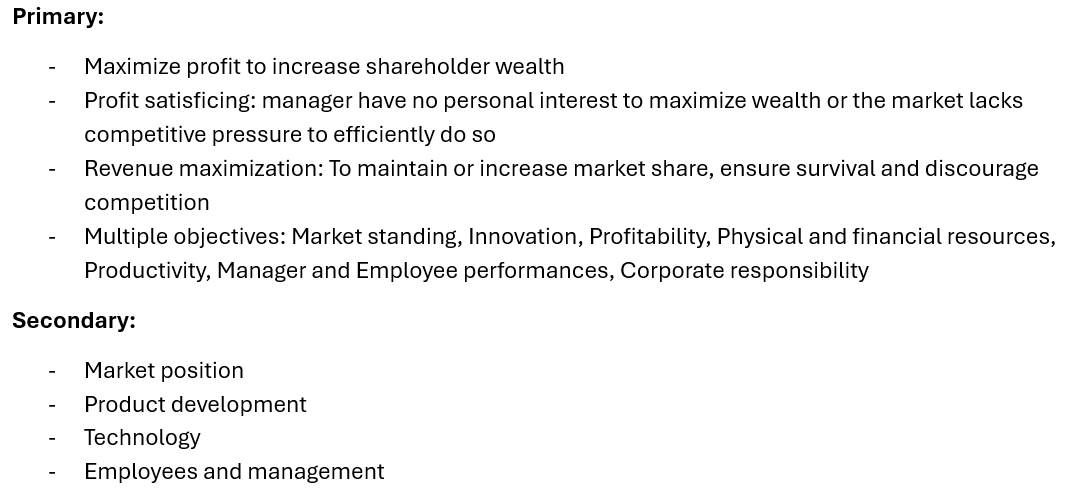

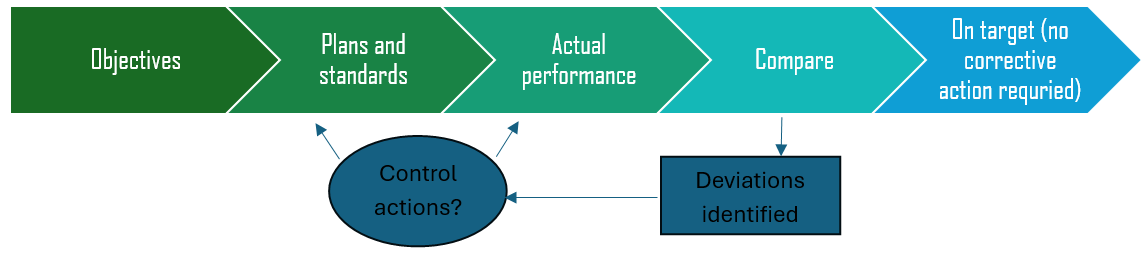

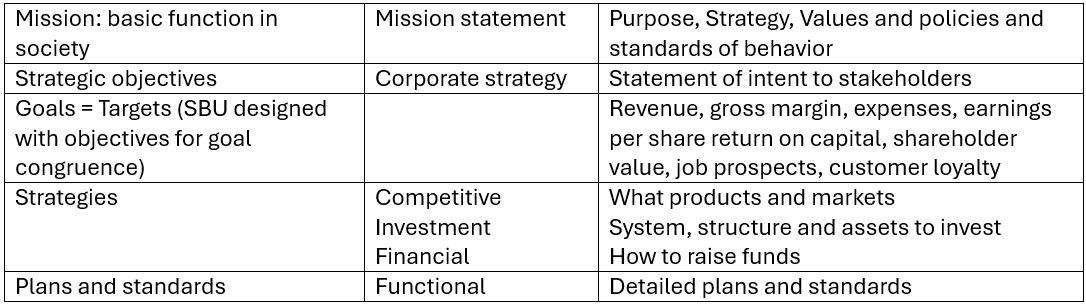

Business's objectives

Mission, goals. plans and standards

The planning and control system:

Mission: Business’s basic function in society expressed in terms of how it satisfies its various stakeholders. Therefore, it sets the overall direction of a business.

- Elements: Purpose, Strategy, Policies and standards of behaviour, Values

- Vision: Future state of the industry or business which determines what its mission should be

Goals: Aims and objectives; a desired end result

- Non-operational or Qualitative goals

- Operational or Quantitative goals: SMART

- Specific, Measurable, Achievable, Relevant, Time-bound

- Example: Reduce budgeted expenditure on office stationery by 5% in 2 years

- Purpose:

- Implement mission

- Publicize the direction of organisation to managers and staff

- Appraise whether decision is valid

- Assess and control actual performance to achieve targets

Plans and standards

Plans: State what should be done to achieve the operational objectives. Standard and targets specify a desired level of performance (physical, cost, quantity)

Plans are set through a strategic planning process [details explained in Chapter 4]

Chapter 2

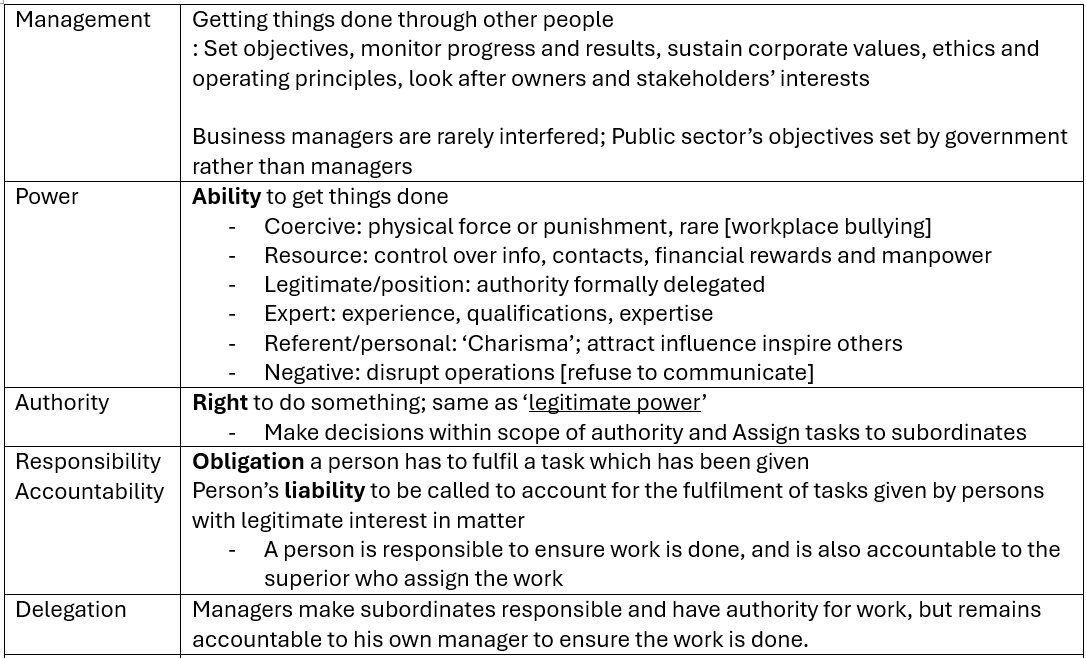

Managing a business

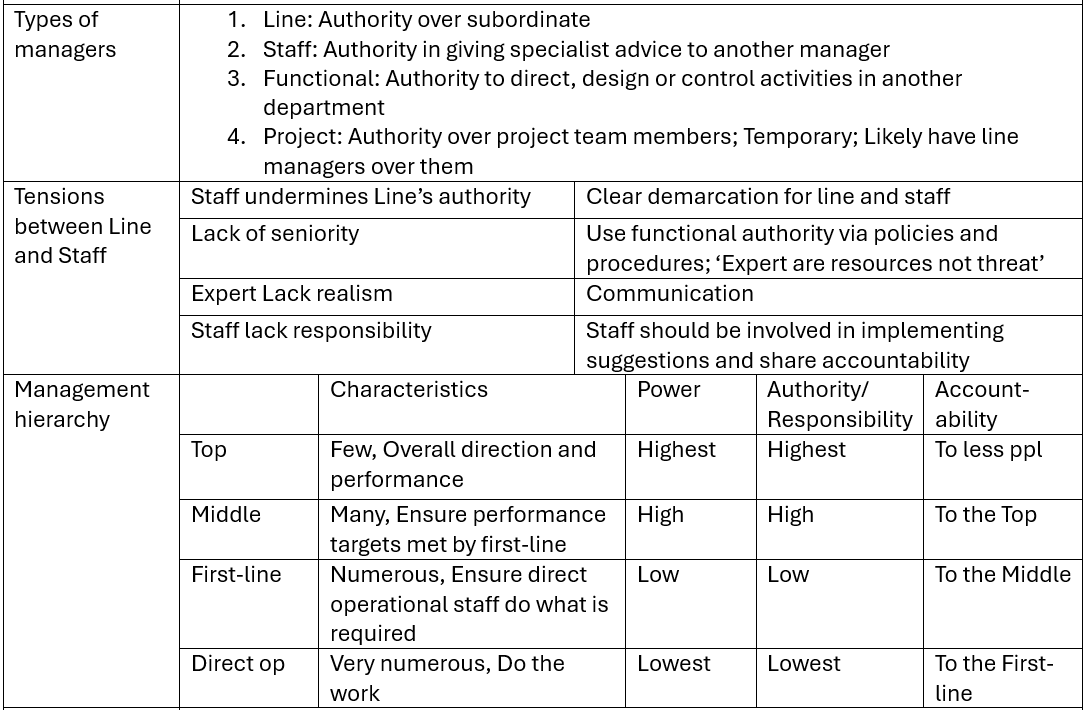

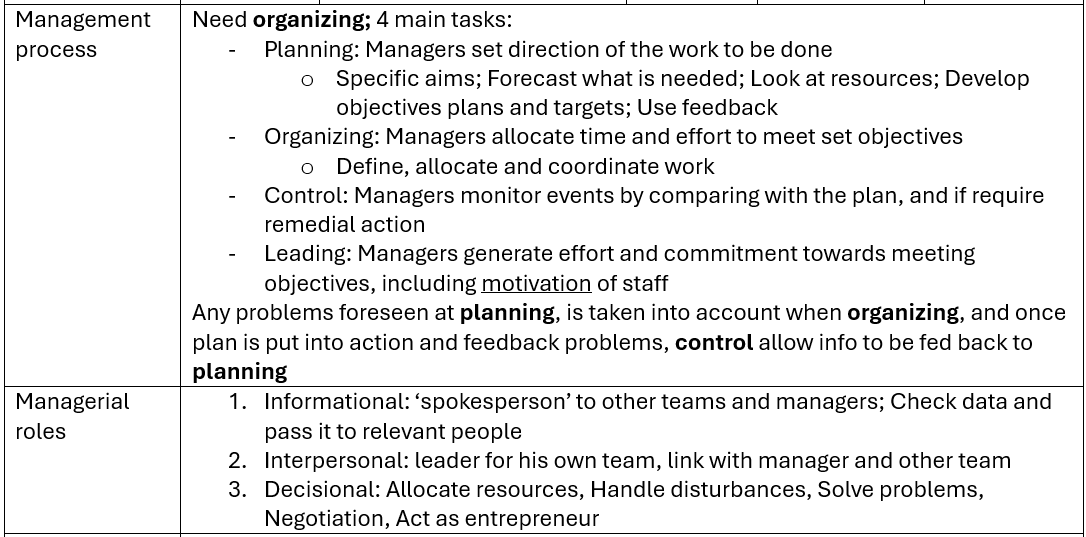

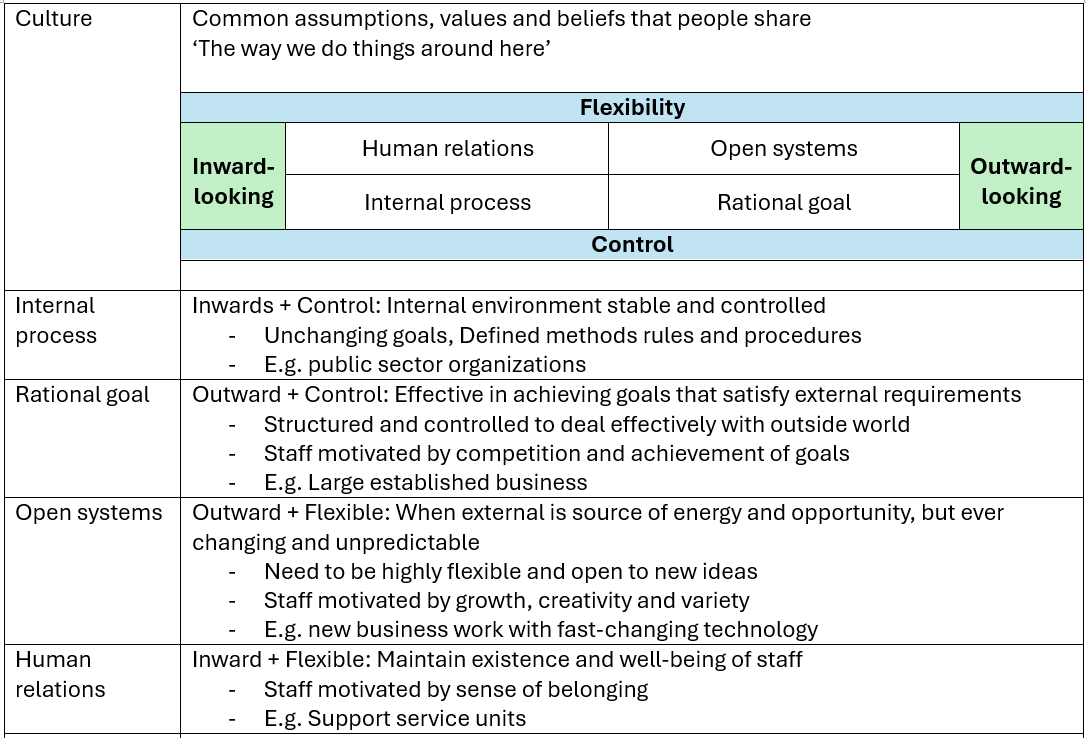

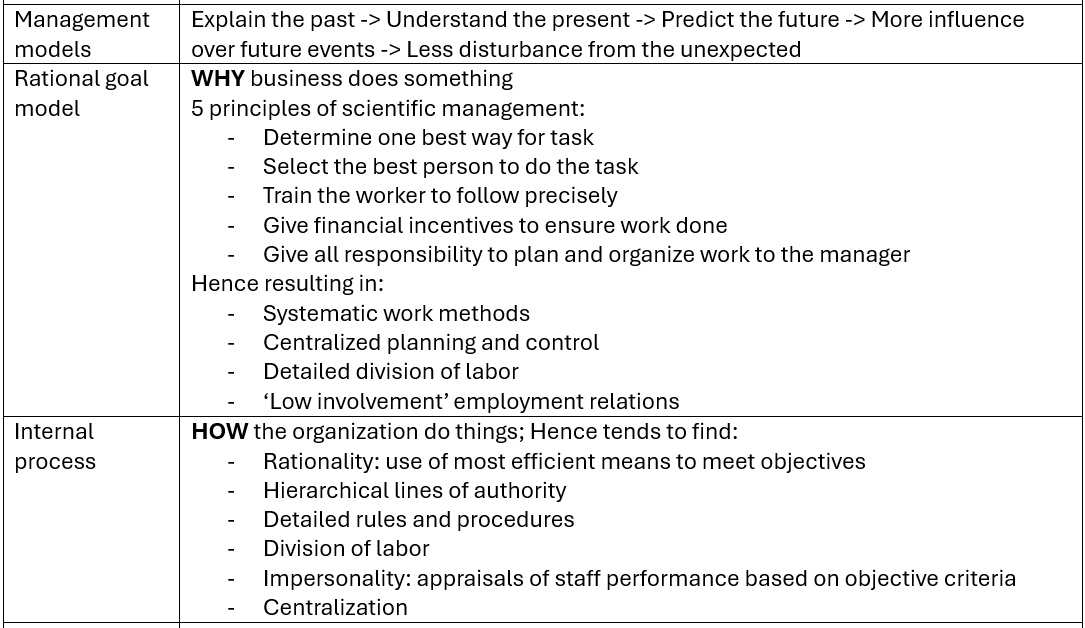

Management, Power, Authority, Responsibility, Accountability and Delegation

Management

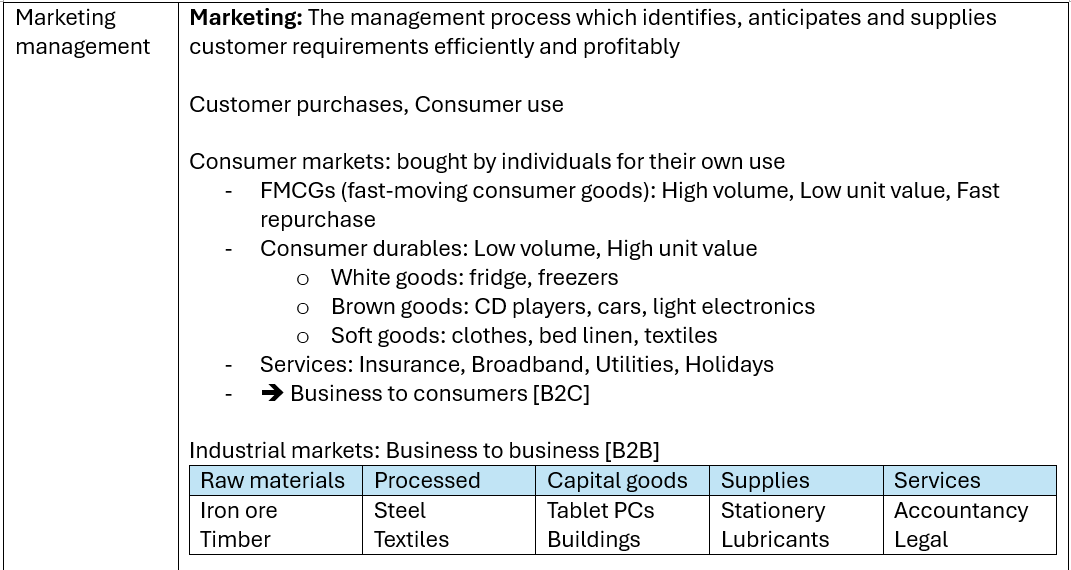

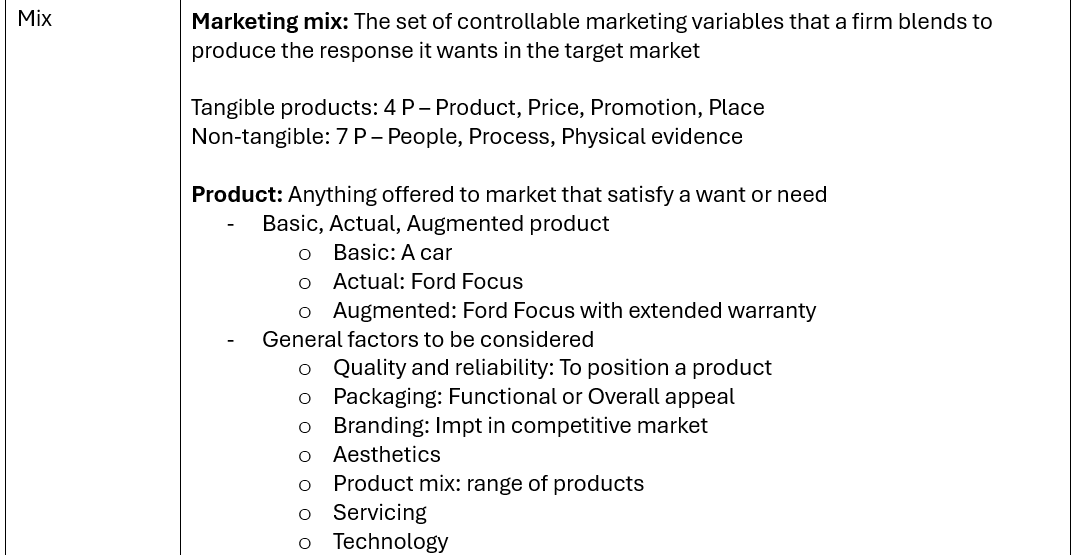

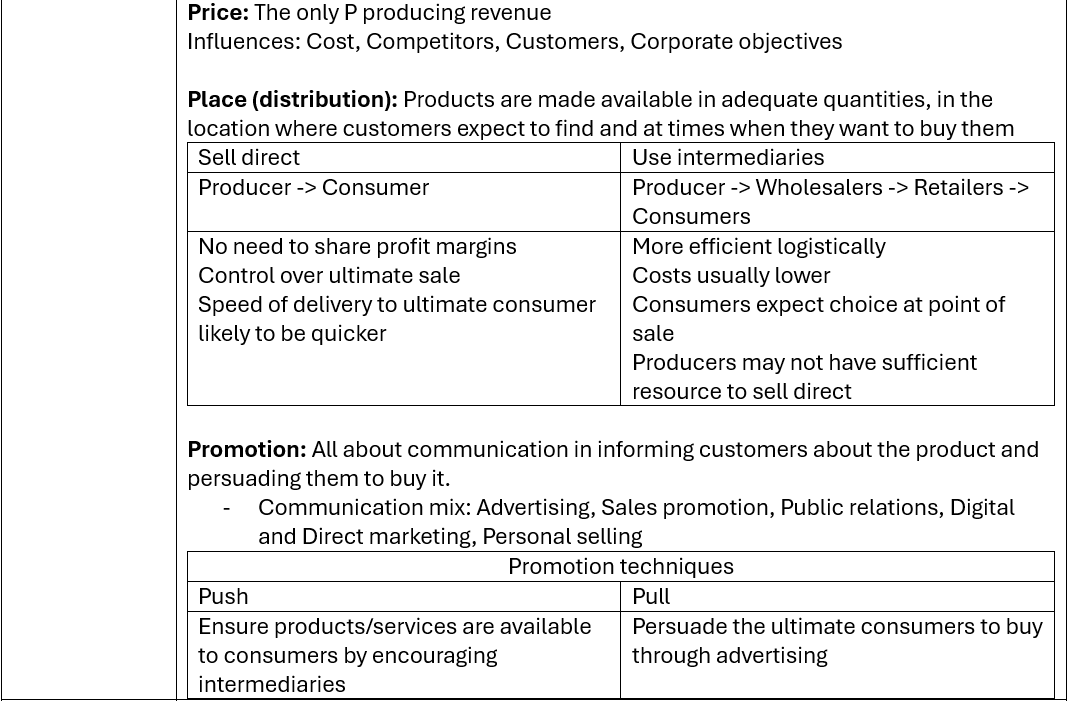

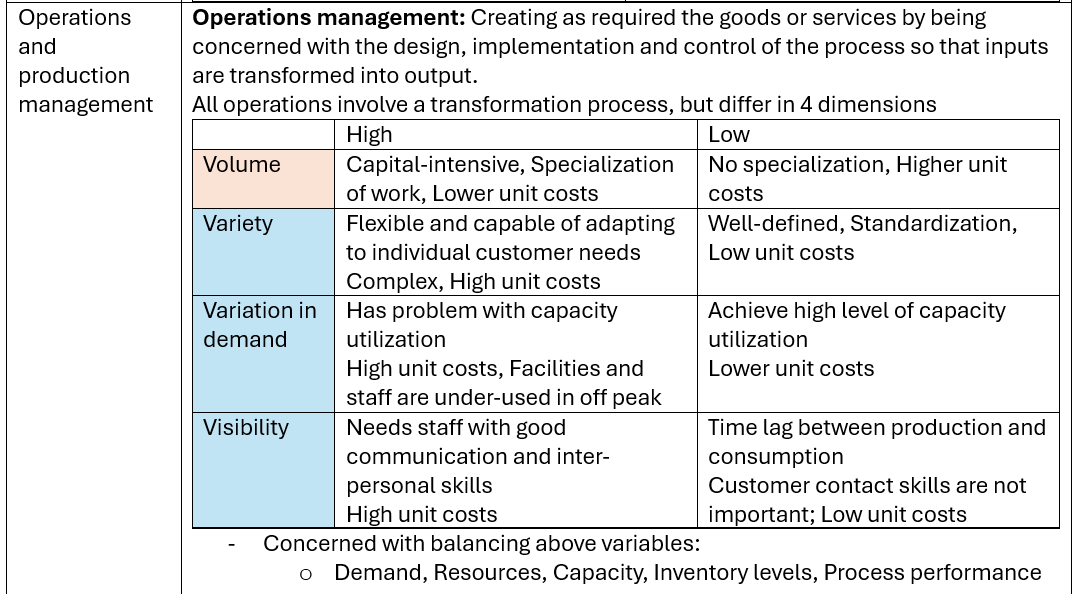

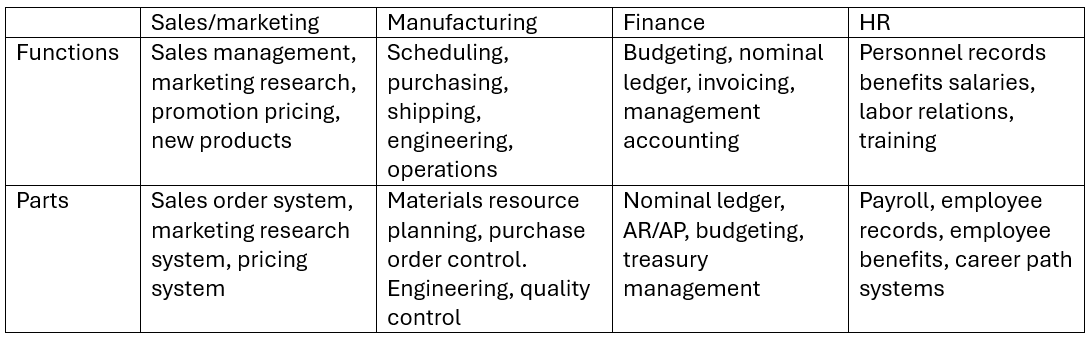

There are 5 business functions: Marketing, Operations/production, Human resources, Finance, Information technology

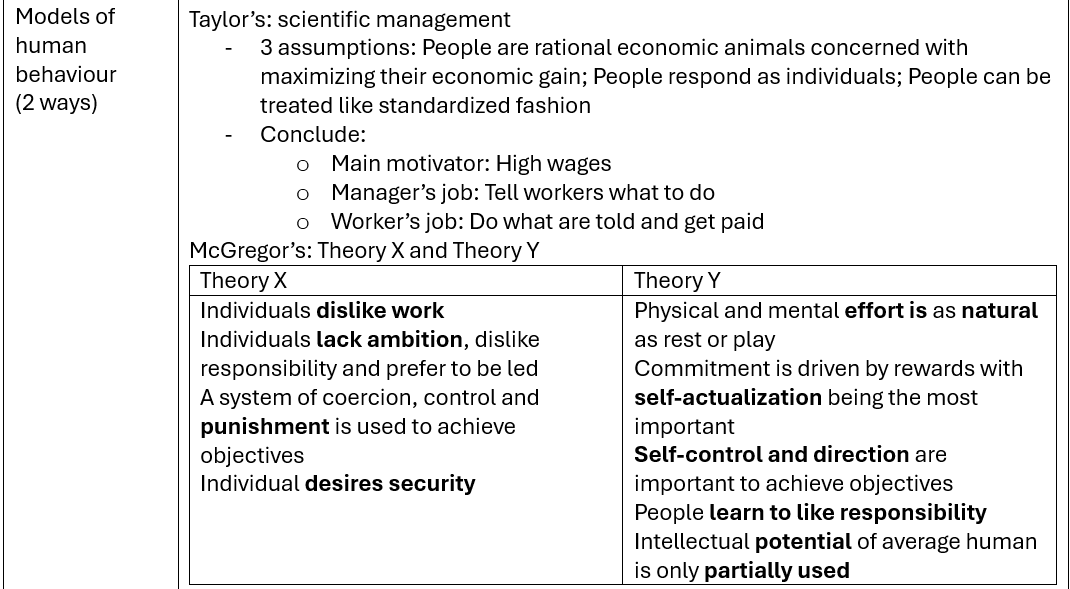

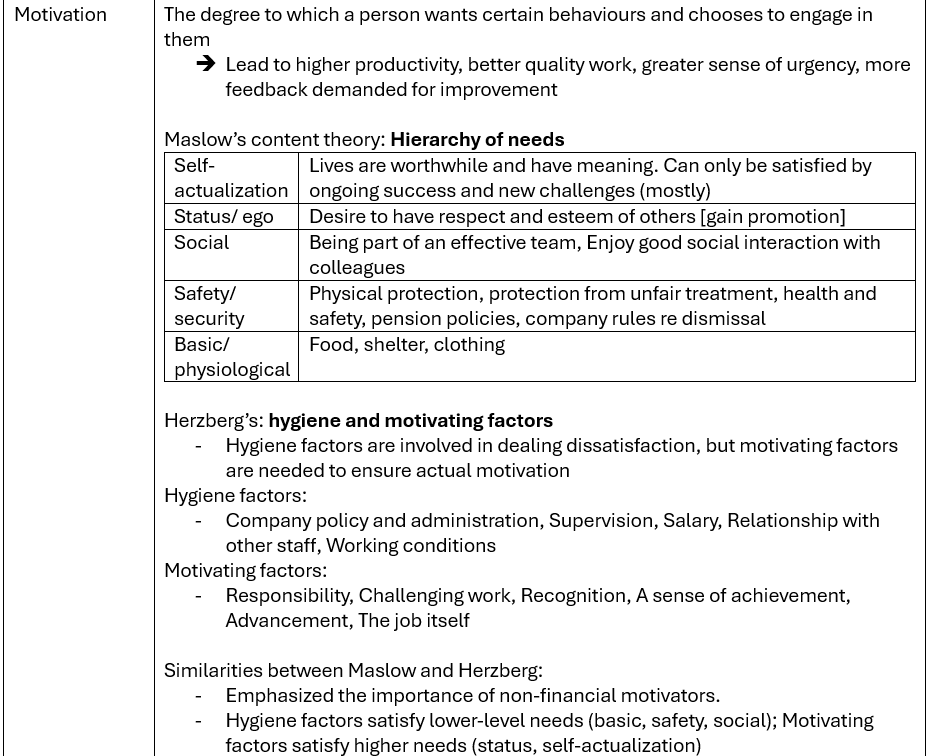

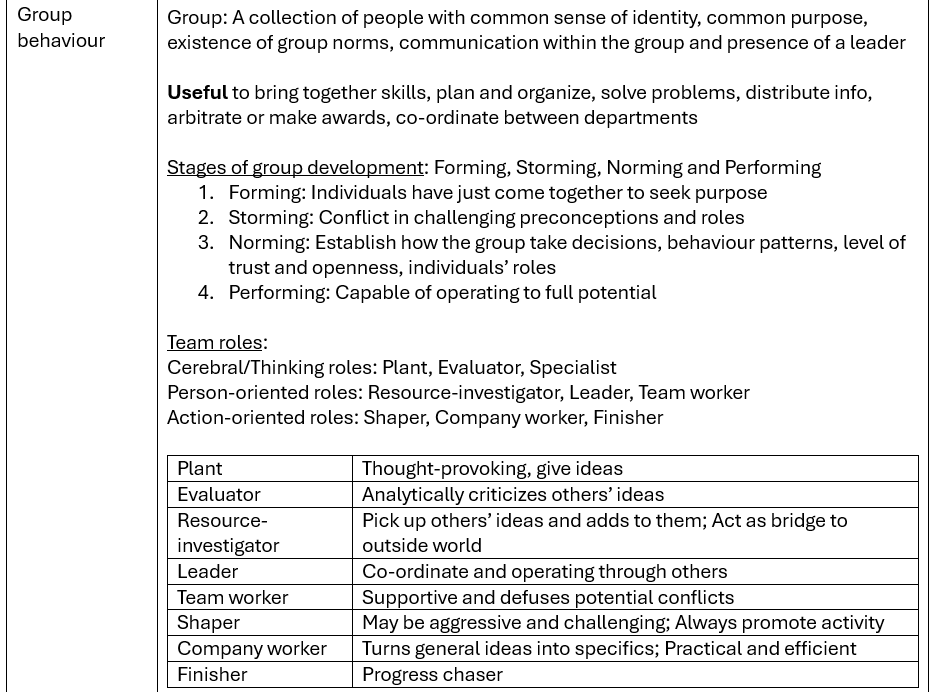

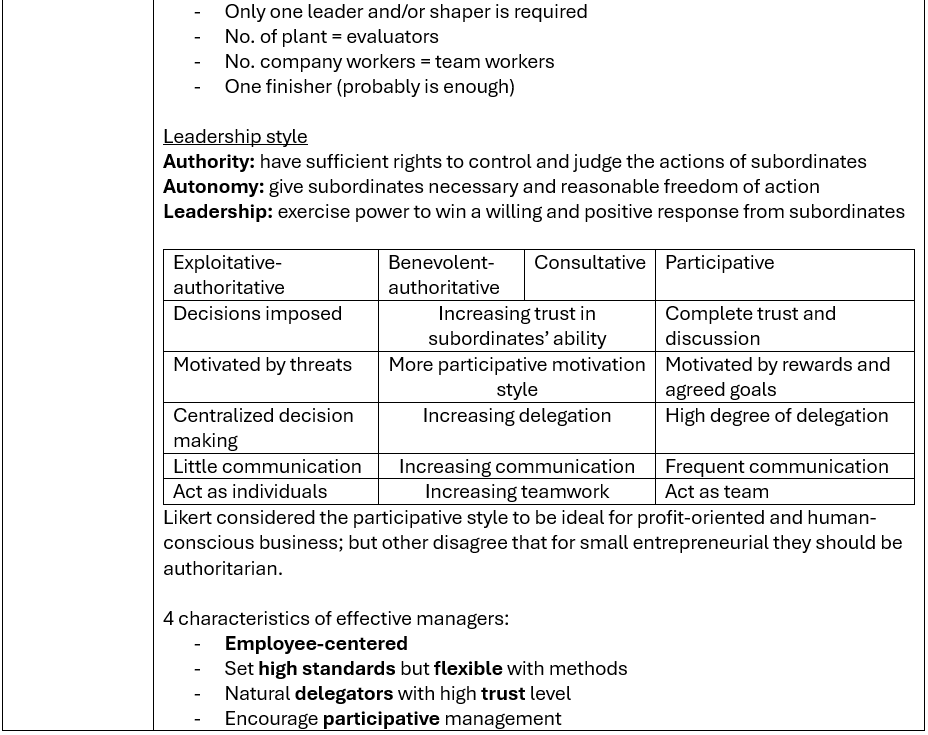

Organization and human behaviour

Chapter 3

Organisational and business structures

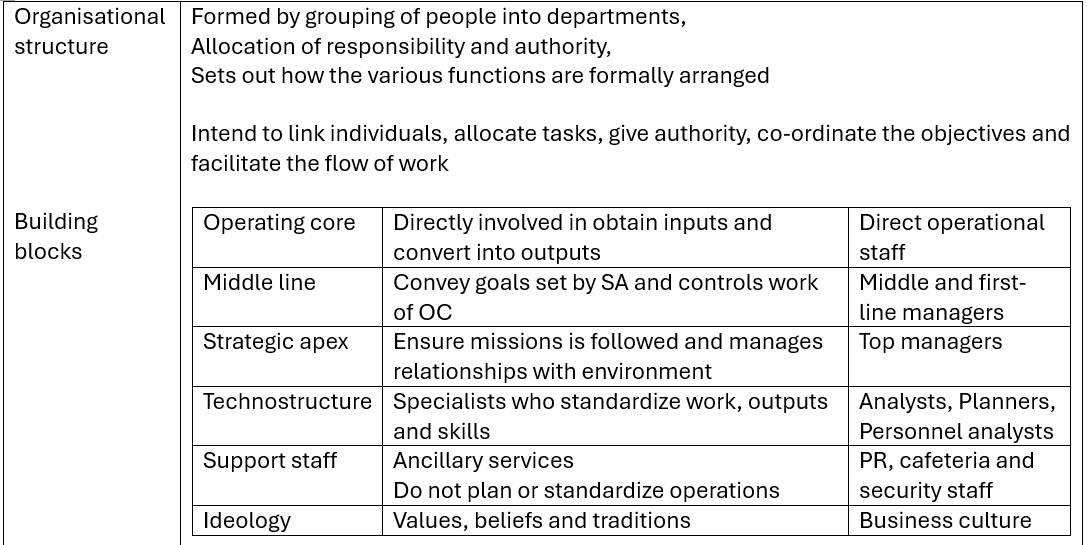

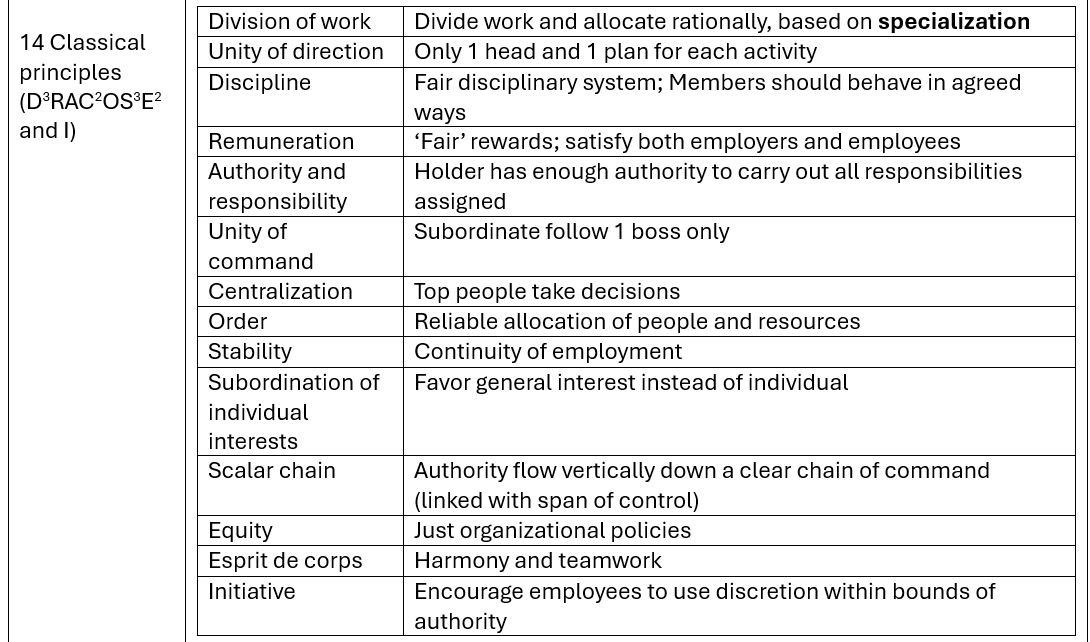

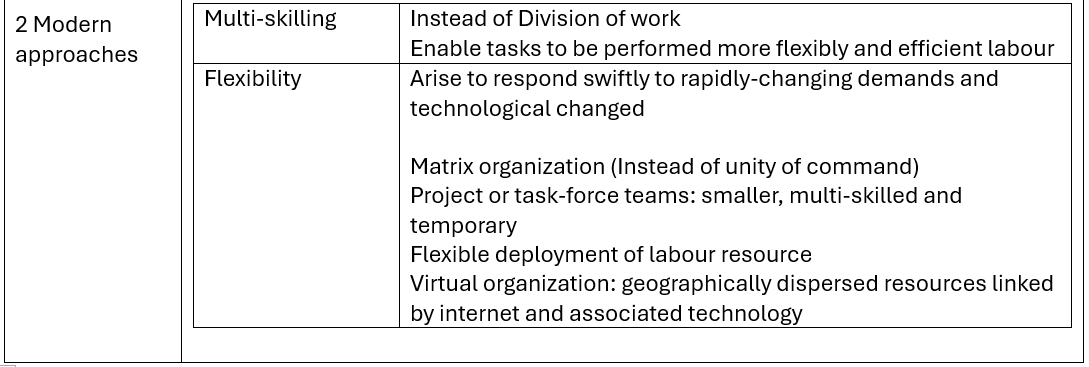

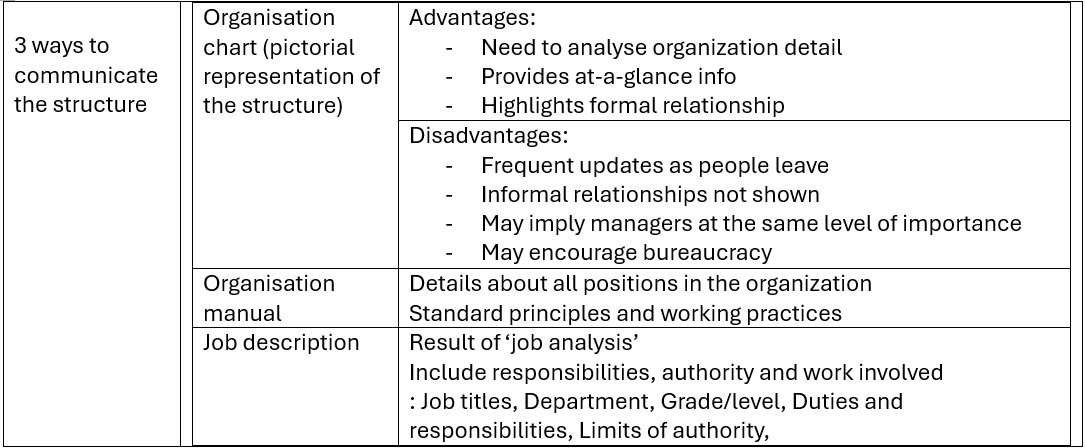

Organisational structure and its principles

Communication of structure

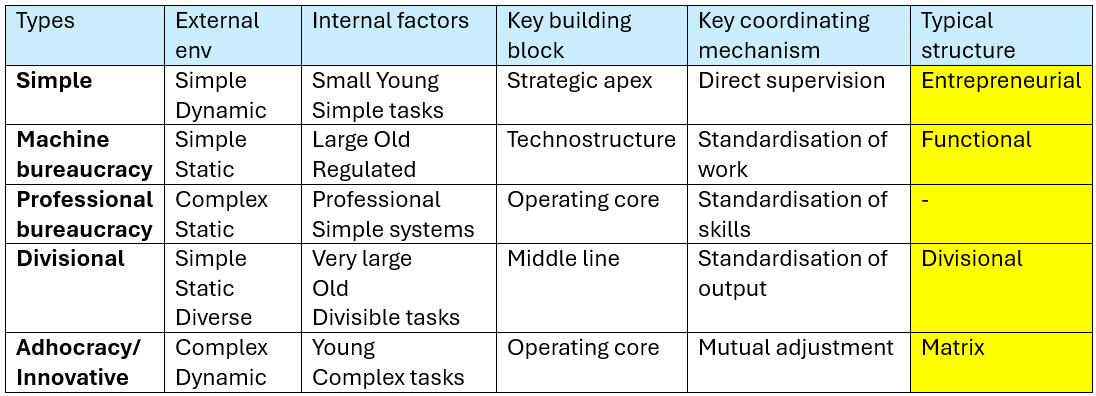

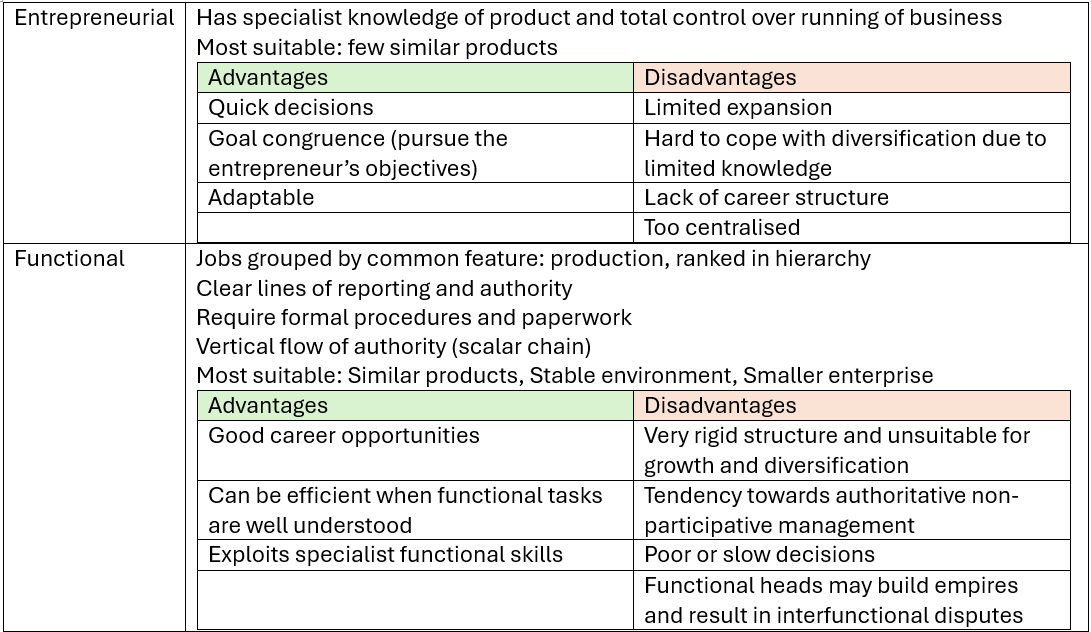

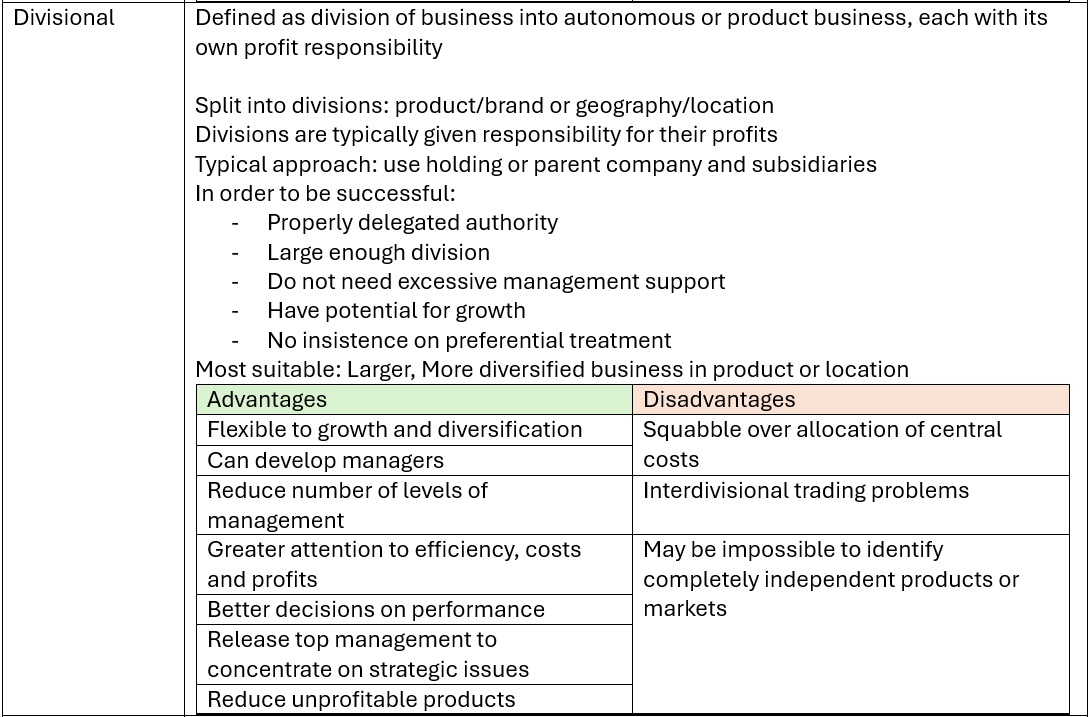

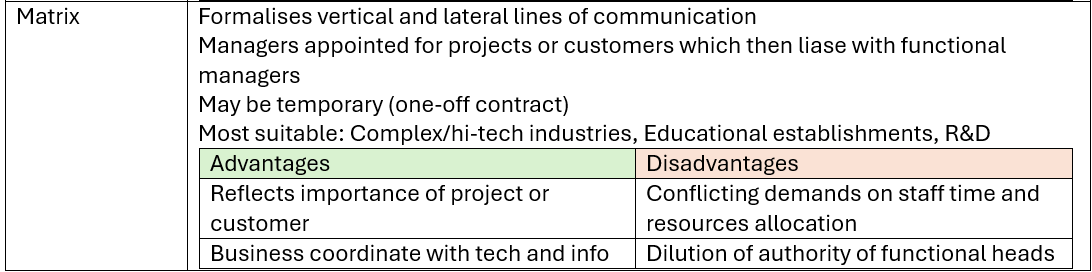

Types of organisational structure

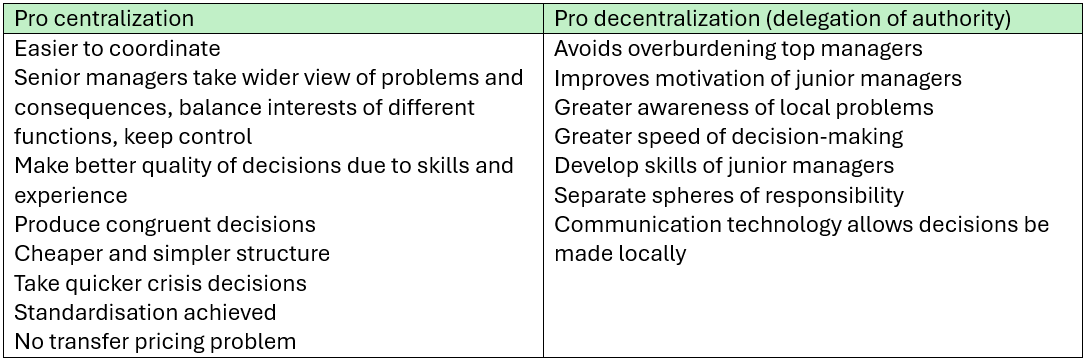

Centralised organisation

One in which decision-making authority is concentrated in one place, that is the strategic apex.

Factors affecting degree of centralization: Leadership style, Size, Diversification of activities, Communication effectiveness, Management ability, Speed of technological advancement, Geography, Local knowledge needed

Tips to remember: [Let See Do-hyun Can Make To Good Kid]

Distributed ledger technology (blockchain): allows people who do not know each other to trust a shared record of events, hence is able to decentralize data storage.

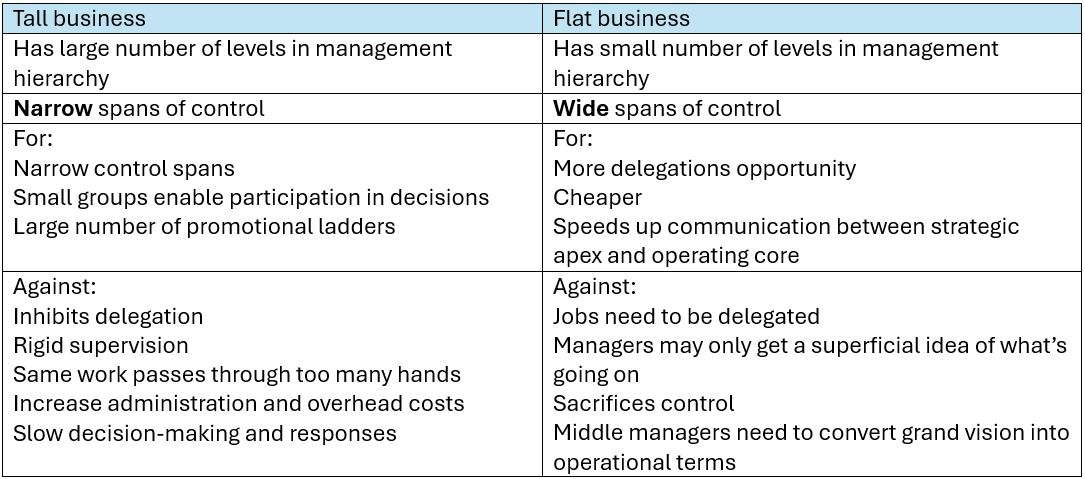

Span of control

The number of people reporting to one person

- Tight managerial control required

- Restricted span of control, to allow max control consistent with capabilities (3 to 6)

- If too wide: too much time taken for routine problems -> less time for planning

- If too narrow: fail to delegate and keep too much routine work to himself; over supervise

Influences:

- Manager’s capabilities: Physical and mental limitations

- Nature of workload: Non-supervisory work (solitary, entrepreneurial and interactions) and Supervision -> More N-S work, narrower span of control

- Geographical dispersion: Dispersed narrows SoC

- Subordinates work: Close group cohesion narrows SoC

- Nature of problems

- Interaction between subordinates: If they can help each other, wider span is possible

- Amount of support and technology

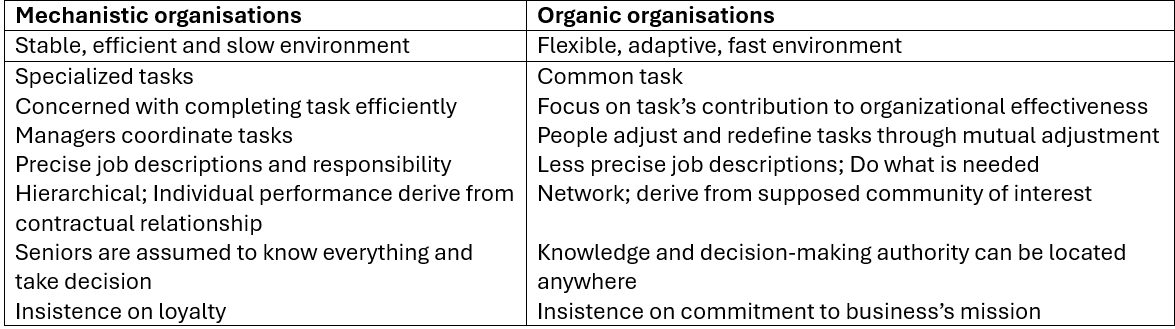

Types of organisation

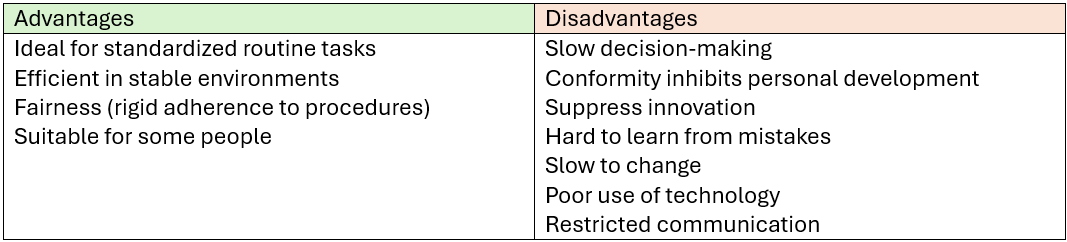

Mechanistic organization = bureaucracy

Bureaucracy – A continuous organization of official functions bound by rules

- Continuous organization: Business stays even if people leave

- Official functions: Divided into areas with specified duties (operations and marketing, etc.)

- Rules: course of actions to be taken under given circumstances

Characteristics: S2TIR pH

- Specialization, Stability, Technical competence, Impersonal nature, Rationality, Professional nature of employment, Hierarchy of roles

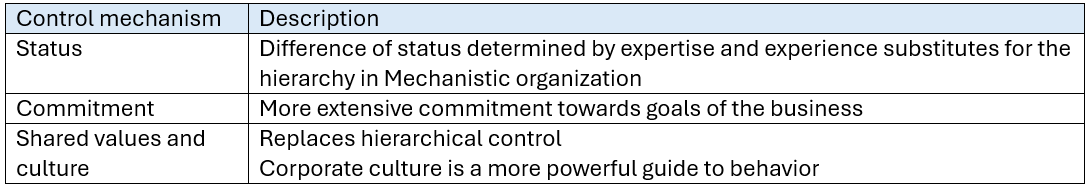

Organic organisation

Business structure

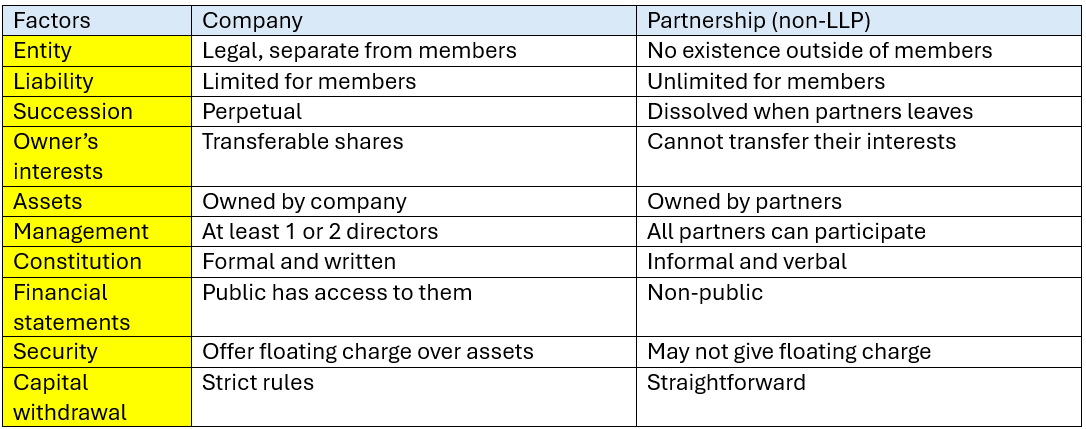

Sole tradership, Partnership Companies

- Details refer to 'Accounting' study

- Main points:

- Sole tradership and partnership are wholly liable for debts of business, and there’s no perpetual succession (except limited liability partnership)

- Company must have at least one shareholder, two directors and 12,500 pounds of share capital paid for registration

- Advantages of companies: Separate legal personality, Limited liability of members, Perpetual succession, Transferability of interests and security for loans

- Disadvantages of companies: Separation of ownership and control, Ownership of assets, Accounting records and returns, Publicity, Regulations and expense

Alliances: Various ways in which businesses can work together

- Joint venture: A + B -> C

- Licenses: permission to manufacture or sell a product under the brand name

- Strategic alliances: A + B = A and B

- Agents: Used as distribution channel where local knowledge are important

- Groups: Parent company owns all shares of subsidiary company

Chapter 4

Introduction to business strategy

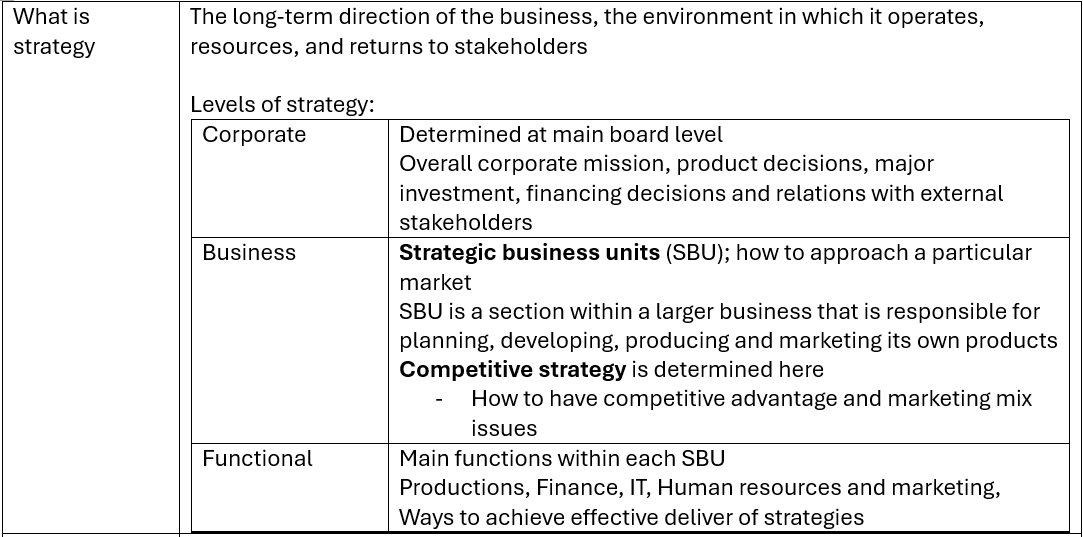

Definition

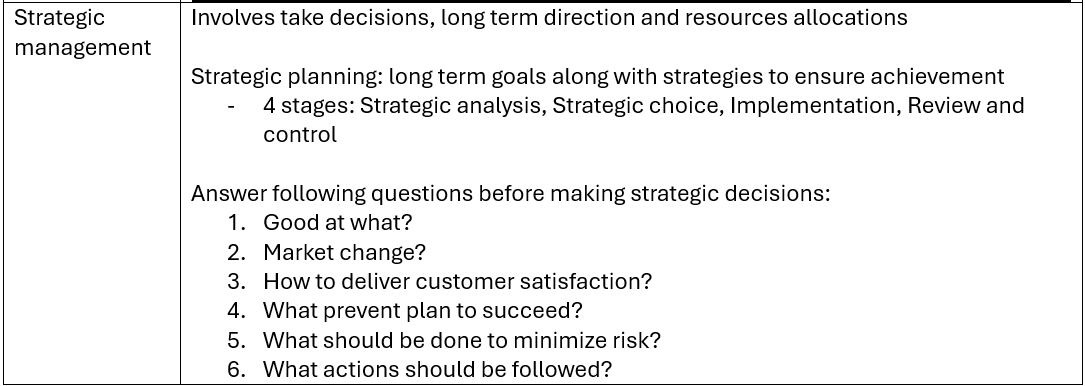

Topic summary

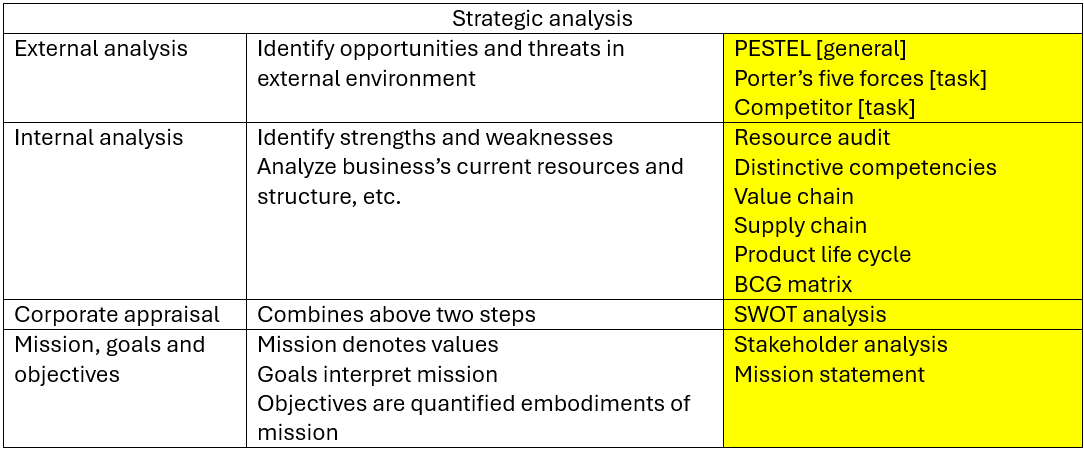

Strategic planning process: Strategic analysis, Strategic choice, Implementation, Review and control

Strategy implementation: conversion of chosen strategies into detailed objectives for operating units, and plans to achieve them

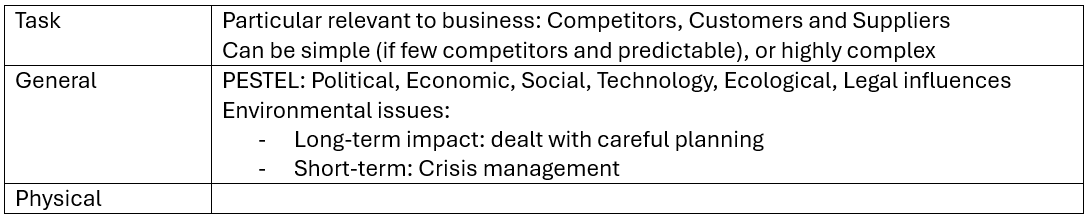

Strategic analysis: External environment

Use PESTEL, Five forces, Competitor analysis

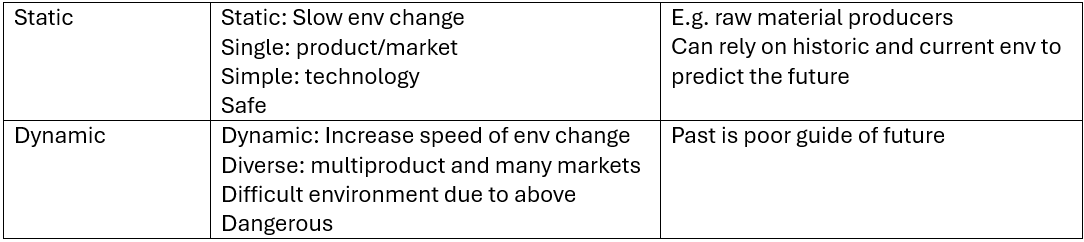

- 3 types of external environment:

- Environmental uncertainty

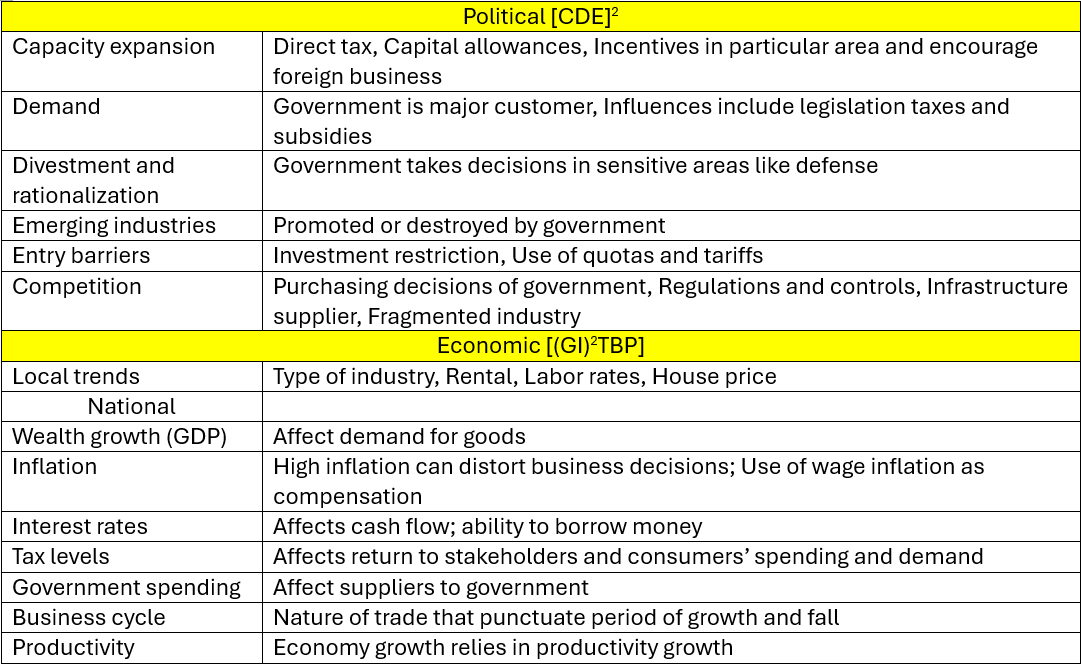

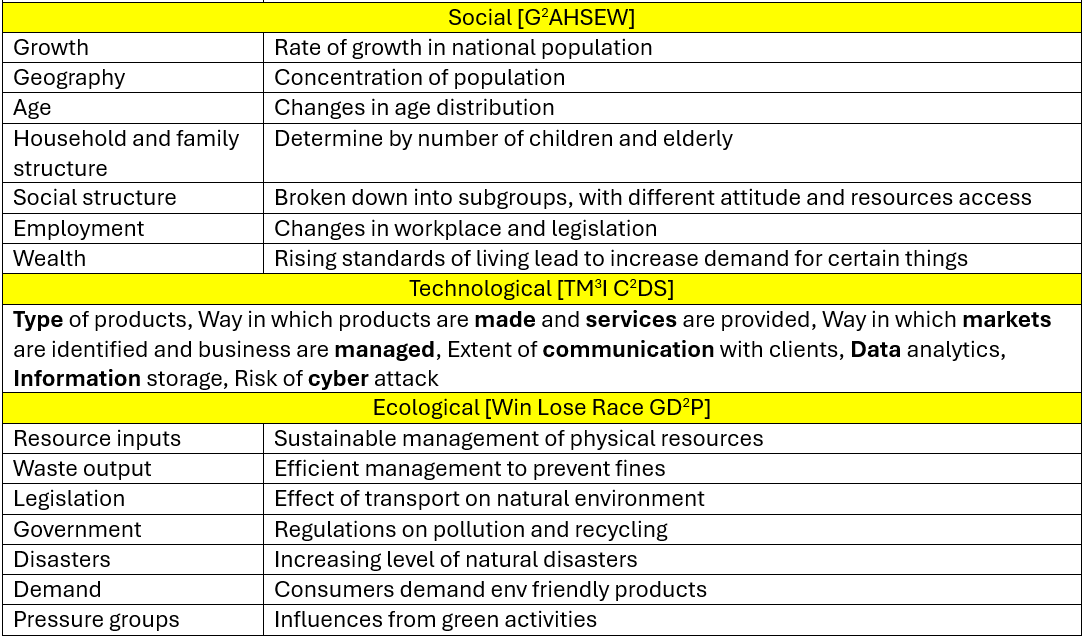

PESTEL analysis: General environment

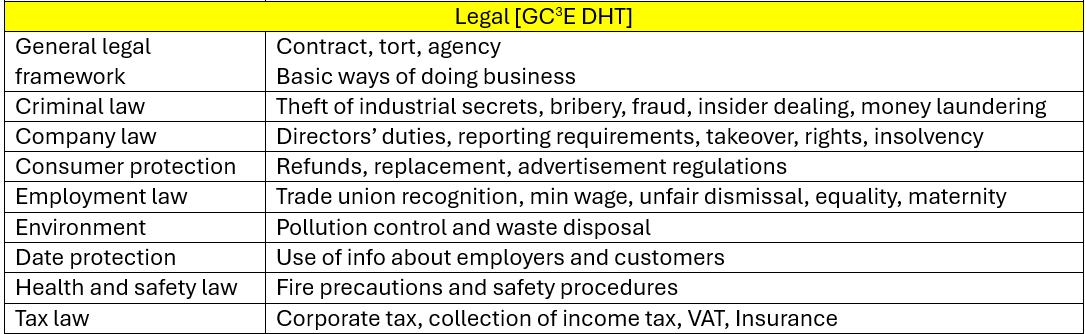

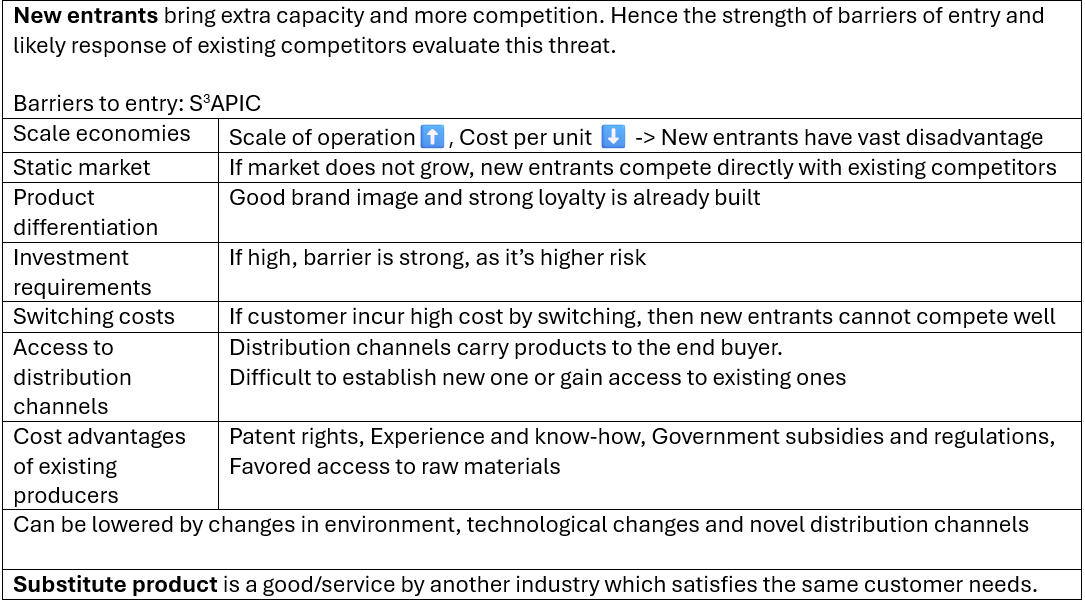

Porter's Five Forces: Task or Competitive environment

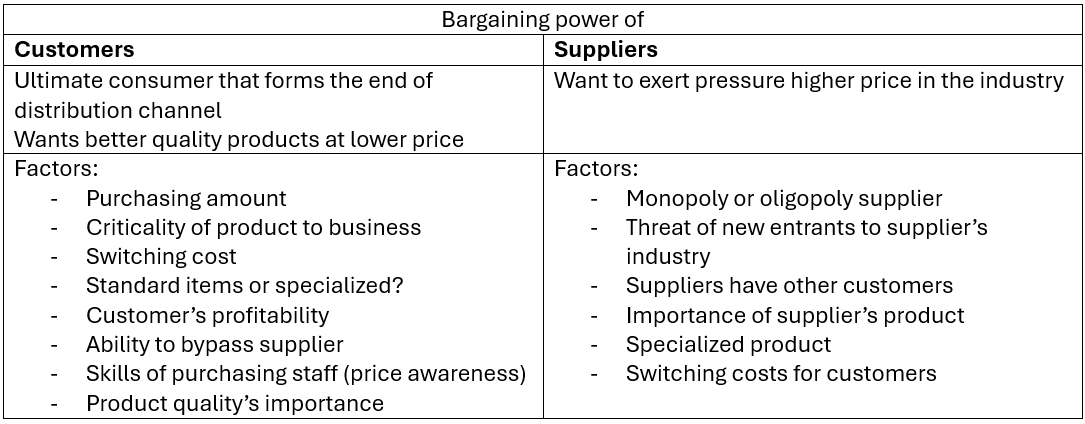

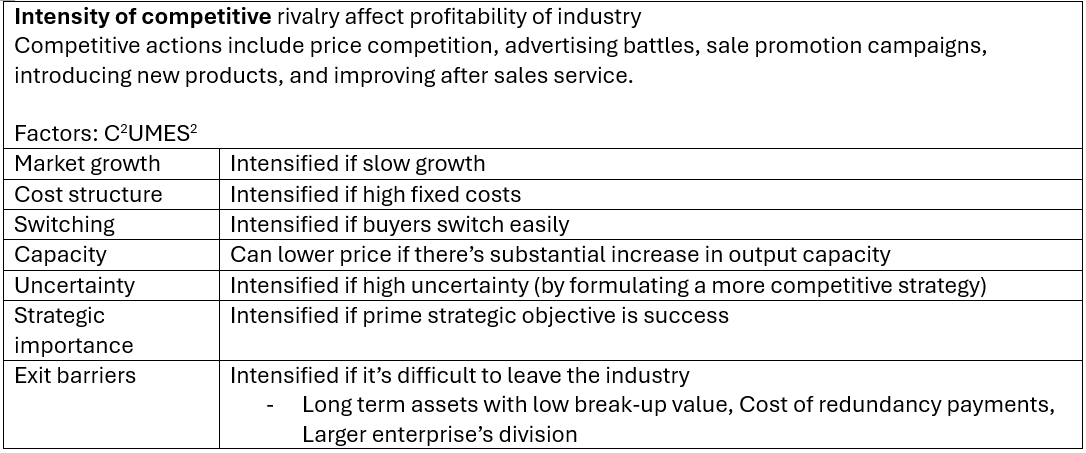

- Threats (new entrants and substitutes)

- Bargaining power (customers and Suppliers)

- Degree of rivalry (competitors)

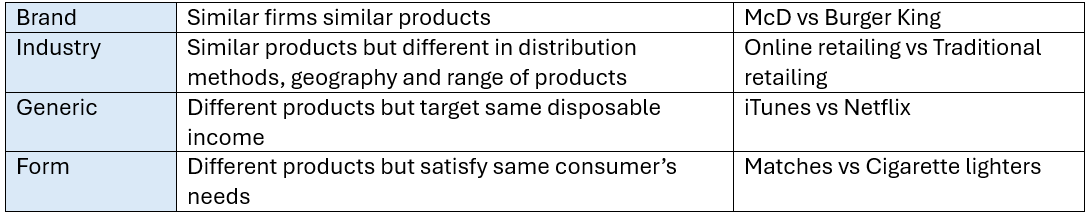

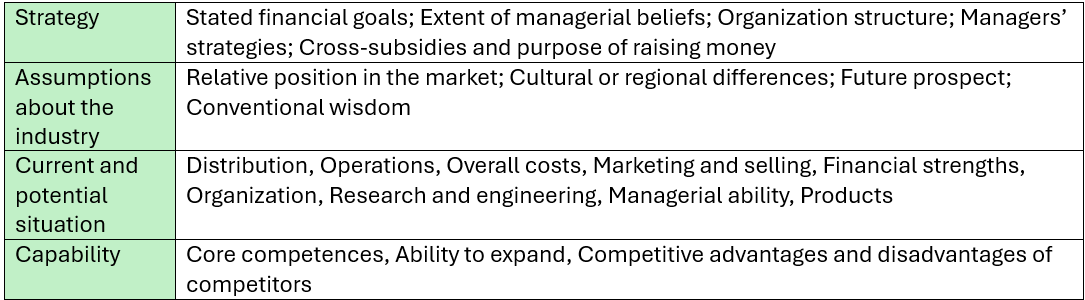

Competitor analysis

4 types of competitors:

Factors to be analyzed: Strategy, Assumptions, Situation, Capability

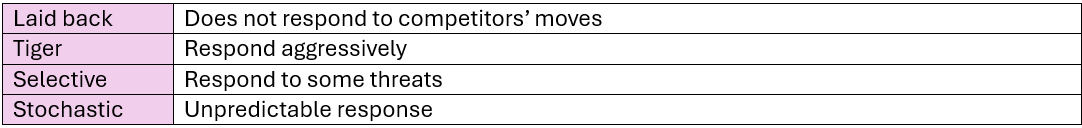

4 reaction profiles: Laid back, Tiger, Selective, Stochastic

Strategic analysis: Internal environment analysis

Use resource audit, distinctive competencies, value chain, supply chain, product life cycle, BCG matrix

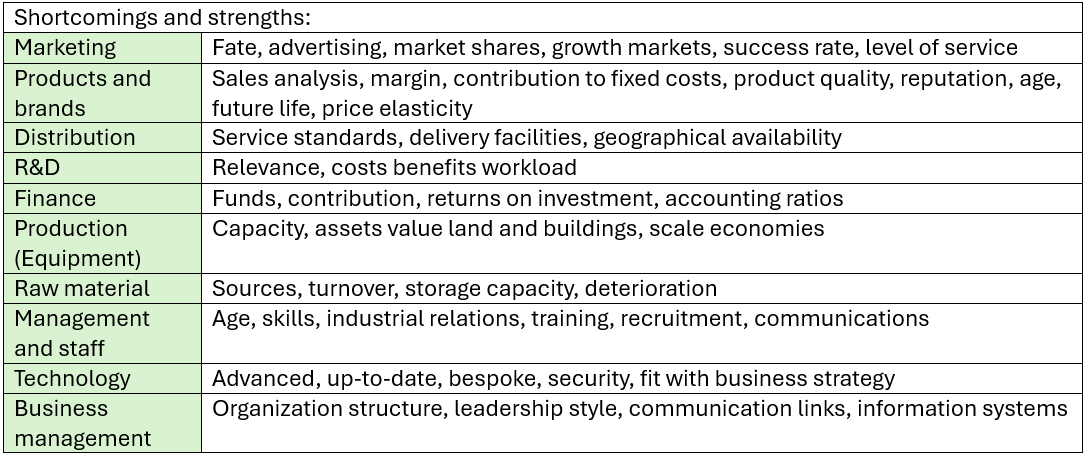

Resources and competencies (the position audit)

Position audit: Part of planning process which examines the current state in respect of resources, competencies, products, operating systems, internal organization, current results and returns to shareholders.

9Ms model: Machinery, Make-up, Management, Management information, Markets, Materials, Men and women, Methods, Money

Resource audit analyzes how limited resources are used effectively or not.

- In the short term, make best use of resources available

- Try to reduce limitation in long term

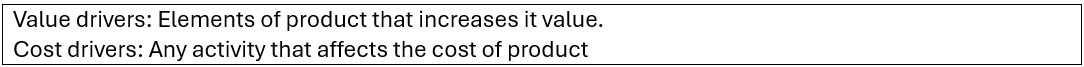

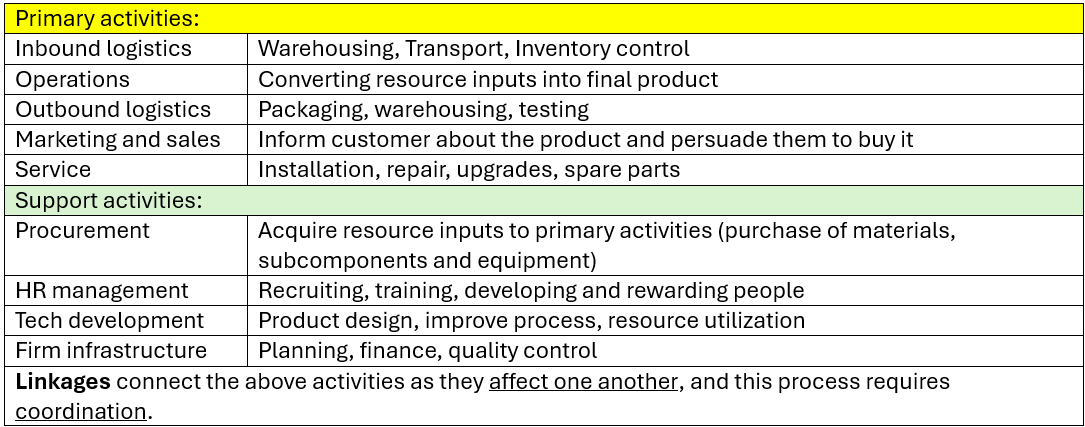

Porter’s value chain: Sequence of business activities by which in the perspective of end-user, value is added to the products

Competitive advantages arise when business performs activities that transform inputs into outputs with higher selling prices. Hence activities = business creates value in its products.

Can be used to secure competitive advantage by invent new and better ways, combine activities, and manage linkages in its own value chain and in the value system.

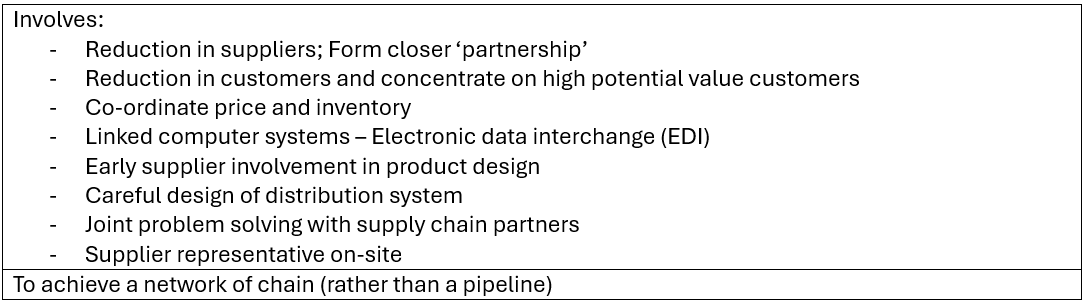

Supply chain management: Optimize the activities working together to produce goods. [Supplier -> Wholesaler -> Retailer -> Customer]

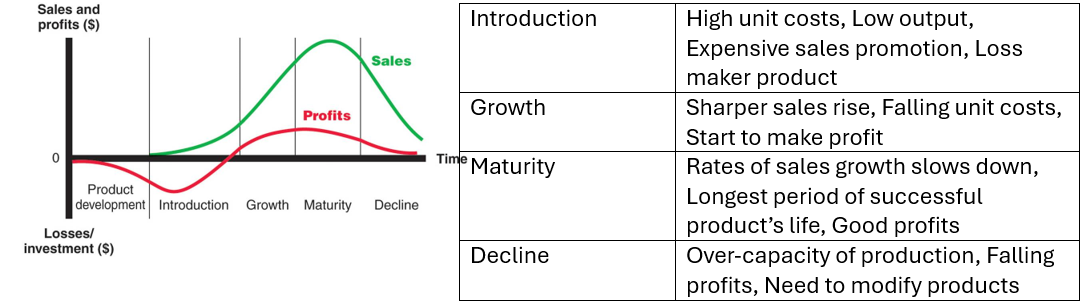

Product life cycle: How a product demonstrates different characteristics of profit and investment over time

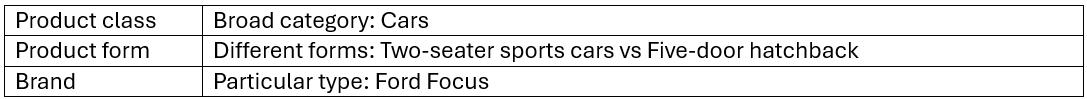

Distinguish of products:

Stages of life cycle:

Planners should assess:

- Stage of product’s life cycle

- Product’s remaining life

- Urgency to innovate

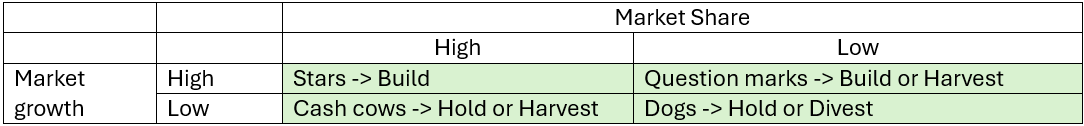

BCG matrix (Boston consulting group): market growth vs market share

- To assess the potential cash generation and cash expenditures requirements

Build = forgo short-term earnings to build market share

Hold = Maintain market position

Harvest = take max earnings in the short term at the expense of long-term development

Divest = Release resources for use elsewhere

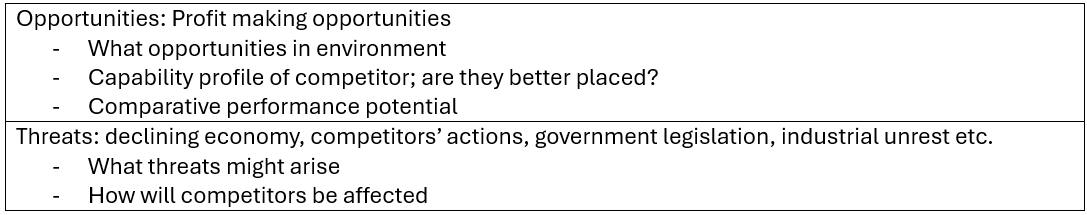

Strategic analysis: Corporate appraisal

Use SWOT analysis

Purpose:

- Capitalize on business’s strengths and external opportunities;

- Mitigate business’s weaknesses and external threats.

Definition

Critical assessment of SWOT in relation to the internal and environmental factors affecting an entity in order to establish ins condition before the preparation of the long-term plan

Relate to any PESTEL and Five forces analysis

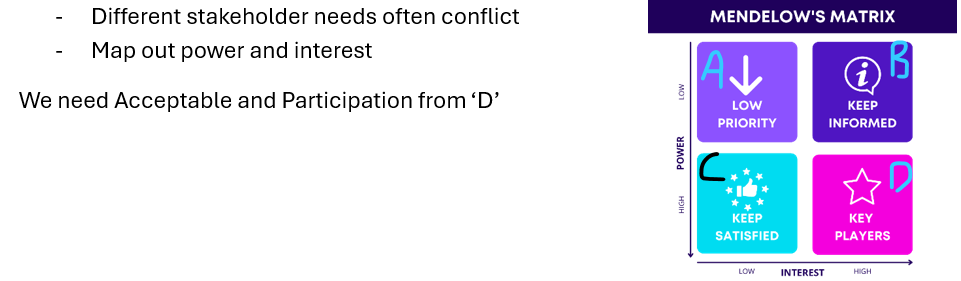

Setting Strategic Objectives

First step: Stakeholder analysis

Power:

- Internal sources: hierarchy, influence, relative pay, control of strategic resources, knowledge skills, environmental control, strategic implementation involvement

- External sources: control over strategic resources, involvement in implementation, knowledge and skills, external links, legal rights

Interest:

- Where their interest rests (e.g. shareholders want capital growth, employees want higher pay, customer wants low prices)

- How interested they are

Second step: Determine mission and strategic objectives

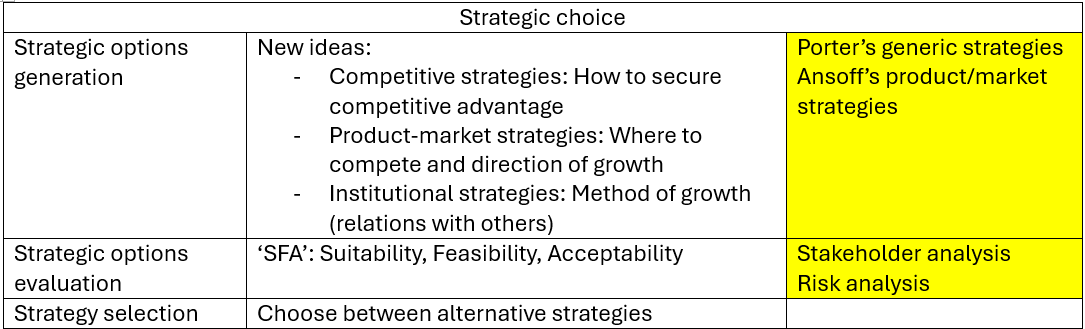

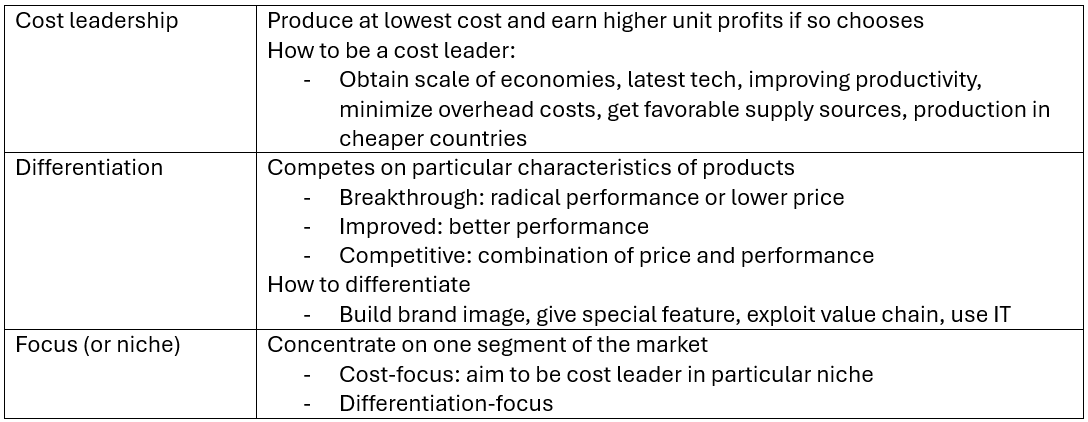

Corporate strategy choice: Generation

Porter's generic competitive strategies

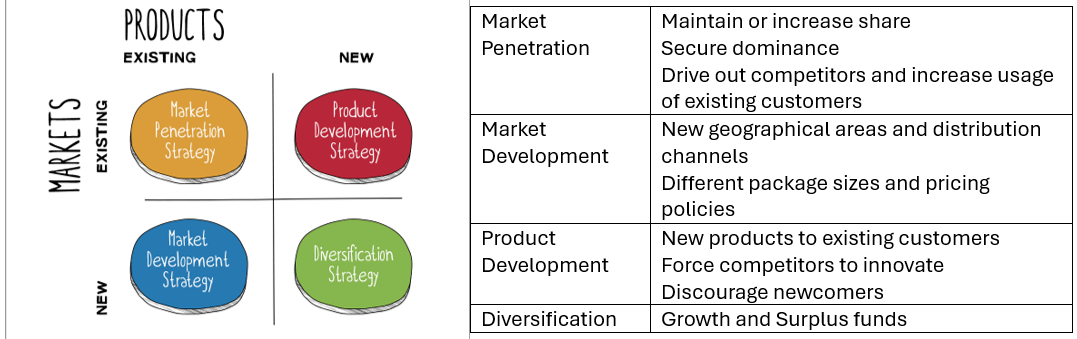

Ansoff’s matrix: product/market strategies

Diversification needs to be more seriously considered, as to what it expects to gain from diversifying to new products and markets at the same time.

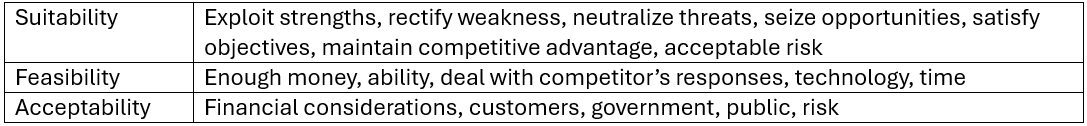

Corporate strategy choice: Evaluation

SFA analysis

- Evaluate each strategy and choose the best one

Strategy implementation

- Break the strategies down:

- Business strategy: How competitive advantage gained by a particular SBU, and how the marketing mix is adjusted to achieve this.

- Functional strategies develop the business strategy: Marketing, Production, HR, Finance, IT

- Levels of plan

- Strategic: Embodies corporate strategy and strategic objectives; General direction but not detailed

- Business: As a whole or for SBU

- Operational: Specified for each function

- Budgeting: board of directors have a master budget, and functions in SBU have detailed budgets.

Chapter 5

Introduction to risk management

Risk for:

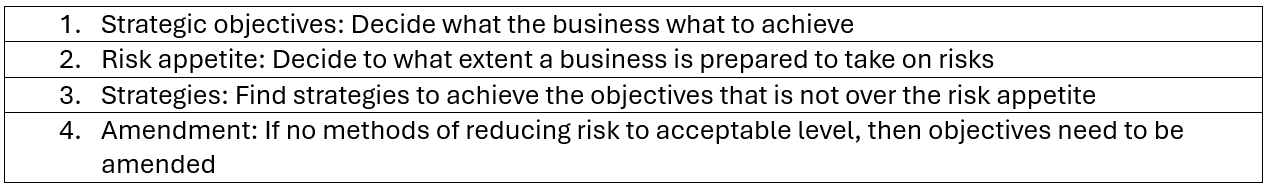

Strategic planning analysis: focus on significant risks to the business

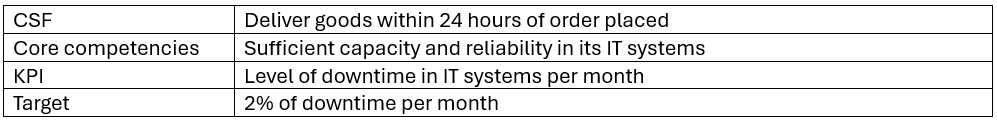

- Relate risks to critical success factors (CSFs)

- CSF: product features that are particularly valued by a group of customers, and therefore, where the organization must excel to outperform the competition.

- Determine the business’s risk appetite

- Risk appetite: the extent to which a business is prepared to take on risks in order to achieve its objectives

- Attitudes to risk:

- Risk averse: Prefer more certain but lower return than alternative

- Risk neutral: Chose according to expected return, irrespective of risk

- Risk seeking: Prefer higher risk even if expected return is lower than alternative

- Expected return = Sum of [Probability x Return of each scenario]

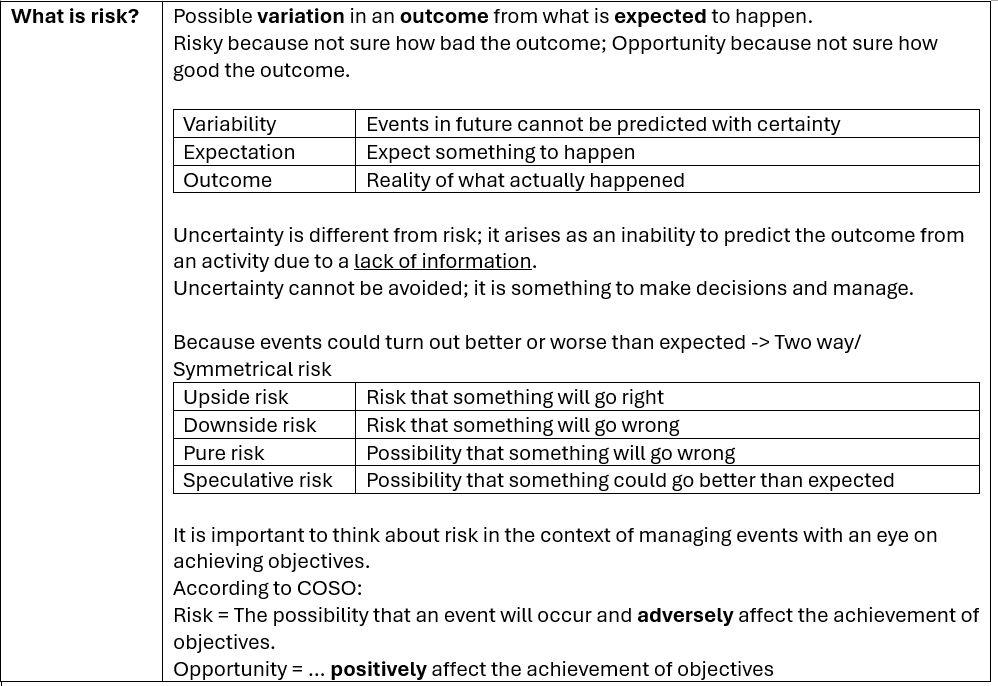

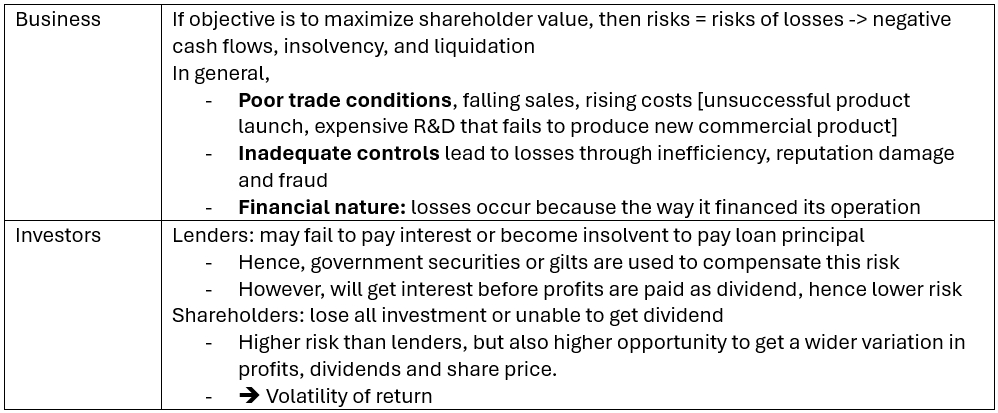

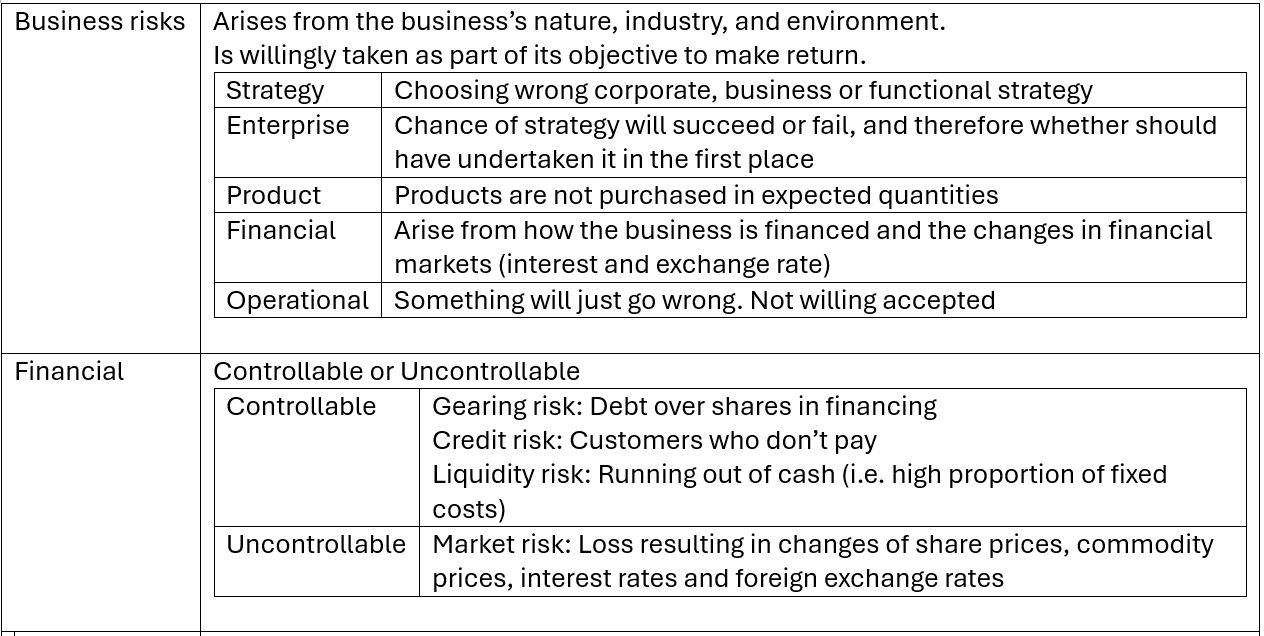

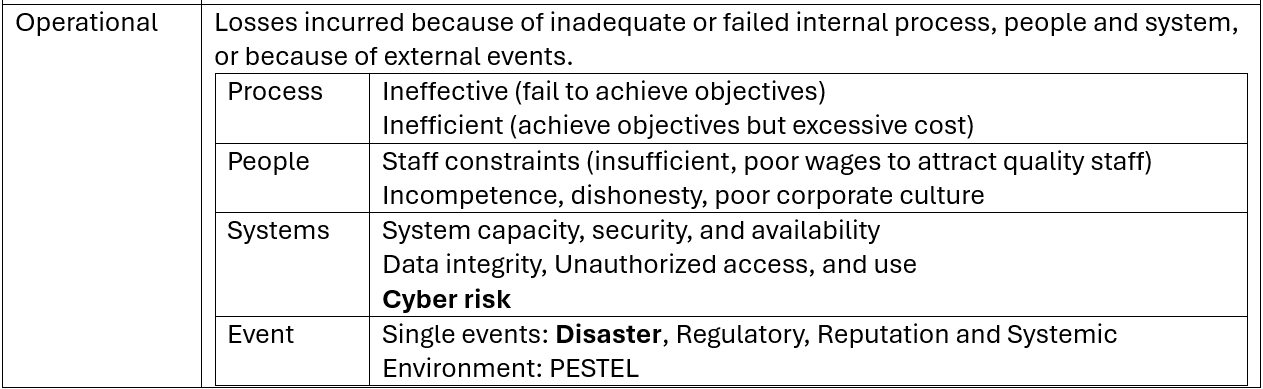

Type of risks

Cyber risk: Any risk of financial loss, disruption or damage to the reputation of organization from failure of its information technology systems

- Cyber-attack: Deliberate and unauthorized security breaches to gain access to information systems for the purposes of espionage, extortion and embarrassment

- Unintentional or accidental security breaches

- Operational IT risks due to poor system integrity

Cyber-attack can include Phishing, Ad clicker, Webcam manager, Keylogging, Screenshot manager, File hijacker/ransomware. However, in context of business: Hacking and DDoS attack are more common.

- Hacking: Gain unauthorized access to network and admin control. Able to amend, copy and delete records.

- Compromise data

- Damage physical infrastructure (i.e. travel company’s booking system)

- Distributed denial of service (DDoS) attacks: overwhelming the organization’s website and communications links using botnets.

How to tackle cyber-attacks: Report incidents, Cyber-risk mitigation, Manage cyber security, Promote awareness, Share knowledge and expertise, Develop cyber skills and awareness.

Technical controls: Access control, boundary firewalls and internet gateways, malware protection, patch management, secure configuration

Cyber security: the protection of systems, networks, and data in cyberspace

Importance of cyber security:

- Legal obligation

- Information stored is vital strategic and commercial importance

- Protect the connectedness of computer systems

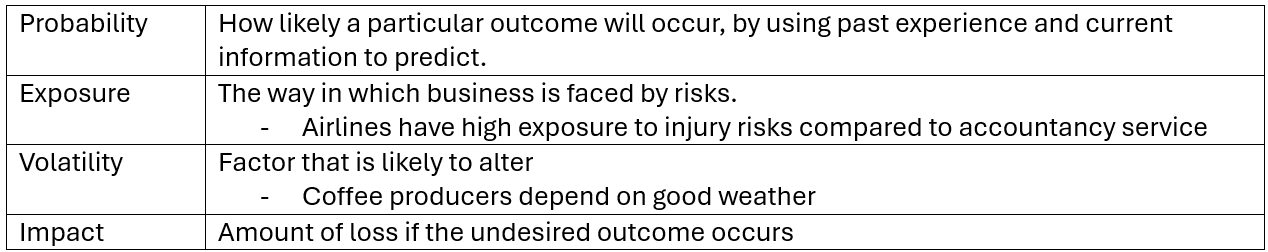

4 risk concepts: PEVI

Greatest risks arise when: High probability and exposure, underlying factor is volatile and severe impact.

Risk management: Identification, analysis and economic control of risks when threaten the assets or earning capacity of a business.

- Purpose: Minimize cost-effectively the business’s exposure to risk by reducing the probability and limiting the impact

- Necessary due to

- Legal requirements

- Required by licensing authority and regulatory bodies (i.e. public liability insurance and professional indemnity insurance)

- Financial organization (lender requires insurance)

Chapter 6

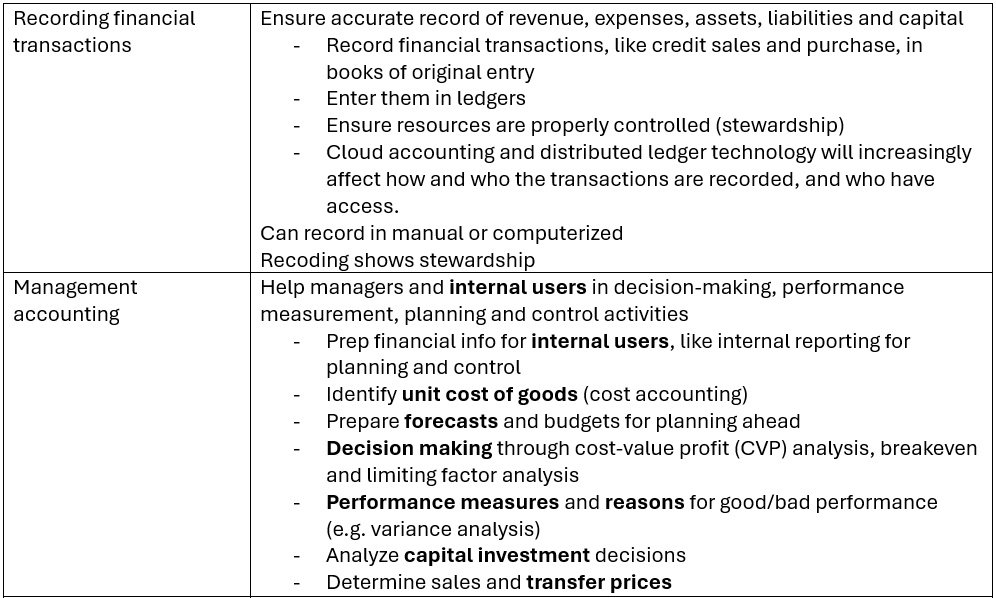

Introduction to financial information

Importance of business finance

- Primary objective: Business exists to make money for shareholders

- Stakeholders have finance at stake in business (e.g. shareholders, lenders, employees)

- Finance is a separate function in the organizational structure of business

- Finance determines business structure/ legal form

- Financial strategy is central to overall corporate strategy

- Financial risks require appropriate management

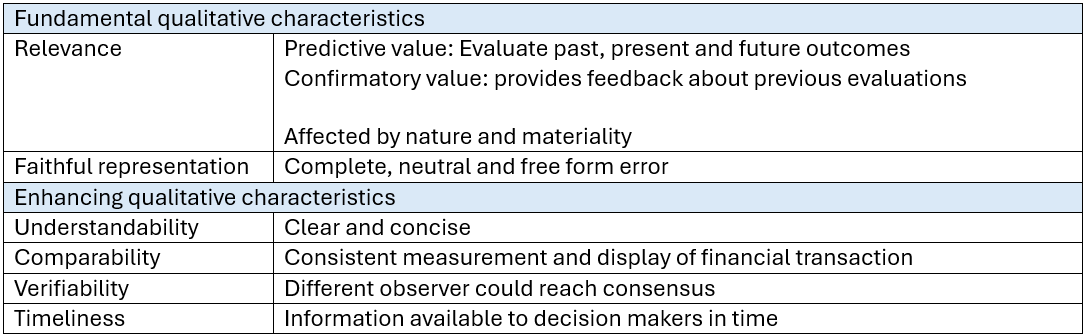

Uses and types of financial information

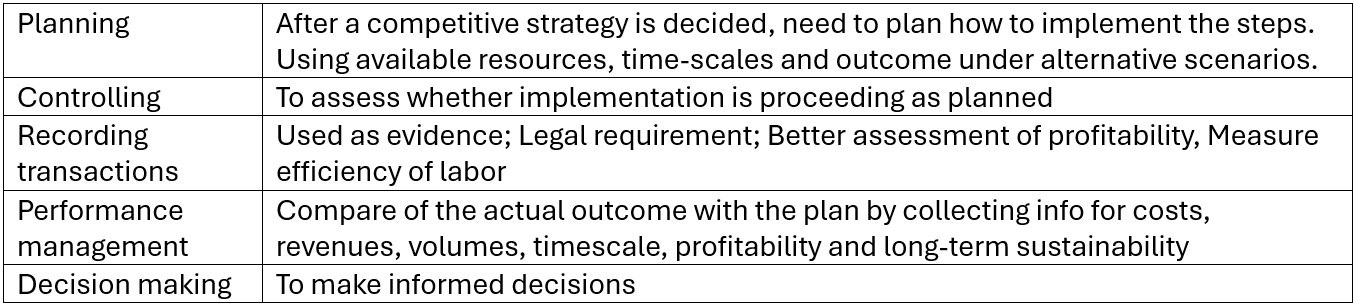

Uses: Plan, control, record, performance, decision

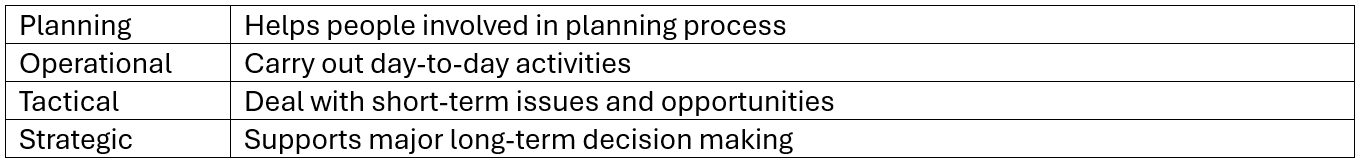

Type of information:

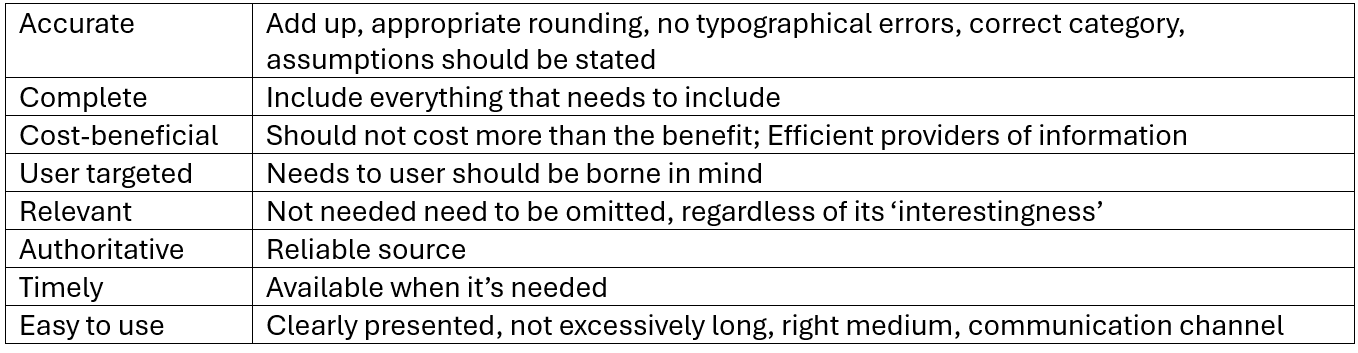

Qualities of good information: ACCURATE

What makes information valuable: respected source, ease of assimilation, accessibility, relevance in the eyes of beholder

Cost and value of information:

- Information that is obtained but not used has no actual value.

- Only when action is taken does that result in the decision made has actual value.

- Worthwhileness depends on extra benefits and extra costs.

- However, benefits are often hard to quantify.

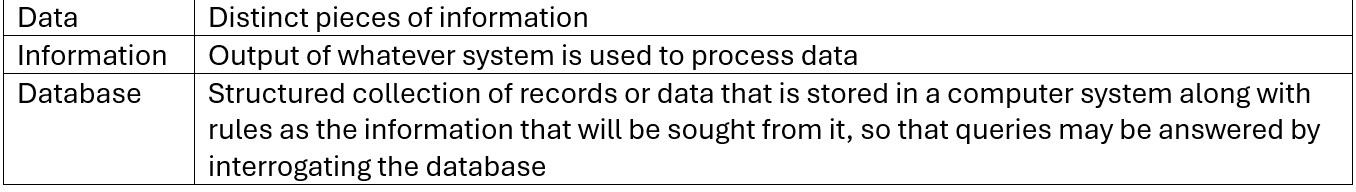

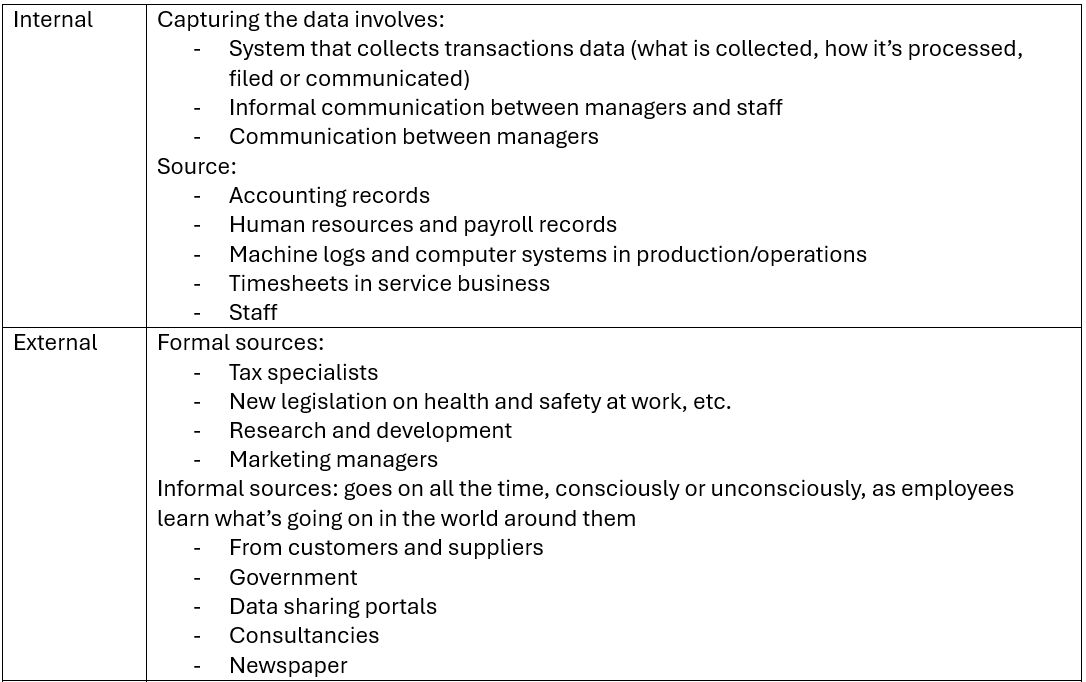

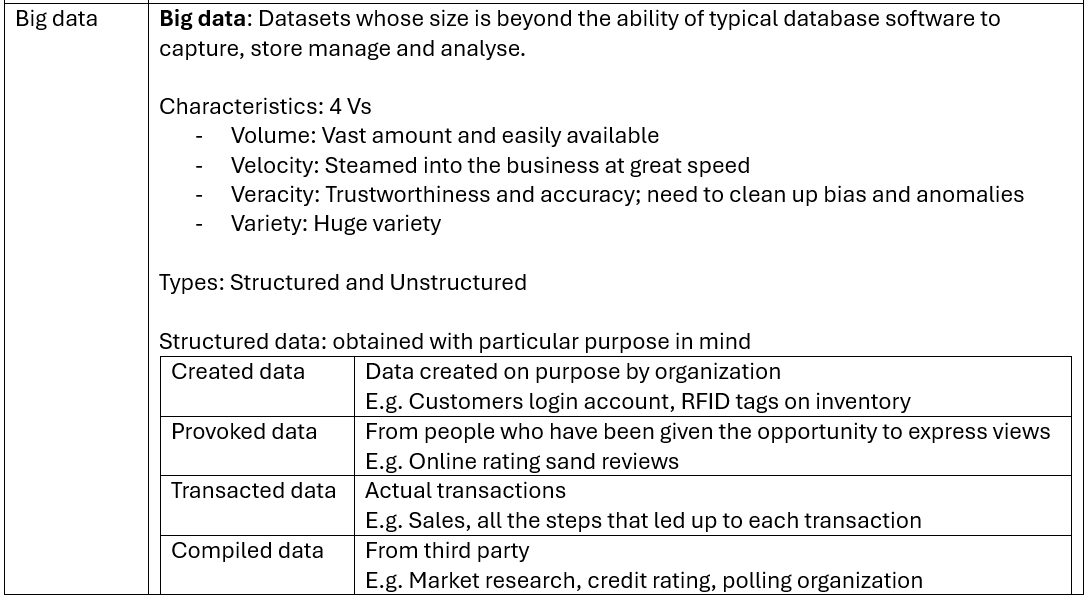

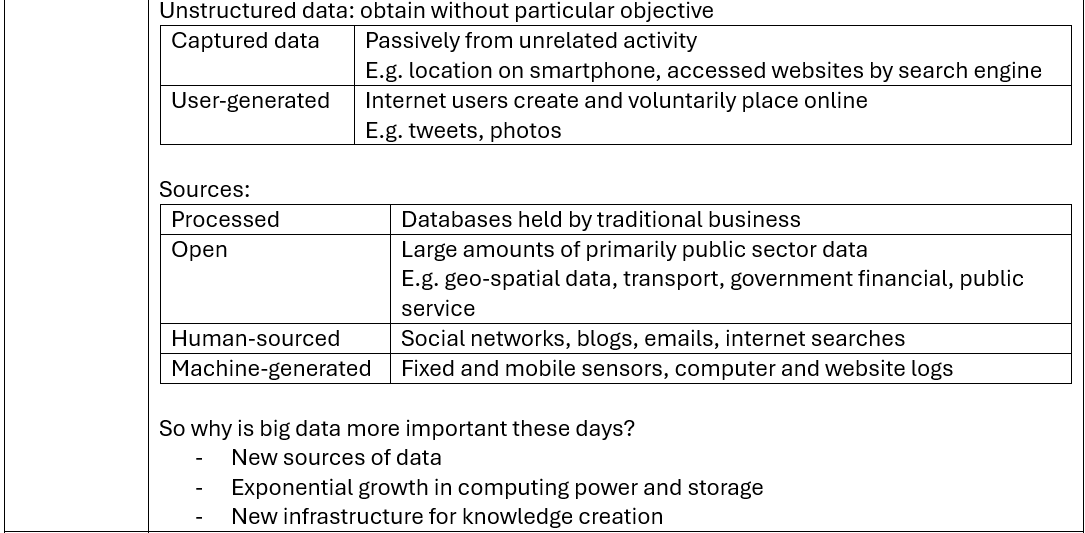

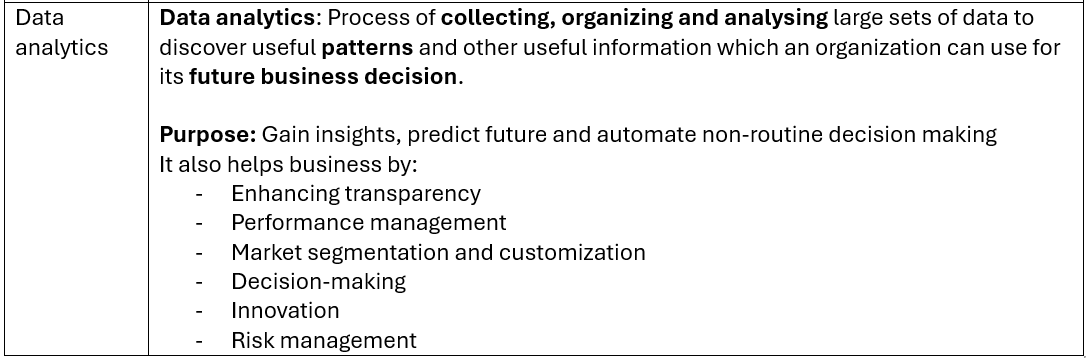

Sources of data and information

Definition

Sources:

Information processing and management

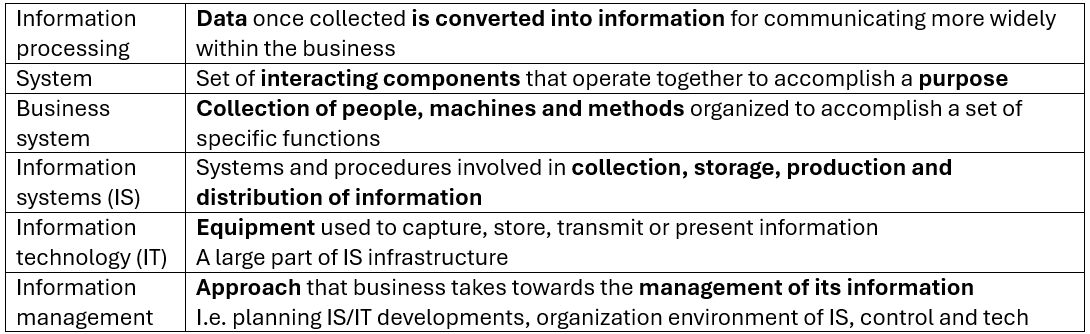

Definition

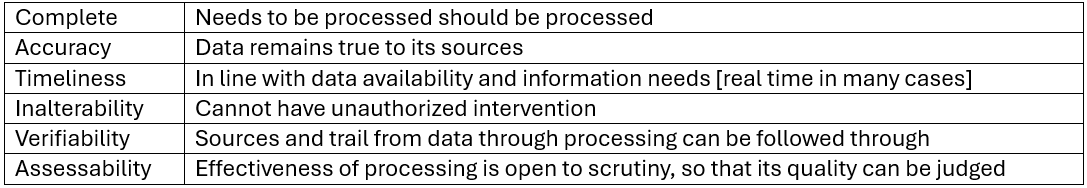

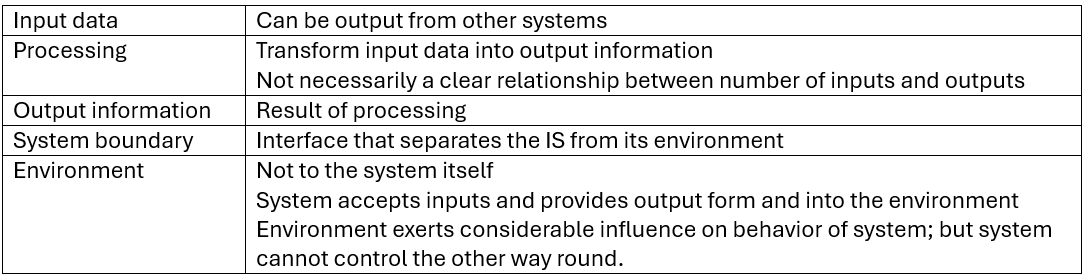

Components of effective Information Processing: CATIVA

Components of information system

TPS and MIS

Transaction processing system (TPS): System which performs, records and processes routine transactions.

- Used for routine tasks: process transactions so that operations can continue

Cloud computing: Model for enabling ubiquitous, convenient, on-demand network access to a shared pool of configurable computing resources that can be rapidly provisioned and released with minimal management effort or service provider interaction.

- Sold on demand: paid for short term usage (processing time) or longer duration (cloud-based storage)

- Elastic: User can have little or much of service at any given time

- Fully managed by provider: User only needs computer and internet access

Cloud accounting is used to process accounting transactions and run reports.

Management information system (MIS): Converts data from mainly internal sources into information (e.g. summary reports). This information enables managers to make timely and effective decisions for planning, direction and controlling the activities for which they are responsible.

- MIS transforms data from TPS into summarized files, used as basis in management reports

- Characteristics:

- Support structured decisions

- Report on existing operations

- Little analytical capability

- Relatively inflexible

- Internal focus

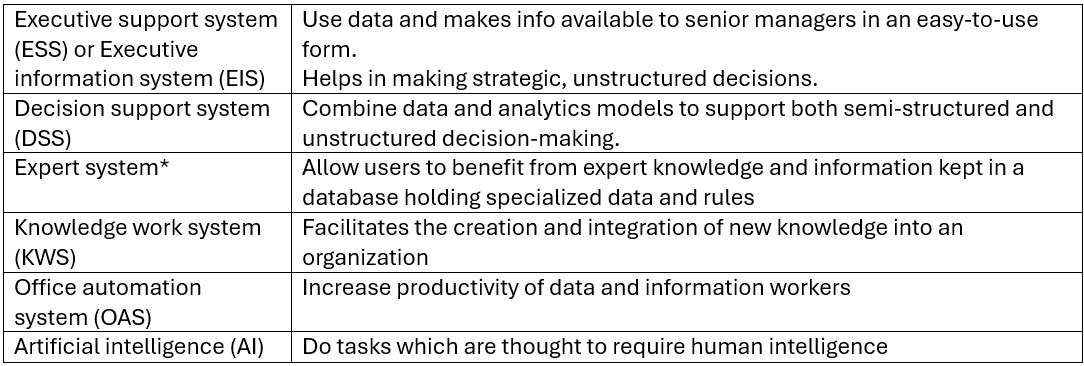

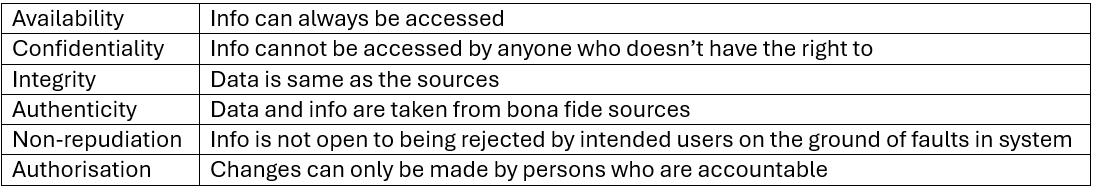

There is a wide range of information management systems (other than TPS and MIS)

In the context of medical profession:

*Expert system has business applications in the following: legal advice, forecasting, surveillance, diagnostic systems, project management, AI, education and training

- Most useful when, the problem is reasonably well-defined, rules can be defined unable to be solved by conventional transaction processing, expert could be released to more difficult problems and investment is cost-justified.

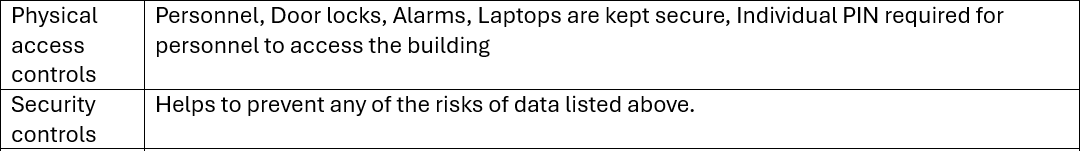

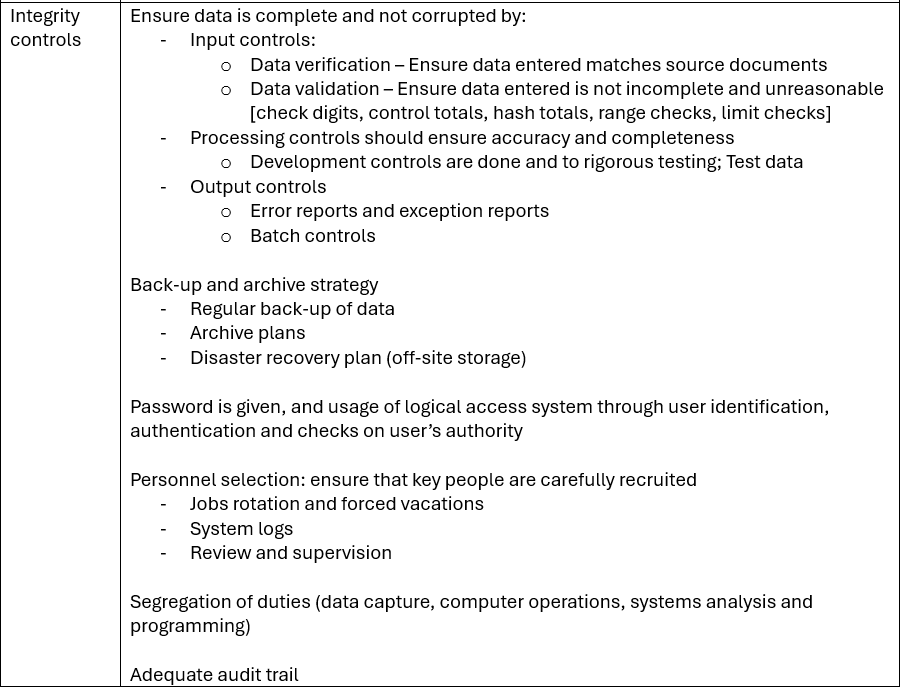

Information security

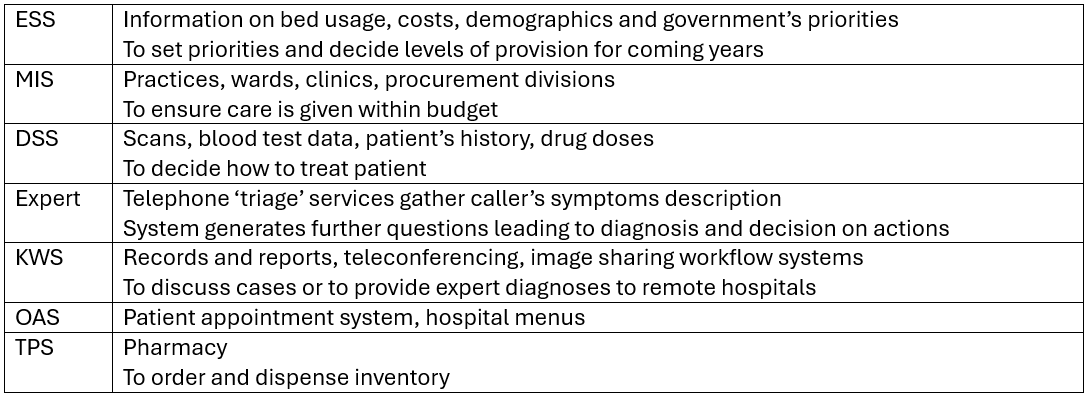

Security: protection of data and information system from threats and disruptions.

- Risk to data: human error, entering incorrect transactions, fail to correct errors, technical error, natural disasters, deliberate actions like fraud, commercial espionage, malicious damage, cyber risks

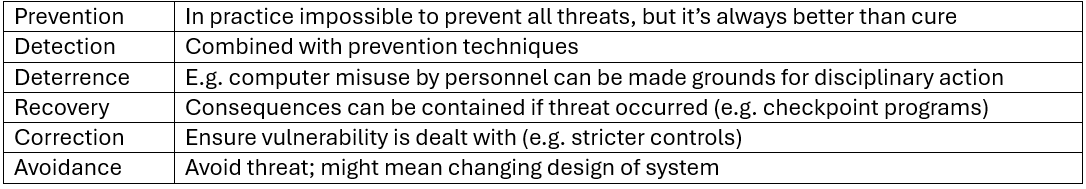

Aspects of security

Qualities of secure info system: ACIANA

Information system is ensured by means of:

Users of financial information and needs

Key word: decision, stewardship, accrual basis of accounting, going concern

Once again, the purpose of financial information for individuals is to help make decision in

- Buy, hold or sell and equity investment or debt instrument

- Replace managers? (through assessing the stewardship)

- Advance a loan? (through assessing adequate security)

- Provide other benefits to its employees?

- Distributable profits and dividends

Users and their information needs

- Investors: risk and return, and dividends

- Employees: stability and profitability, to provide remuneration, retirement benefits and other opportunities

- Lenders: LT-Loans, and interest will be paid

- Suppliers and other creditors: AP will be paid

- Customers: entity’s continuance

- Governments and agencies: regulations and taxation policies

- Public: trends and recent developments in the business’s activities

[This section states the same information as Chapter 1 of Financial Accounting module]

3 information: SOFP, SOPL and Statement of cash flows

Limitations of financial information in meeting users’ needs

- Standardized and aggregated representations

- Limit the usefulness and difficult for reader to evaluate the components of business

- Backward-looking

- Cannot realistically provide the complete information set required for all decisions by all users, which they use to make decisions on expectations about the future.

- Omission of non-financial information

- Narrative major operations

- Risks and opportunities

- Performance and prospects

- Management policies and business’s governance and control

However, users like ___ may ask for other sources of information:

- Internal management information

- Banks

- Potential investors

- Suppliers and lenders

Effects of poor financial information: Undermine integrity of financial markets and fail to serve the public interest

Chapter 7

The business’s finance function

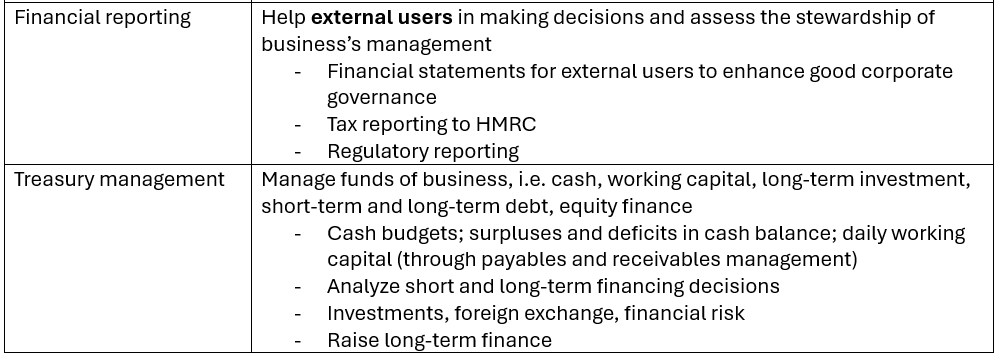

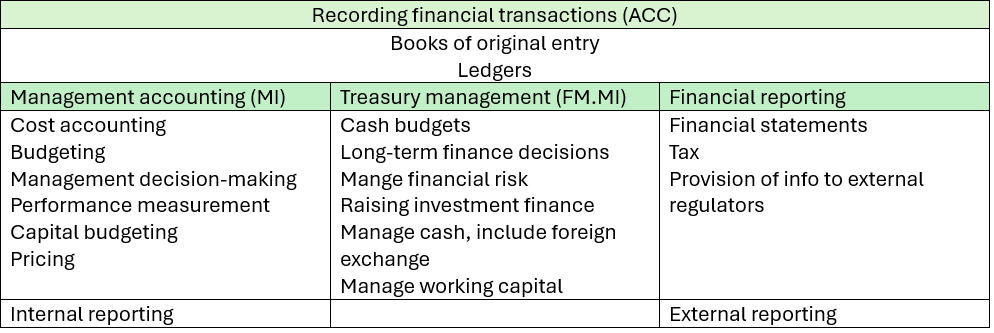

Task of finance function:

Finance function in achieving business objectives

- Undertake transaction processing, ensure sufficient financial control process

- Provide info to support decisions and measure performance

- Ensure finance and cash available for activities

Structure of finance function

Manage finance function

Factors affecting business’s finance function (mentioned in C3):

- Business structure, Organizational structure, markets, technology, ownership, culture

Planning and control the overall direction

- Forecasting what is needed (processing, reports, finance)

- Evaluate available resources

- Objectives, plans and targets

- Implement plan and measure performance

- Use feedback to make amendments

Organizing and leading time and effort

- Define what process, tech and people are required

- Allocate and co-ordinate work

- Generate effort and commitment in finance staff

Measuring performance

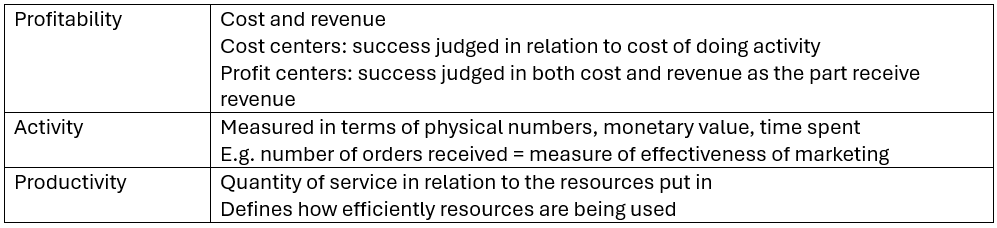

There are qualitative and quantitative measures. Here, we only discuss the quantitative measures, which are objective and based on data which must be reliable and expressed in numerical terms

- Financial measures (sales, profit)

- Non-financial measures (number of items produced or phone call answered)

3 points of reference: profitability, activity, productivity

However, dividing line between productivity and activity is thin.

Measuring profitability

Profits = Revenue – Costs. It is measured in absolute ($) and relative terms (margin of revenue or capital)

If desired level of profit is not achieved, the owner closes the business, the shareholders take their money elsewhere.

Profit must be specified quantified terms, and by examining the opportunity cost (rate of profit available on alternative investments and risks), we get the minimum rate of return acceptable to shareholders.

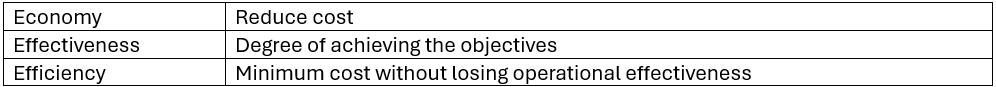

Measuring resource use: effectiveness, economy and efficiency

Resources include: materials, labor, finance, physical assets, competences, intangible assets, business structure, knowledge.

Measuring CSF and KPI

Critical success factors (CSF): Product features that are particularly valued by a group of customers

Key performance indicators (KPI): A measure of the level of performance in an area where a target level must achieve for the business to outperform rivals and achieve competitive advantage.

Example: Internet retailer

One way to decide which KPI to measure is through benchmarking.

Benchmarking: Data gathering of targets and comparators, and relative levels of performance -> identify best practices to improve performance.

Measuring sustainability

Accountants are expected to provide information regarding sustainability management, by improving decision-making in:

- Response to risks

- Develop existing and new markets

- Innovating process

- Improve operational efficiency

- Engage stakeholders towards sustainability

Triple bottom line:

Strategic approach to sustainability management by Sustainability at Work

- Key sustainability issues

- Develop and implement good practice

- Governance and accountability

- Target and action plan

- Measure performance in process, outcomes and trend

- Report and evaluate

Using information on performance measurement

Used by managers, directors and external users. Users need comparability against:

- Budgets, targets, or standards

- Trends over time

- Results of other parts of the business

- Results of other businesses

Comparisons can only be made ‘like with like’. However performance measures do not provide answers but help to ask informed questions and focus attention on important areas.

Limitations of financial measures

- Information problems: out of date base info, historical cost may not be most appropriately used, more detailed info may be needed by external users, only identifies symptoms and not cause

- Comparison problems

- Trends: effect of price changes, tech, environment, accounting policies; problems in using normal base year for comparison

- Different business: Different financial and business irks profiles, accounting policies, impacts of size, environments

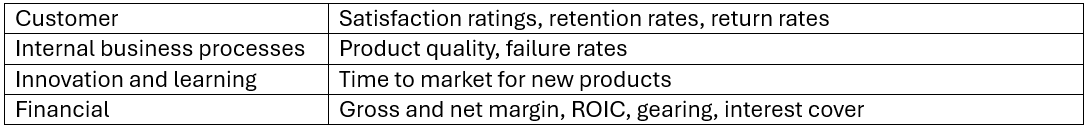

Balanced scorecard

Combines traditional financial performance measures with other operational and staff performance and customer satisfaction.

An integrated set of performance measures lined to the achievement of strategic objectives

Establishing financial control processes and internal controls

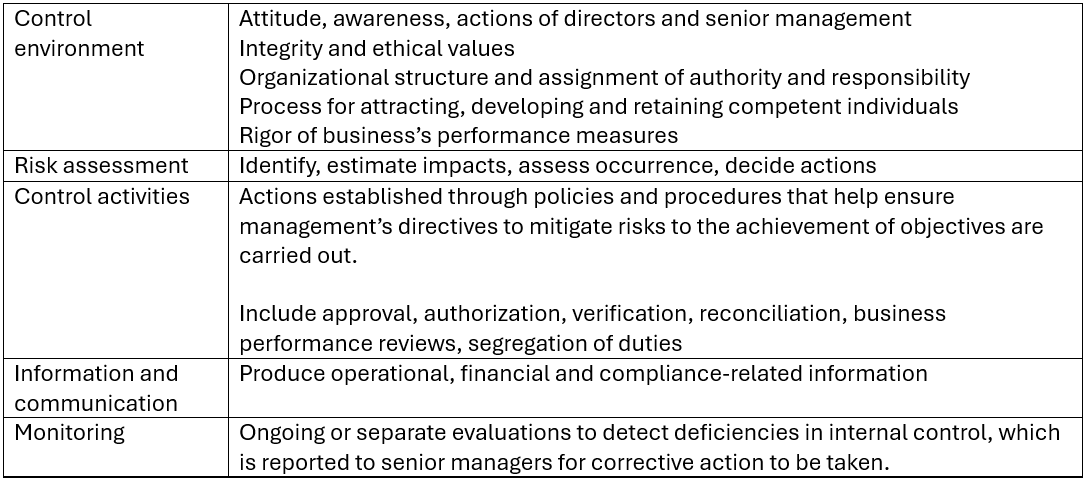

Internal control: A process, effected by an entity’s board of directors, management and other personnel, designed to provide reasonable assurance regarding the achievement of objectives relating to operations, reporting and compliance.

Key points: objectives, process consisting of tasks, effected by people, reasonable (and not absolute) assurance, adaptable to structure.

5 components of effective internal control:

Risk management and internal control

A system encompassing the policies, culture, organization, behaviors, processes, systems and other aspects of a company that, taken together.

- Assess risks, responses to risks, significant control failures; safeguard its assets

- Reduce impact of poor judgement, risk-taking, human error, control processes being deliberately circumvented

- Ensure quality of internal and external reporting

- Ensure compliance with law and regulations

Responsibility: Board of directors – policymaking, review, reporting

Sound IC system:

- Managers take risk-based approach

- Nature and extent of risks

- Likelihood of risks concerned materializing

- Should be

- Embedded in operations and form its culture

- Capable to respond quickly to evolving risks and changes in the business environment

- Include procedures for reporting any significant control failings and corrective action

Chapter 8

Business and personal finance

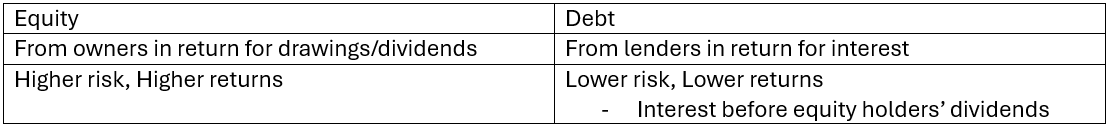

Business is financed by:

Short term finance -> working capital; Medium to long-term finance -> Investments

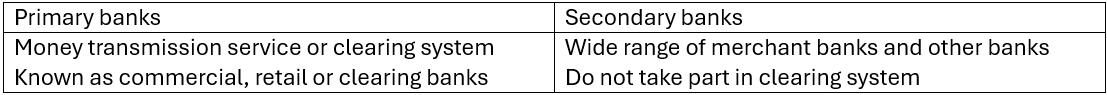

Banking system

Act as financial intermediation

- Small amounts deposit combined for larger loan packages to business

- Short-term savings transferred into long-term loans

- Reduced risks, not borrowing to one individual only

- Reduced search costs

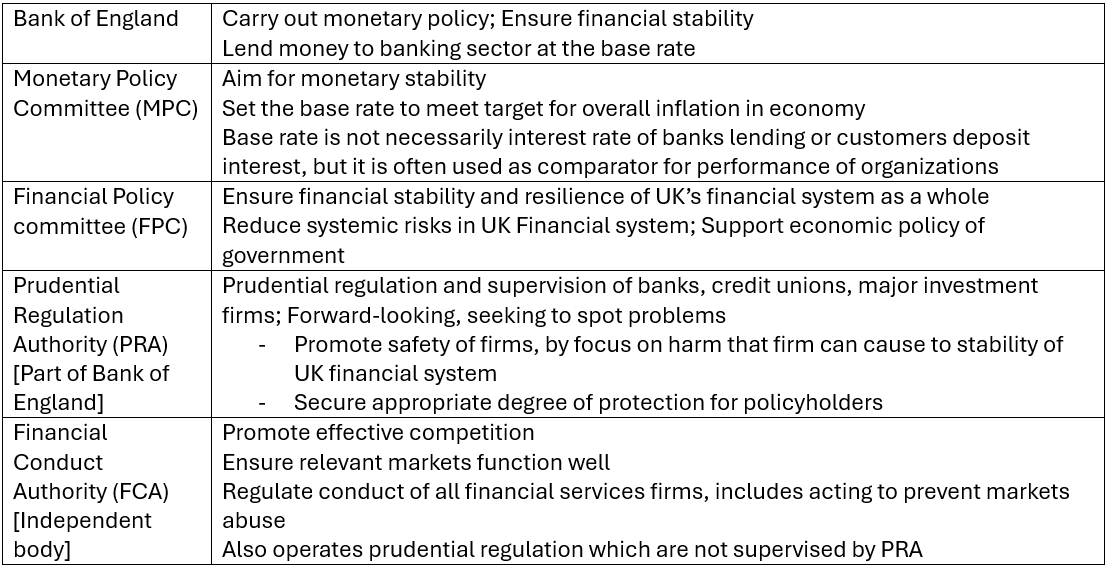

Regulatory:

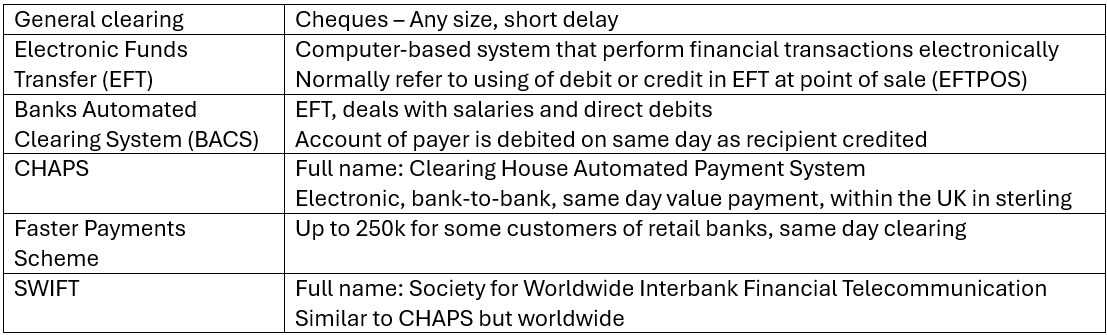

Clearing mechanisms

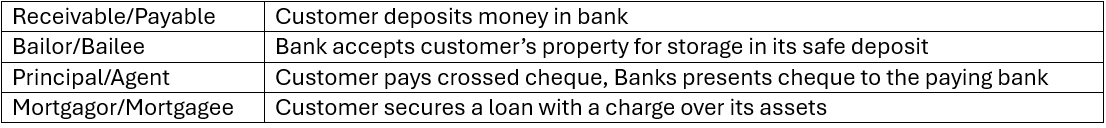

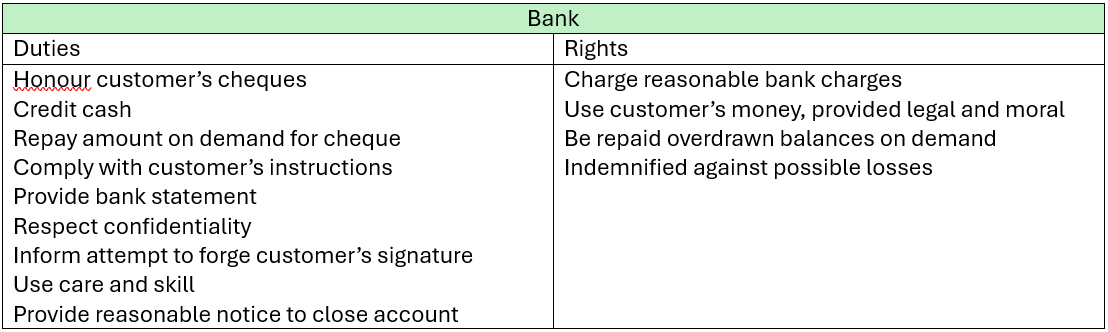

Customer/Bank contractual relationships

Customer/Bank fiduciary relationship: Bank with more relative power is expected to act with good faith

Customer’s duties: Draw up cheques carefully, Tell bank any known forgeries

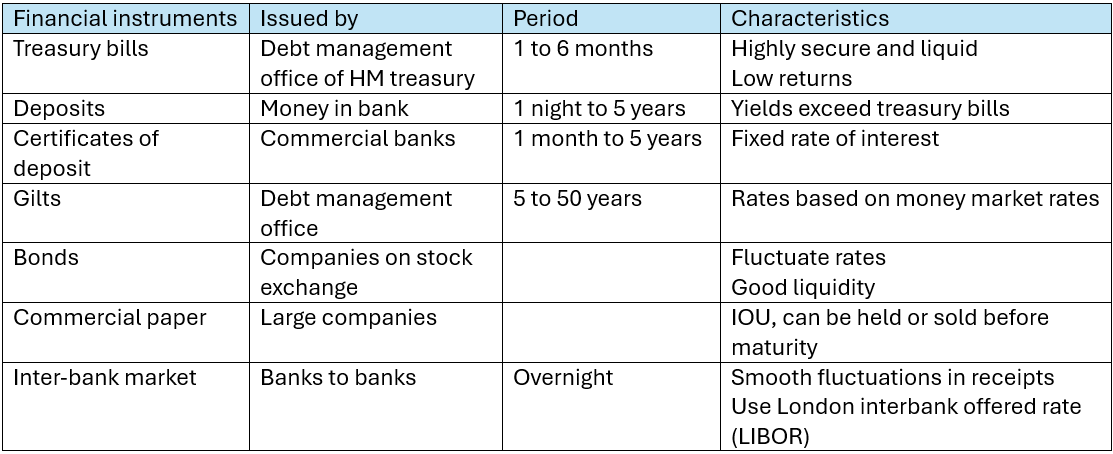

Money markets

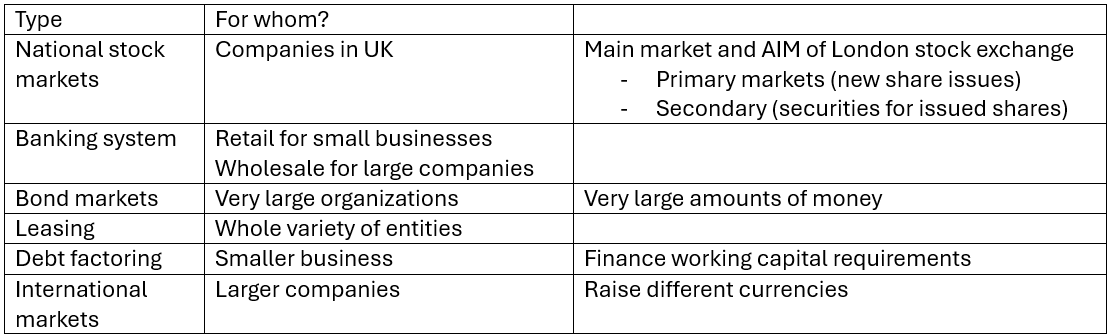

Capital market

Source of funds for business and exit route for investors

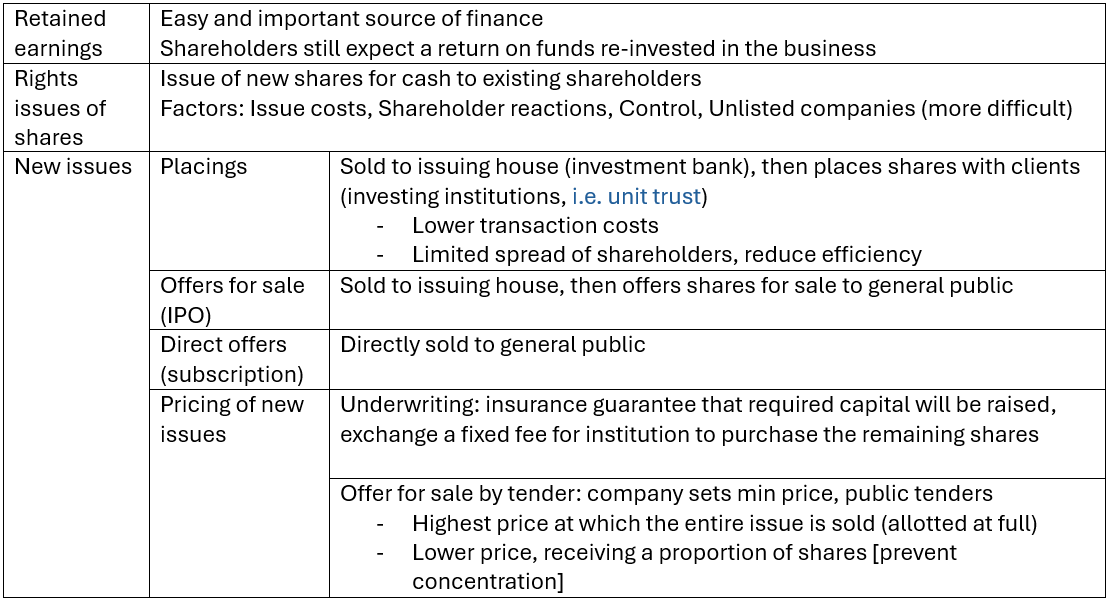

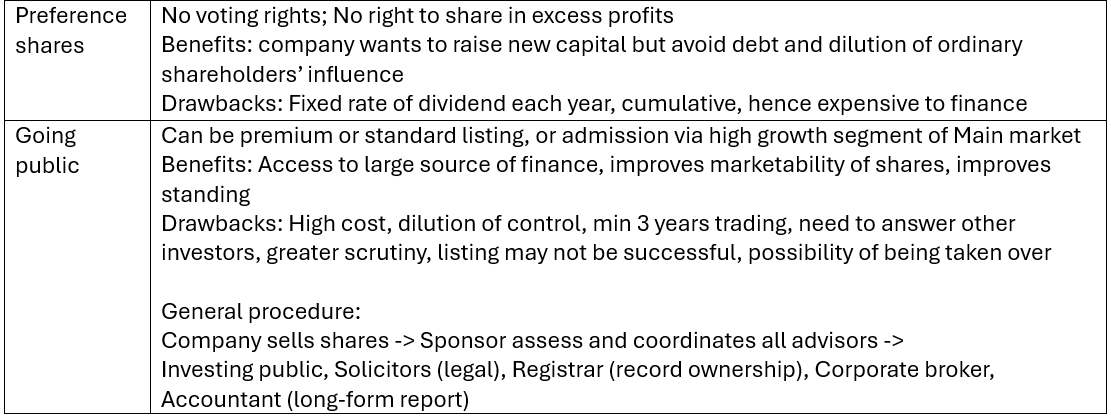

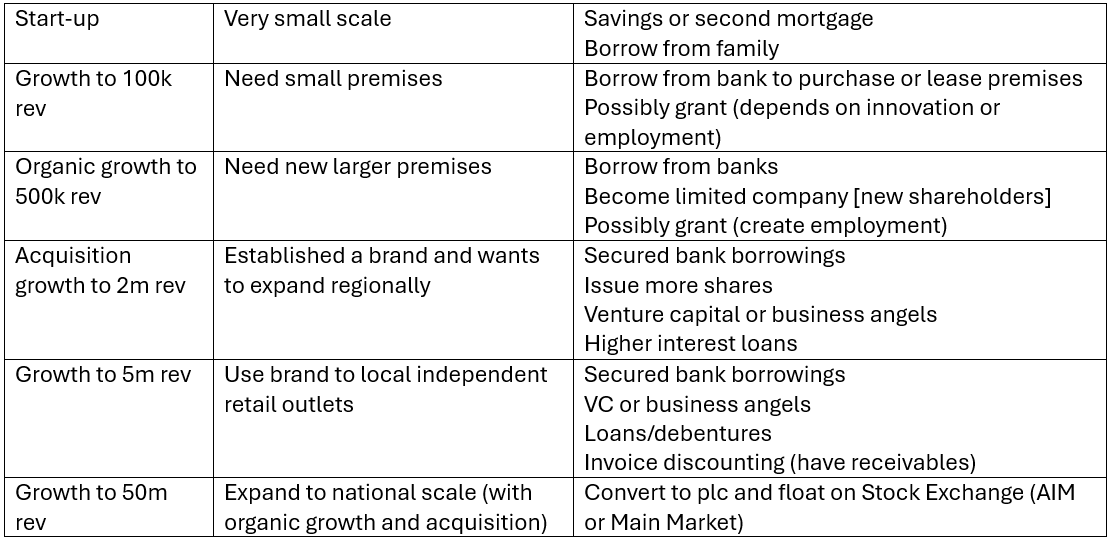

Sources of equity finance

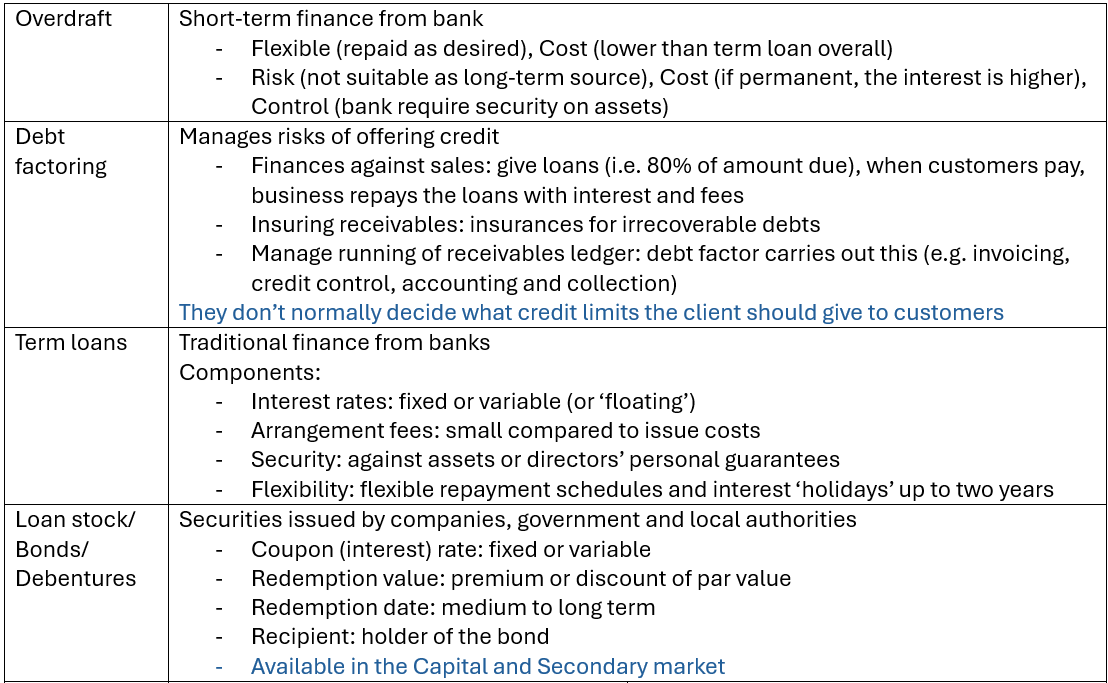

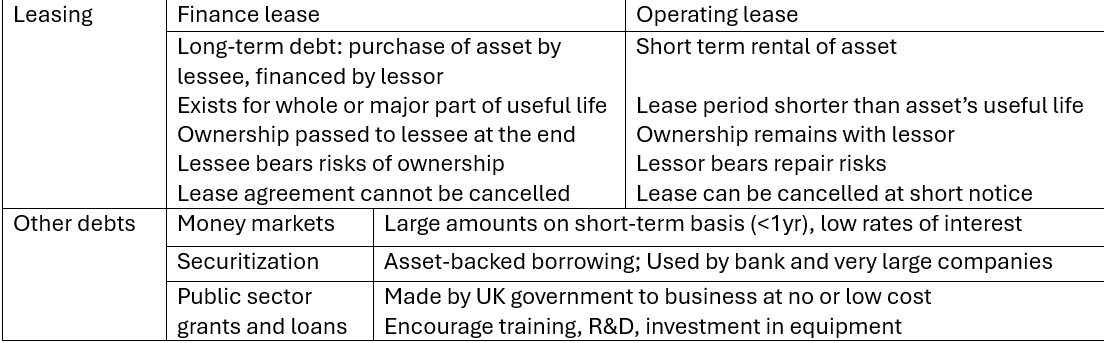

Sources of debt finance

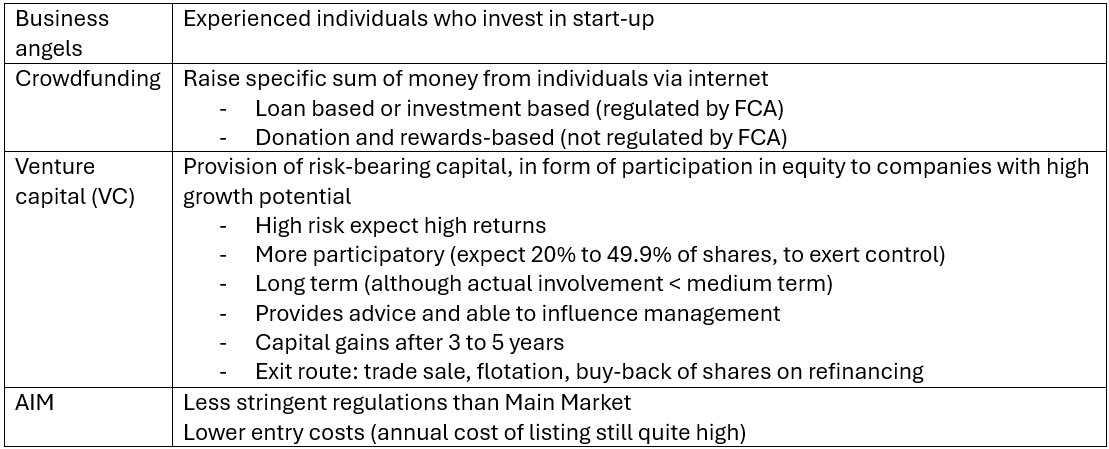

Financing a growing business

Problem: hard to raise finance due to its nature

Solutions:

Example: A growing business to national one

Financing exports

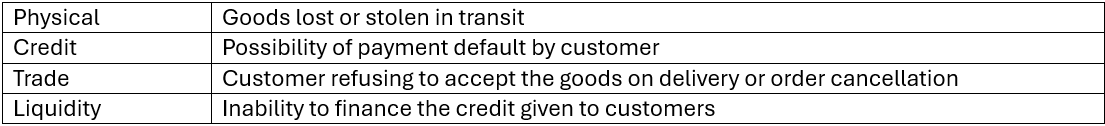

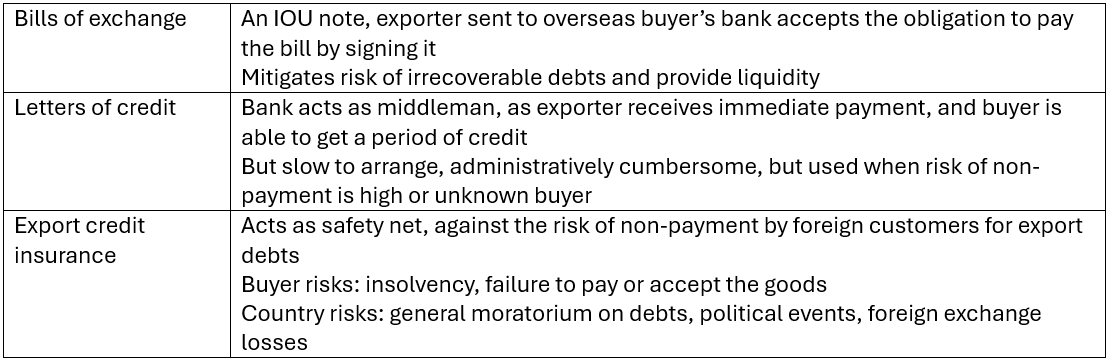

Trading risks: political and cultural risks

Reducing credit risk

Personal financial management (Financial capability)

Individual’s ability to manage money, keep track of finances, plan ahead, choose financial product and stay informed about financial matters

Key issues: objectives, attitude to risk, individual circumstances, income and expenditure, action (borrowing, investment, protection, retirement or estate planning)

Less risk -> short to medium term or high priority objectives -> Lower returns

More risk -> longer term or lower priority objectives -> Higher returns

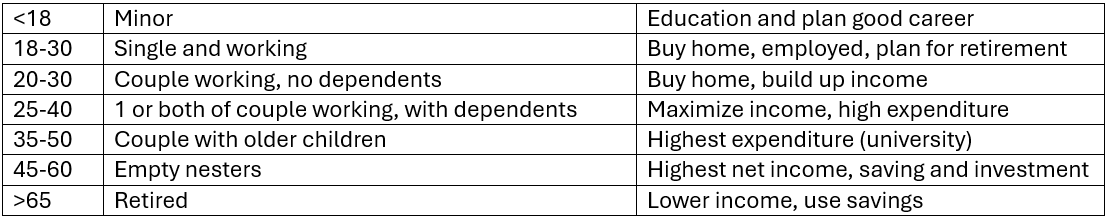

- Life stages

- Individual’s risk profile: affect savings and investment choices

- Personal budgeting: use spreadsheet to list income and expenses

- Take actions:

- Income shortfall – cut spending

- Income surplus – use to achieve financial objectives

- Borrowing

- Secured borrowing: mortgages to buy house [capital and interest, interest only]

- Unsecured borrowing: current account overdraft, credit card borrowing, personal loans, hire purchase (similar to finance lease)

- Investment and saving

- Short-term: deposit account

- Longer-term needs: investing for retirement

- Consider ease of access [saved vs invested]

- Risk: capital, shortfall, interest, inflation

- Aims for diversified investment portfolio: deposits, bond, property, equity

- Protection against risks: avoidance, reduction, sharing via insurance, acceptance

- Retirement planning: planned age, income expectations, dependents, available assets, provision from state

- Estate planning: make a will, inheritance tax

- IT and personal financial management: using internet tech, home computer and mobile devices to have greater control over finances

Chapter 9

The professional accountant

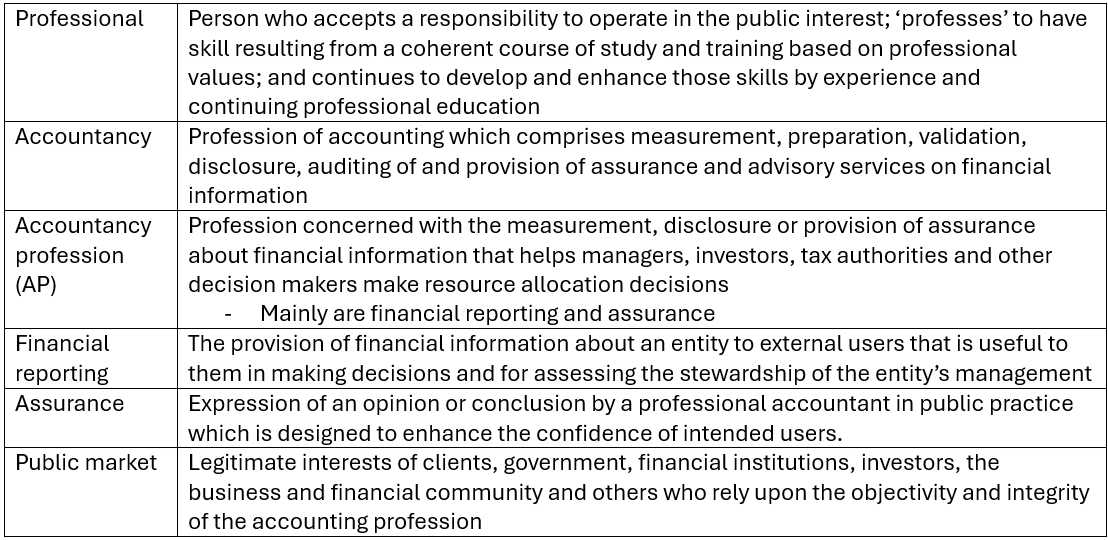

Definition

Work of AP supports the

- Effective working of capital markets

- Ensure organizations have access to sufficient finance by providing adequate information to investors and other providers to make decisions

- As FS demonstrate qualitative characteristics, a high quality and accurate financial reporting and assurance that AP gives, supports effective working of capital markets

- Public market

- Public is confident in AP’s expertise and integrity, in either business or in public practice.

- ICAEW members must report acts of misconduct (if unreported, could adversely affect the good name of profession)

- Hence ICAEW Code Ethics states the 5 fundamental professional principles to be compliant with, and the first two integrity and objectivity, are the qualities underlie the reliance of public on AP

- AP should show professional responsibility and technical competence

Professional responsibility

- Ethics tell us ‘How to behave’ and ethical behavior is ‘behaving well’

- Public trust requires AP to behave ethically

- Professional ethics: Identify ethical dilemmas, understand implications and behave appropriately in line with a code of behavior that is accepted among fellow professional as being correct.

- Importance of upholding professional ethics

- Protect public interest; Comply with law and regulation; Protect reputation and standing

- Disciplinary action from unethical behavior; Protect tax-payer’s money in the public sector

- ICAEW Code of Ethics: Framework-based approach using 5 fundamental principles

- Integrity; Objectivity; Professional competence and due care; Confidentiality; Professional behavior

- Identify threats and safeguards to the 5 principles (more details in last chapter of ‘Assurance’)

- Regulation

- Technical competence:

- Education requirements

- 4 Reserved areas: audit, investment business, insolvency, probate

- Public practice: Hold professional indemnity insurance (PII)

- Oversight regulation by FRC

- Rigorous complaints procedure involve ICAEW, and ultimately FRC

- Technical competence:

Technical competence

- Education:

- 2 passes at A level; 450 days of training; theoretical instruction; pass ICAEW;s professional exams; submit certificate of suitability for membership; pay admission and subscription fees

- Ensures students account have knowledge and understanding; skills and abilities; build personal commitment and professional ethics

- The training covers fundamental values, competencies, technical knowledge and skills in tax, financial reporting, governance and related assurance requirements

- Students should develop

- Basic accounting skills

- Understand accounting principles

- Understand the numbers that come out of reporting process are telling them

- Apply professional skepticism (a questioning mind and being alert to possible misstatements due to error or fraud)

- Continuing membership of ICAEW

- Obey rules and regulations

- Pay subscription fee annually

- Undertake continuing professional development (CPD)

- For those in public practice

- Hold a Practicing Certificate

- Implement ICAEW Code of Ethics

- Covered by PII

- Reserved areas of practice: Statutory audit, investment business, insolvency, probate

- Have required level of technical competence and subject to disciplinary regime

- The Institute is a recognized professional regulation: Audit Regulations, DPB Handbook, Insolvency Licensing Regulation, Probate Regulations

- Content: Eligibility, conduct, competence

Work of AP: 3 areas

- Maintain control and safeguard assets

- Complete, timely and accurate recording of transactions

- Sufficient internal controls

- Properly constituted audit committee

- Non-executive directors are qualified and resourced

- Financial management (manage processes associated with raising and use of financial resources)

- Transactions recording, raise new finance, use existing funds that support objectives achievement, planning and control systems, treasury management

- To support good corporate governance as it protects investors against interests of managers by taking considered risks

- Financial reporting

- Report accounting records to external stakeholders (e.g. investors)

- Professional ethics and accounting principles of AP ensures high quality financial reporting

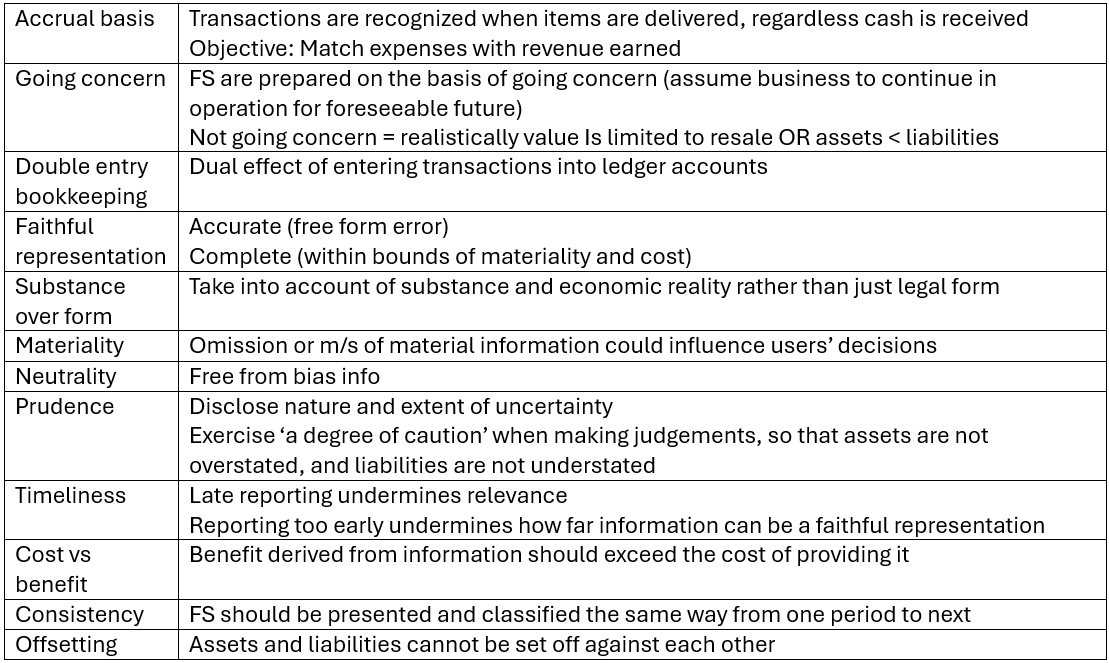

Accounting principles

Accounting standards

- Purpose: identify appropriate accounting practice for preparers, auditors and users of FS

- IASB and IFRS

Roles of AP

- Work in public practice

- Include accounting, auditing, taxation, management consulting, investment business, insolvency, financial management, corporate finance, information and communications technology, forensic accounting, probate

- Size varies from sole practitioner to ‘Big Four’

- Qualification for appointment of external auditor

- Independent: cannot be officer, partner or employee of the company

- May be a sole practitioner, partnership or a corporate body

- Member of a recognized supervisory body, such as ICAEW

- Hold an appropriate qualification

- In business

- Include commerce, industry, service, public sector, education, not-for-profit, regulatory or professional bodies

- Often in smaller business, can involve law, administration, insurance, pensions, property, personnel, procurement and IT

- Should be open about acting outside their own professional knowledge and skill; exercise sound and independent judgement and act diligently.

Limits of AP’s responsibilities

- Normally NOT in their roles

- Legal matters; will employ qualified solicitors or barristers

- Can be in their roles

- Administrative matters: tasks by company secretary to share registrations, calling meetings, drafting resolutions for meetings and submitting annual return to Registrar of Companies

- And because company secretary needs to be a member of one of a list of qualifying bodies

- Insurance policies

- If too complex, insurance specialists and actuaries should be used

- Acquisition, refurbishment or disposal of property

- Personnel (though rare now)

- As people are paid by the payroll function in the accounting and finance department

- Procurement (as suppliers are paid by finance function)

- IT acquisition

- Administrative matters: tasks by company secretary to share registrations, calling meetings, drafting resolutions for meetings and submitting annual return to Registrar of Companies

Chapter 10

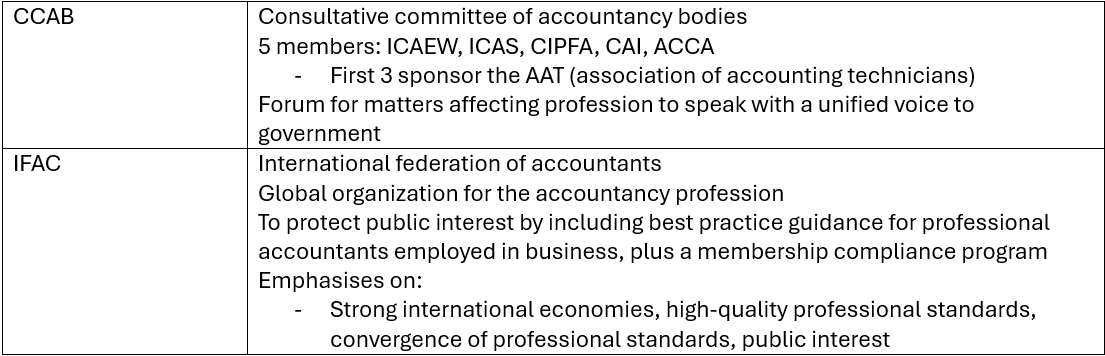

Structure and regulation of the accountancy profession

Who can call themselves accountant in UK:

- Anyone except in the 4 reserved areas.

- Hence, institute members are open to competition from anyone

Regulation of professions

- To protect public interest, facilitate competition, reduce barriers to trade, ensure technical and ethical standards, flexibility, justice, transparency

- Should not protect vested interests, personal gain, distort competition

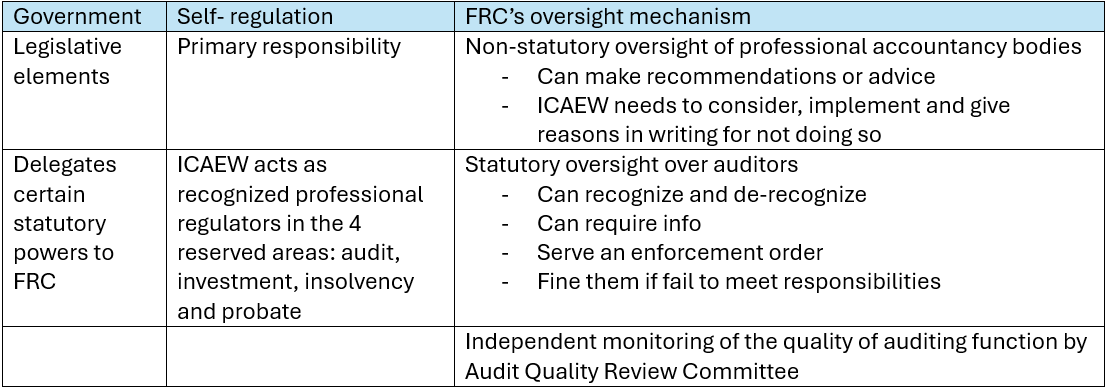

- Methods of regulation: legislation by government, delegated legislation by FRC, self-regulation by ICAEW

- Self-regulation: efficient when there’s oversight mechanism

- Requires: independence, knowledge, input from profession, balance various stakeholder interests, authority good communication and sufficient resources

- Key participants: government, regulators, members of the profession and public

- Self-regulation: efficient when there’s oversight mechanism

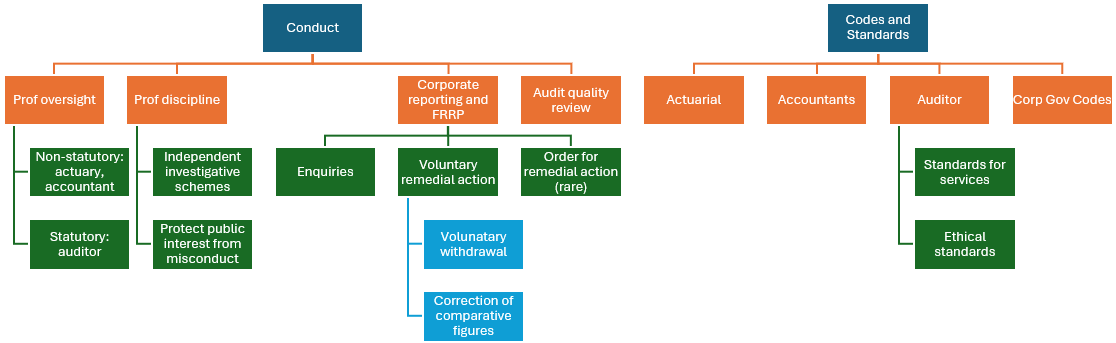

Financial Reporting Council (FRC)

Role: Set standards; monitor quality of FR, regulate audit profession, oversee self-regulation, ultimate disciplinary body for accountancy and actuarial

Structure

Details of regulation: government, self-regulation, oversight by FRC

Regulation of financial services

- By PRA and FCA

- Affects accountancy profession through:

- Investment business by Designated Professional Body (DPB) handbook

- UK Listing Authority and FRC’s UK Corporate Governance Code

- Listing Rules, Disclosure and Transparency Rules and Prospectus Rules issued by FCA

- Other financial regulators:

- Financial Ombudsman: settle disputes between providers and customers

- Pensions Regulator: regulate work-based pensions (EPF)

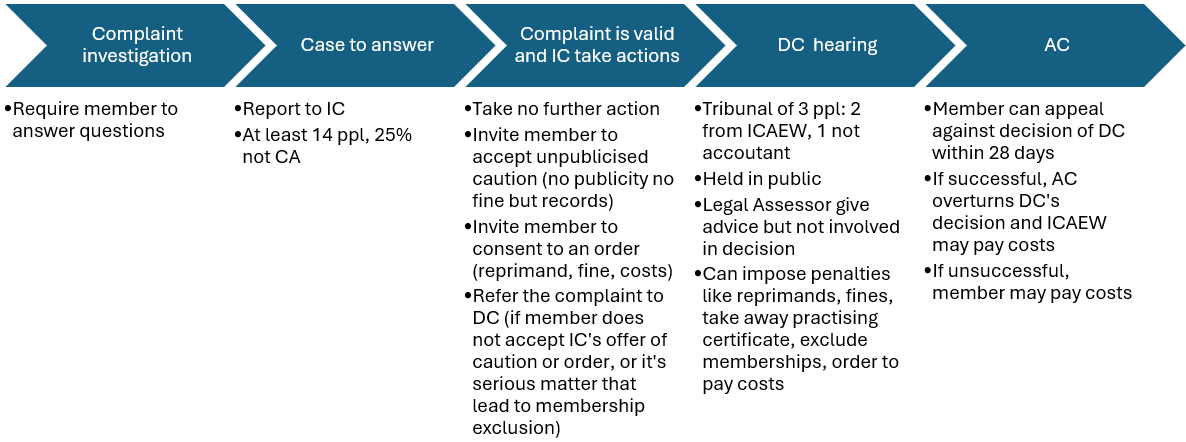

Disciplinary procedures against accountants

- Handled by ICAEW Professional Standards department, but if very serious that is already in public domain it will be referred to FRC’s Accountancy Scheme

- What can a complaint be based on:

- Breaching a regulation

- Departing from guidance

- Bringing discredit on ICAEW

- Complaint does not include Fee disputes

- Who can make a complaint: Anyone

ICAEW disciplinary procedure:

- Conciliation: find practical solution

- Investigation: by Investigation Committee (IC)

- Disciplinary proceedings: by Disciplinary Committee (DC)

Appeal committee (AC) can be involved as well

FRC’s Accountancy Scheme

- Independent investigative and disciplinary body for ICAEW, ACCA, CIMA, CIPFA, ICAS, CAI

- Deal with cases that raise important issues affecting public interest, serious public concern or damage to public confidence in the accountancy profession in UK

- Dealt in 2 ways

- Referrals from accountancy body

- Self-referral

Procedures:

- Executive Counsel carries out investigation

- Can require relevant documents, evidence to tribunal from the accountants and firms

- Disciplinary Tribunal to decide on the complaints filed by EC

- Consists of 3 or 5 people from Panel of Tribunal members maintained by FRC

- To ensure independence, no member of Tribunal can be from any of the accountants’ professional bodies or FRC

- Tribunal hearings are open to public

- Less formal than court proceedings, not restricted in accepting evidence

- Accountant is entitled to attend and be legally represented at hearings

- If complaint is upheld -> Accountant pay all or part of costs

- If complaint is dismissed -> FRC pay legal costs

- But Tribunal does not have power to order compensation to be paid.

- Accountant can appeal to Appeal Tribunal

- To be effective in oversight of self-regulation, FRC uphold

- Transparency: all decisions made are published

- Independency: majority of FRC’s members and chairman are non-accountants

- Fairness: Accountant is able to be legally represented at all times

Chapter 11

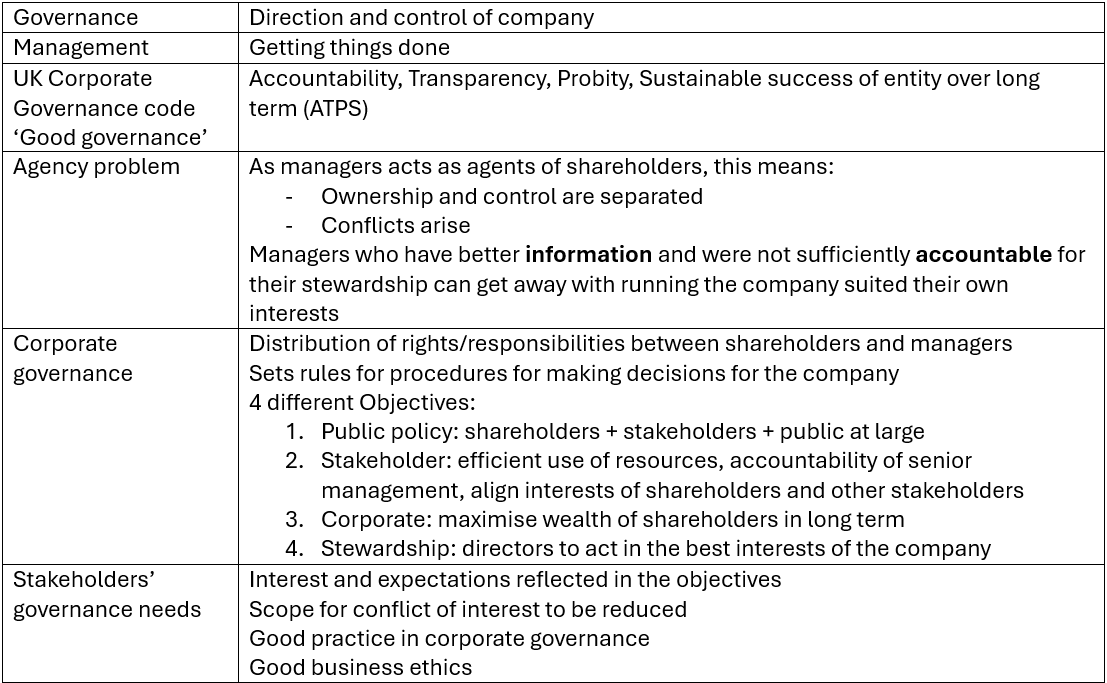

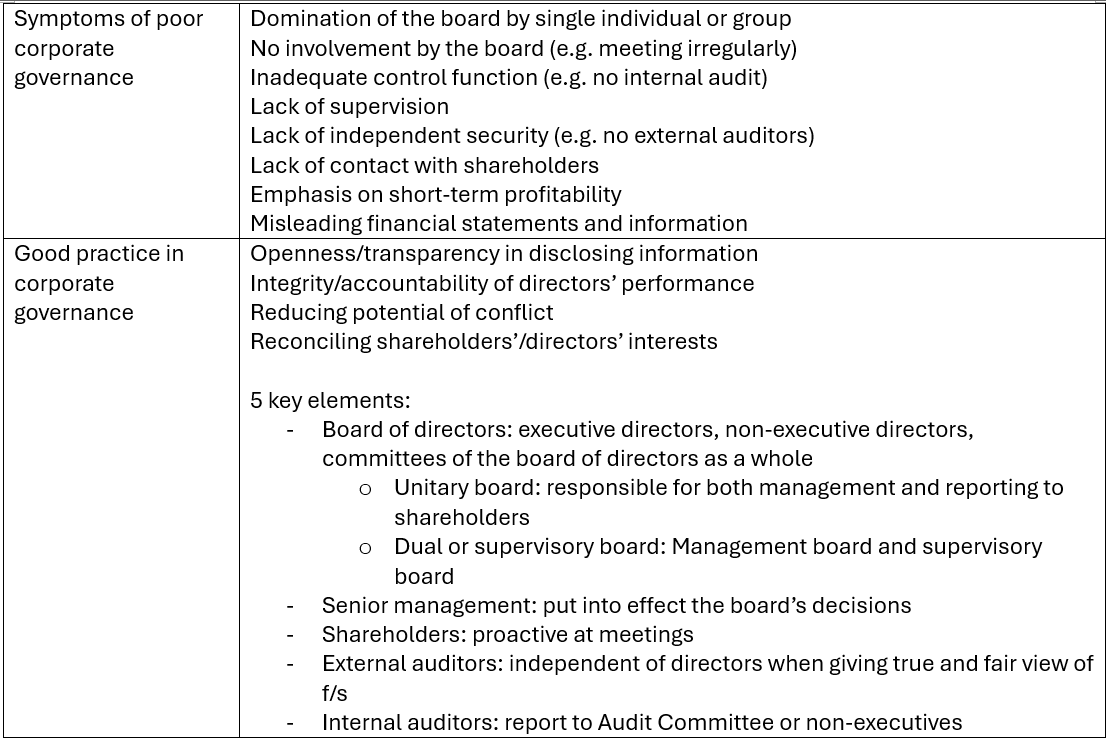

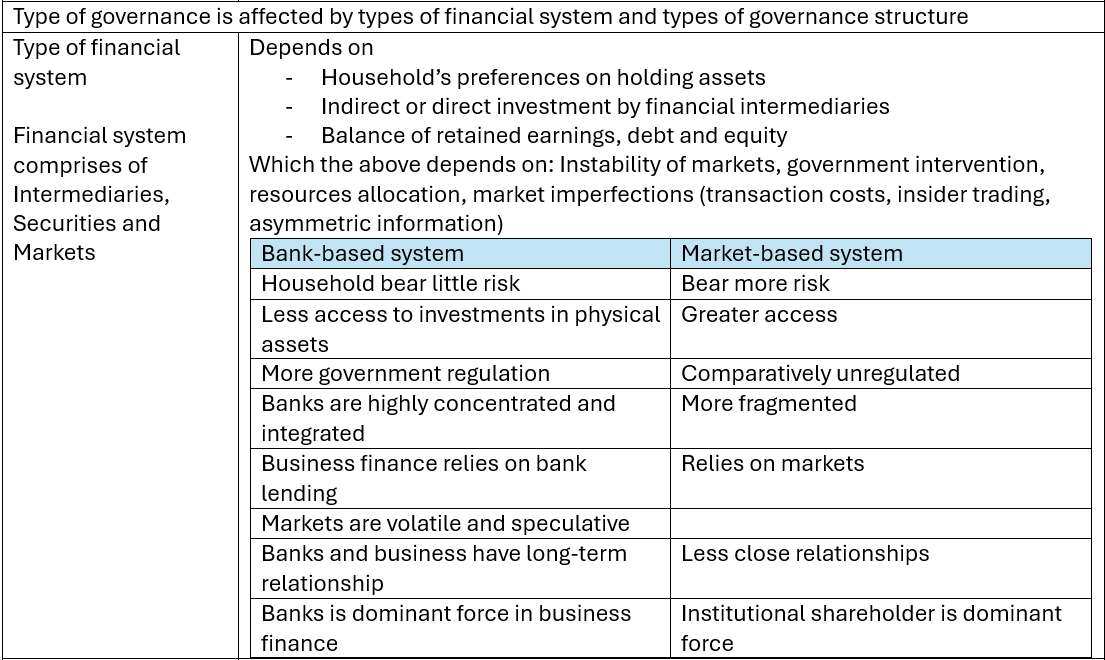

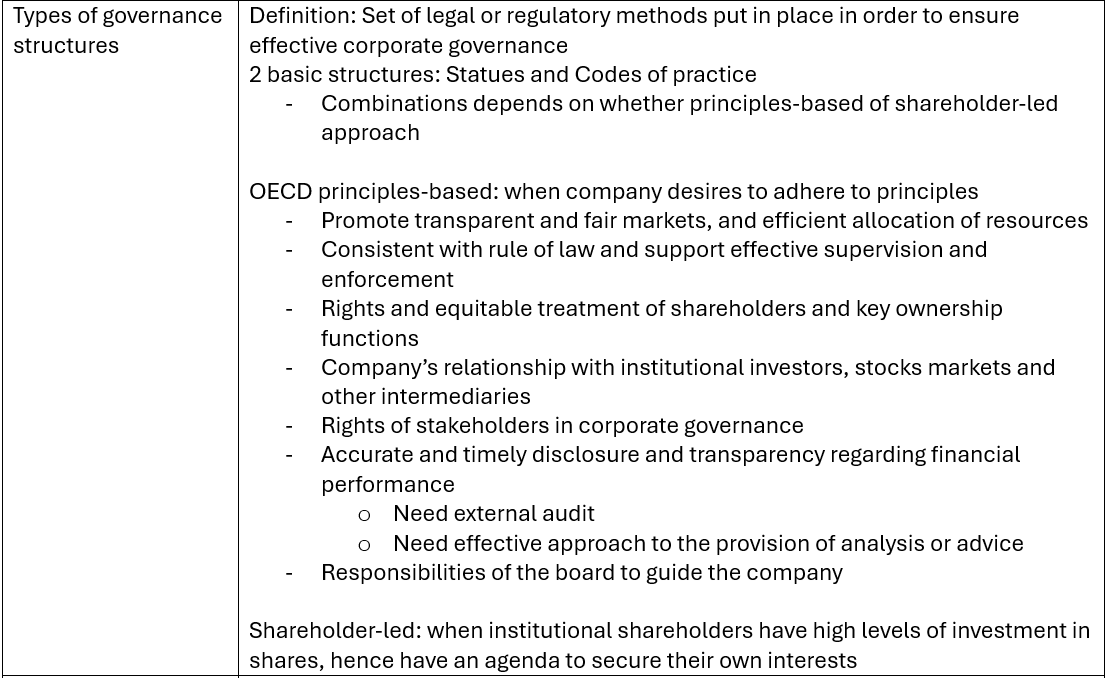

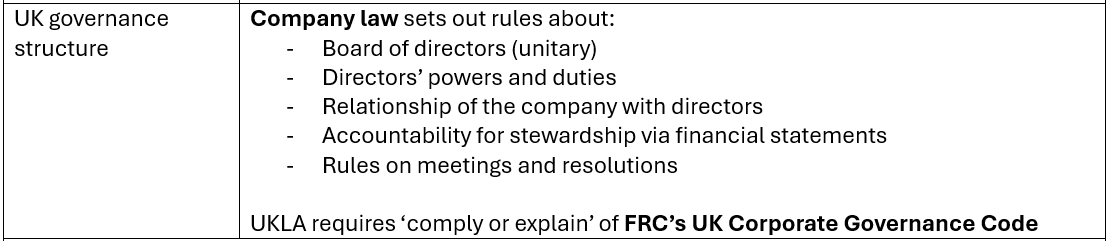

Governance and ethics

Governance

Ethics

Chapter 13

The economic environment of business and finance

Economic environment: Macro and micro

Macroeconomic environment: National and Global

National economy

- National output measured by GDP

- 4 factors of GDP: Land -> Rent; Labour -> Wages; Capital -> Interest; Entrepreneurship -> Profit

- GDP = expenditure by consumers, government and foreign buyers

- Why level of national output is important:

- Aggregate of personal incomes

- Spending

- Growth, amount of production and productivity

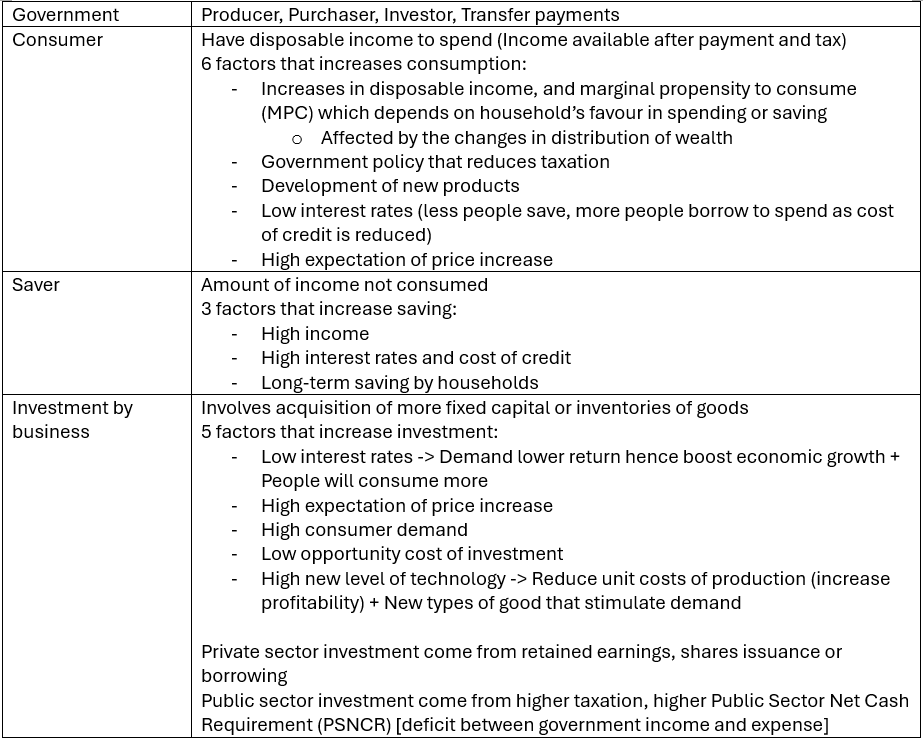

4 different roles:

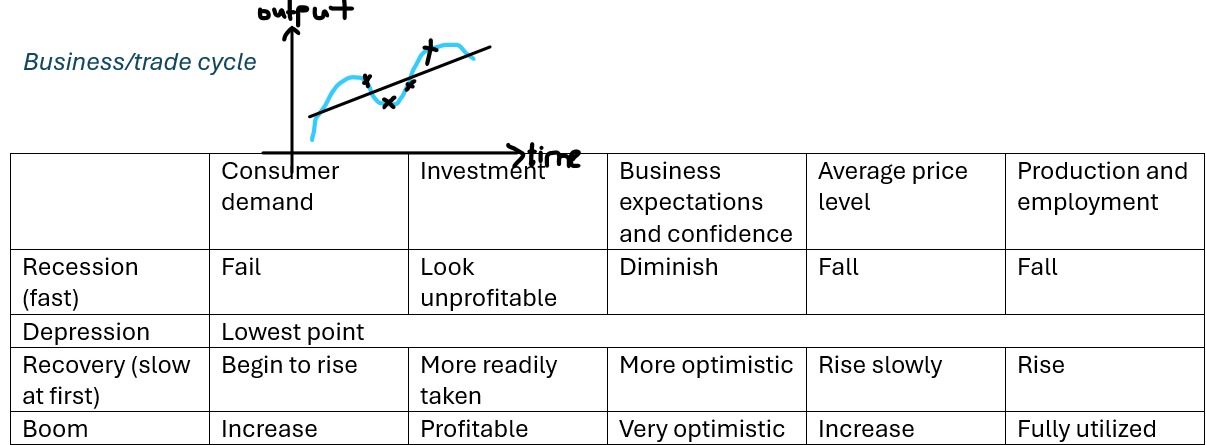

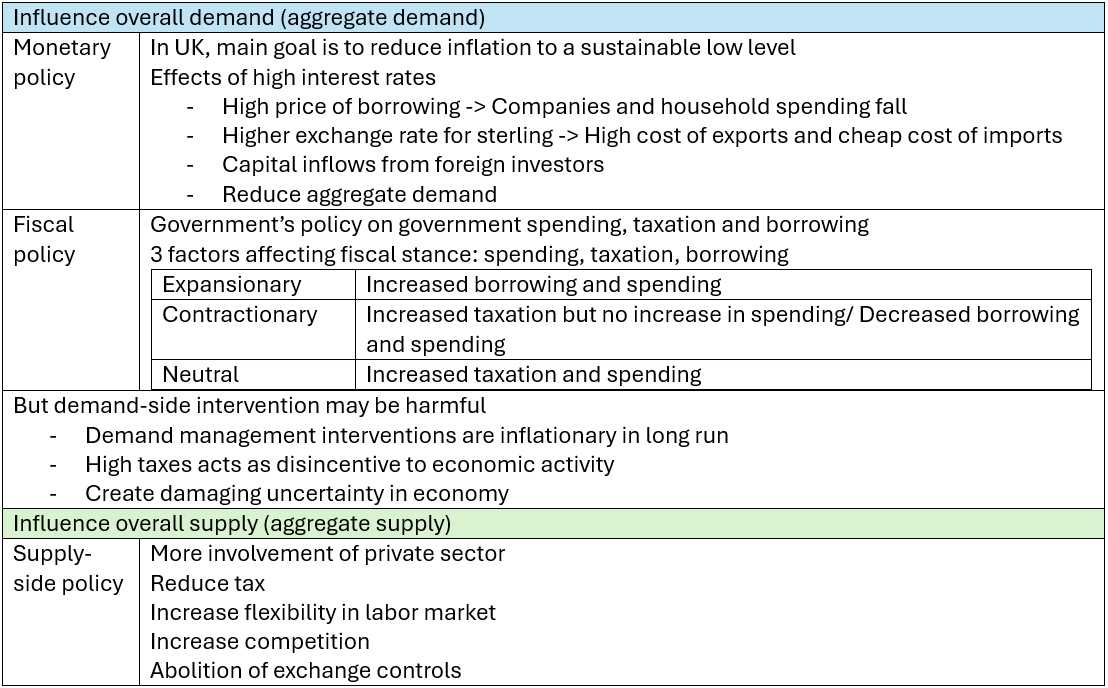

To avoid the boom-and-bust cycle, government intervene by

- Boost demand in recession

- Dampen over demand in boom

Inflation: Increase in price levels and decrease in purchasing power of money

Why is it a problem

- Redistribution of income and wealth from suppliers to customers

- Balance of payment effects: expensive exports and cheap imports

- Price signaling and ‘noise’ in business confidence and forecasting

- Wage bargaining as wage demands increase

- Consumer becomes anxious and push prices up further by increasing demand

Types of inflation:

- Demand pull: Persistent excess of demand over supply

- Fiscal – Increase in government spending or reduction in tax -> high demand

- Credit – Lower interest rates -> higher credits -> high expenditure -> high demand

- Cost push: Increase in costs of production

Once inflation rate rises -> expectational inflation occur -> wage-prices spiral

Government objectives and policies to control inflation

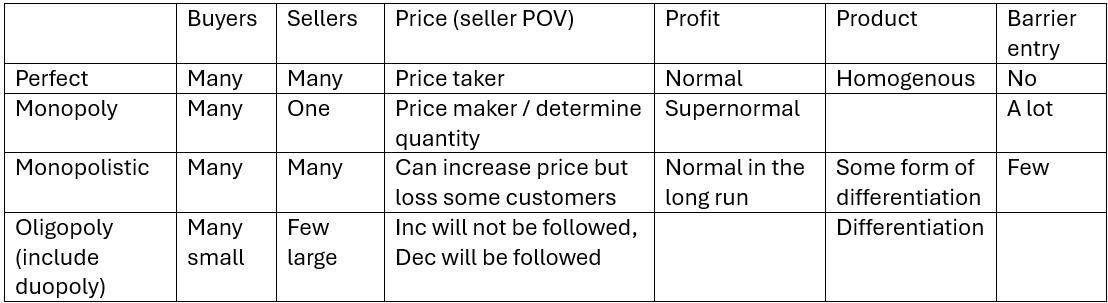

Types of market structure

Market structure: A description of number of buyers and sellers in a market for a particular good, and their relative bargaining power.

Why perfect competition is not in practice:

- Barriers to entry

- Asymmetric information

- Differentiated goods

- There may be collusion

Perfect competition = free market.

- Assumptions of free market: efficient in resource allocation (allocative or productive), impersonal

- In reality, it fails, because

- Market imperfections

- Monopoly: create barrier to entry -> keep price high

- Monopsony: large individual buyers force price to be lower

- Asymmetric information: Consumers have incomplete and inaccurate info cause bad purchase

- Slowness of response: price mechanism takes time to work -> short-run inefficiency

- Externalities (happens when private cost ≠ social cost, private benefit ≠ social benefit)

- PC + EC = SC ; PB + EB = SB

- E.g. EC: pollution; EB: free rider

- Public goods

- Government organizes the production

- Impossible to exclude anyone from its benefits

- E.g. National defense and Policing

- Economies of scale: Able to produce goods at low unit costs

- Internal economies (within business due to production) – More significant

- High specialization and division of labor

- Larger and more specialized machinery

- Large buying economies -> Able to buy bulk at discount

- More efficient holding inventories

- Greater dimension economies of scale

- External economies (when industry grows in size)

- Large skilled labor force -> train new entrants

- Specialized ancillary industries benefit from another larger industry

- Internal economies (within business due to production) – More significant

- Market imperfections

Microeconomic environment

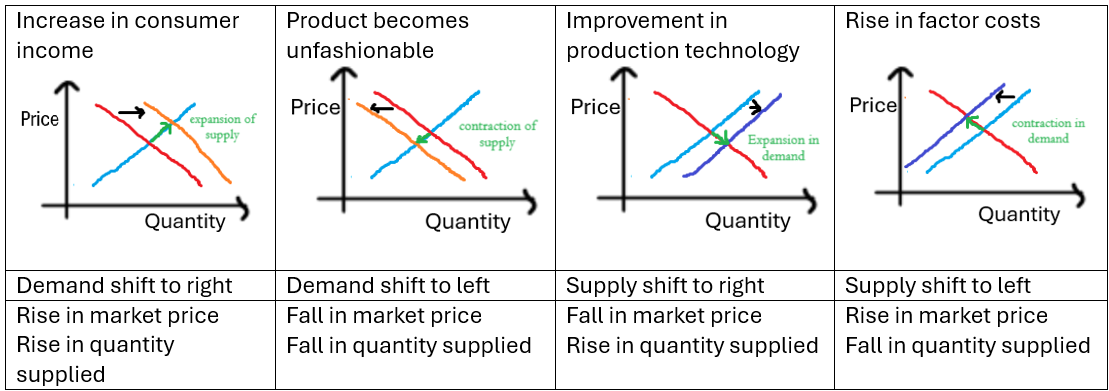

Market mechanism: The interaction of demand and supply for a particular item

Market: potential buyers and sellers come together for the purpose of exchange

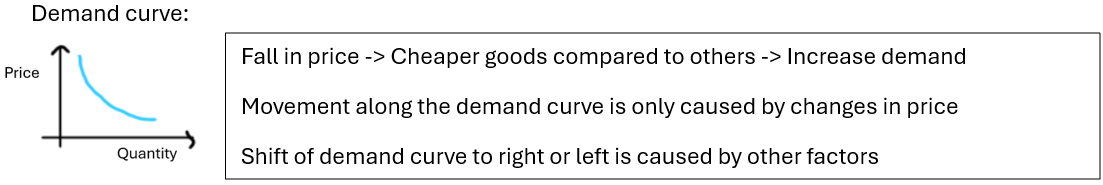

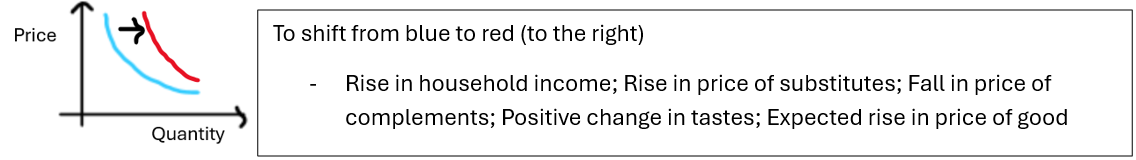

Demand:

Quantity of good that potential purchasers would or attempt to buy at certain price level

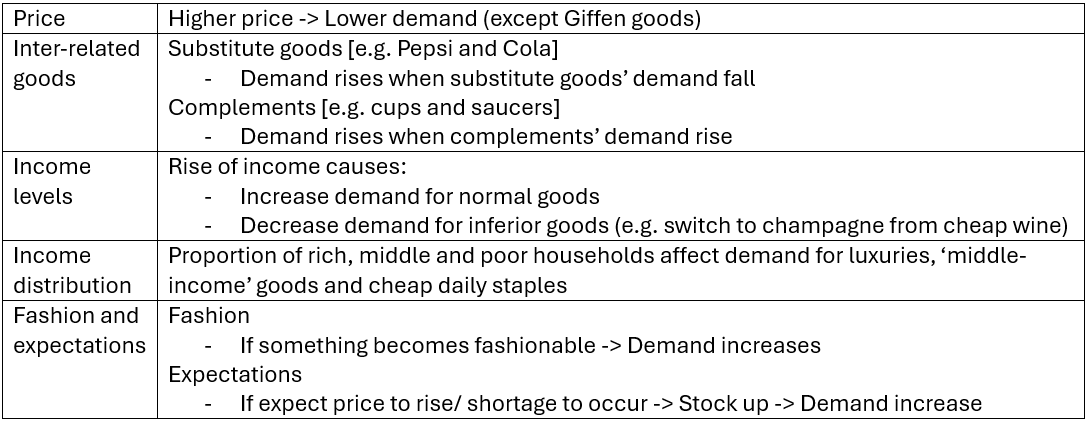

Factors determine demand

- Within (7 Ps) and outside the control of business

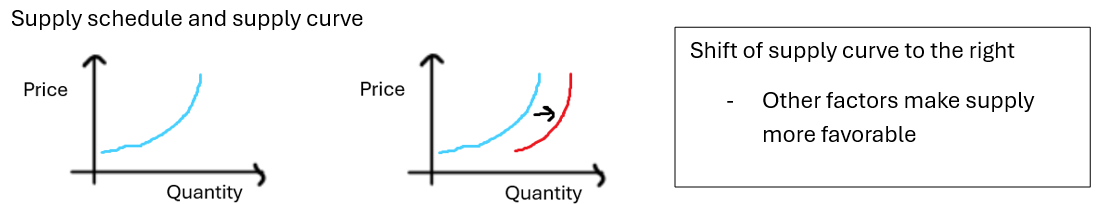

Supply

Quantity of good that existing or would-be suppliers would want to produce at a given price

Factors influence supply

- Price of goods

- Price of other goods [If higher, supplier might want to switch -> low supply]

- Price of related goods [If higher, supplier want to produce more -> high supply]

- Cost of making [If high -> low supply]

- New technologies -> high supply

- Other factors (changes in weather for agriculture, natural disasters or industrial disruption)

Effects of time on supply and demand

- Short run: both supply and demand are unresponsive

- Long run

- Supply: acquisition of new machinery

- Demand: adjust buying patterns [more rapid than supply]

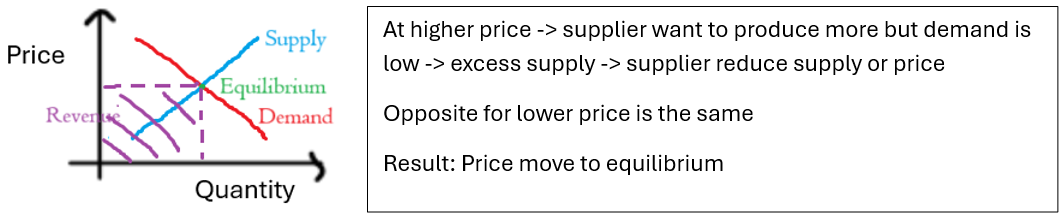

Equilibrium price

Supply decisions are influenced by price signals and incentives.

Efficient market brings supply and demand into equilibrium at market price, which is where the supply and demand curves intersect.

Adjustment to equilibrium

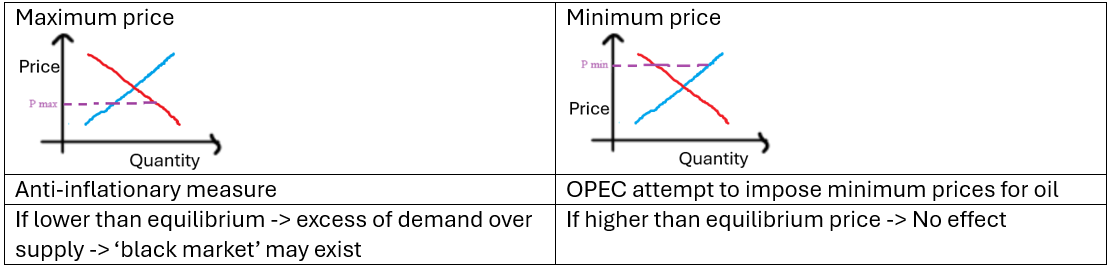

Price regulation by government

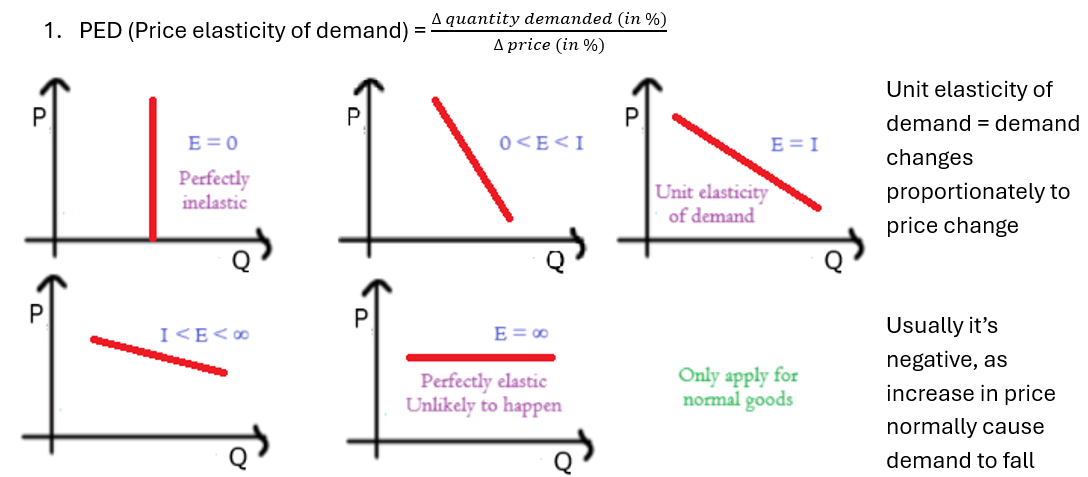

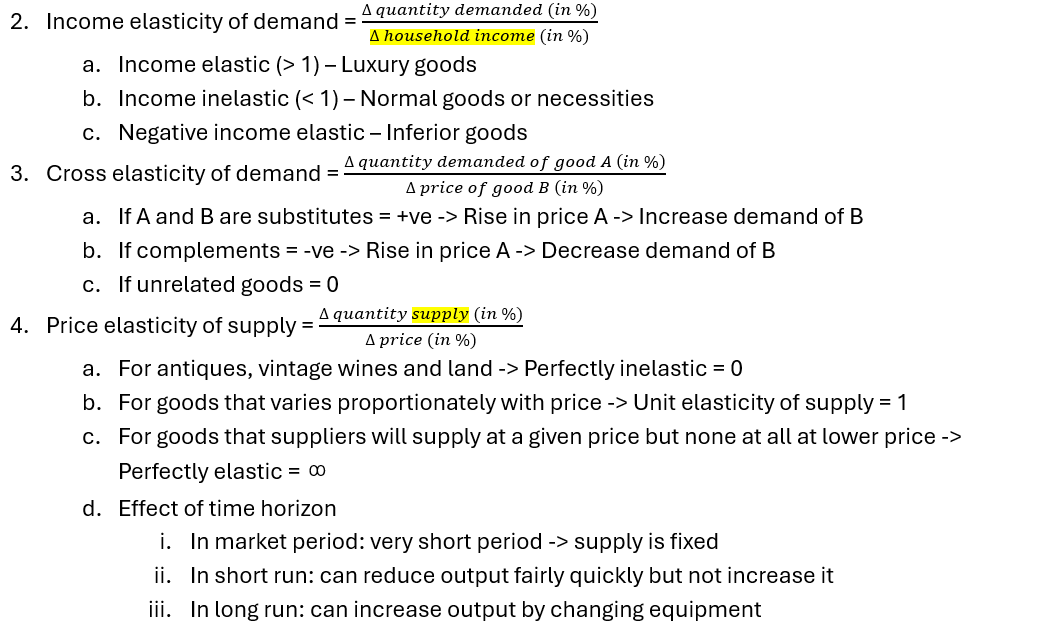

Elasticity

The extent of a change in demand and/or supply given a change in price

Why is this important

- PED>1, Demand is elastic -> Increase in price -> fall in demand -> Expense and revenue fall

- PED<1, Demand is inelastic -> Increase in price -> fall in demand -> Expense and revenue will rise instead

Exceptions: Positive price elasticity in demand

- Giffen goods: increase in price of cheap daily staples -> poor people can only buy this product even though price is higher rather than substitution -> increase in demand

- Veblen goods: increase in price of goods for purposes of ostentation -> higher price makes it more desirable to consumers -> increase in demand

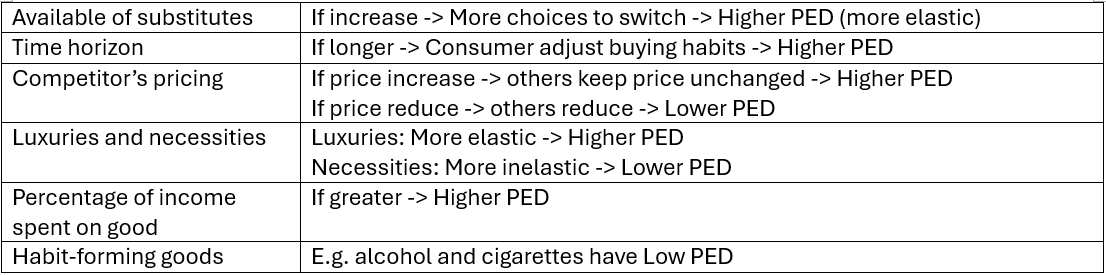

Factors influence PED

Important points from practice questions

- (8) Natural monopoly: the production is associated with low marginal costs and high fixed costs

- (9) Government intervention to correct a market failure: Taxation of goods with negative externalities

- (19) Minimum price below equilibrium: Demand fall; Supply rise

- (21) Basic economic problem facing all national economies: allocating scarce resources (not inflation)

- (23) Source of economies of scale: X new production techniques

- (24) MPC measures: the relationship between changes in income and changes in consumption

- (26) Recession phase is accompanied by improvement in trade balance due to decrease in demand of imports; but is not accompanied by rise in rate of inflation

Chapter 14

External regulation of business

Purpose: Address market failure and externalities; Protect public interest -> Restore balance of power and improve public trust

Ways of government’s intervention to address market failure:

- Provide public goods, merit goods

- Control means of production through state ownership

- Wealth distribution through direct taxation of income

- Create demand for output that creates jobs

- Influence supply and demand through

- Price regulation (min or max price)

- Indirect taxation (restrict supply)

- Subsidies (promote supply)

- Persuasion (influence market)

- Legislation

Legislation and regulation during:

- Market imperfection: monopoly leads to inefficiency -> government intervene through prices or profits

- Externalities: Controls on pollutions (emission, car usage, ban smoking, car insurance and education)

- Asymmetric information: regulation of financial reporting; legally enforced product quality and safety; consumer protection legislation; provision of job centers

- Equity: To improve social justice – Prevent discrimination in labor market; minimum wage; equal access to goods and healthcare

Protect public interest: ensure that needs of other stakeholders can be met (other than shareholders, directors and managers)

Regulation = rule created by government; form of delegated legislation to implement primary piece

Outcomes of efficient regulation (benefits to some people exceed costs to others):

- Address market failures

- Reduce social standing of various social groups

- See through collective desires

- Enhance opportunities for formation of diverse preferences in society

- Deal with problem of irreversibility (e.g. pollution and pension)

Business responses to regulation

- Non-response

- Mere compliance: business pass the cost to clients

- Full compliance: cost absorbed by business

- Innovation: Porter hypothesis – discovery of cleaner technology -> improve production process -> more efficient and cost savings

Regulatory compliance: Systems of business which ensure that people are aware of and comply with relevant laws and regulations

- E.g. Banks: Comply with Basel Accord, regulations by PRA and FCA; Comply with employment and health and safety regulations with other businesses

What is regulated: Competition, Externalities, People in business

Regulation of competition

Why: monopolies are not in public interest as they do not allocate resources efficiently

How is it regulated in UK: Competition Act 1988 and Enterprise Act 2002

- Anti-competitive agreements (to prevent collusion that restrict competition)

- Fix purchase or selling prices

- Limit production, markets, investment

- Sharing markets or supply sources

- Apply different trading conditions

- Supplementary obligations

- Abuse of a dominant position [>40% of market share]

- Same as above, but mainly it’s for big companies

- Cartel activity: agreement between business not to compete with each othe

- Collude on prices, output levels, discounts, credit terms, technology, customers to supply, who should win contract (bid rigging)

- Occur when few competitors, similar products, established communication channels, excess capacity in industry, economic recession

- Type of market failure due to market power

Competition and Markets Authority (CMA): Government body that is responsible for promoting effective competition. Is responsible for:

- Investigate mergers

- Conduct market studies

- Investigate breaches of the 3 agreements

- Bring criminal proceedings

- Encourage sector regulators to use their competitive powers

CMA can:

- Enter premises and demand relevant documents

- Impose fine

- Cause adverse publicity

- Make Competition Disqualification Orders against directors

Takeover Code: general principles and rules set out in the City Code on Takeovers and Mergers to ensure merger activity does not undermine competition in the UK

Regulation of externalities

By influencing external costs and benefits to affect level of supply through:

- Price regulations (min and max price)

- Taxations or tariffs

- Subsidies to suppliers (e.g. encourage exports)

- Regulation by quotas, standards and fines

- However, regarding pollution by emissions trading, it is hard to set fines and quotas

Regulation of people in business

Purpose:

- Prevent insider dealing, which is to make profit when trading shares on insider knowledge [guilty for market manipulation]

- Prevent market abuse (follow Code of Market Conduct)

- Insider dealing include improper disclosure and misuse of information

- Manipulating transactions and devices

- Dissemination of false information

- Distortion and misleading behavior

- Prevent fraudulent trading

- When directors continue to trade even when company cannot pay its debts as they fall due (insolvent), with the intent to defraud creditors

- Directors may face criminal sanctions

- Prevent wrongful trading

- When directors continue to trade even knowing that there was no reasonable prospect of the company to avoid insolvent liquidation

- Higher standards are applied to professional accountants

- Prevent money laundering (very extensive regulations)

- CCAB issued Anti-Money Laundering Guidance for Accountancy Sector

Under Company Directors Disqualification Act 1986, director can be disqualified if

- Insider dealing

- Fraudulent or wrongful trading

- Violate competition laws

- Convicted of offence, Unfit, Consistently in default with law requirements

- Threat to public interest

- Make loans that cannot be paid

Government legislation is also affected by international legislation

- Markets like gambling and drugs are global, but legislation differs with government policy

- US and EU have huge influence over the globalization of regulation

- International organizations like WTO, IMF, ICC have extensive power of influence

- US corporations are effective in enrolling their power to their government for own interests

- Business needs to remain alert to the general thrust of regulation

International regulation of trade

Free trade’s advantages lie on comparative advantage of countries on their expertise

Two main routes of benefiting from industrialization:

- Import substitution by manufacturing goods itself

- Export-led growth relies on cheap labor

Advantages of encouraging international free trade

- Countries specialize -> efficient resource allocation

- Countries that have surplus can export to countries that have deficit

- Competition is increased -> prevent monopoly

- Larger markets -> companies benefit from economies of scale

- Development of trading links provide foundation for closer political links

However, nations can set up barriers to international free trade via protectionism practice to protect home industries against foreign competition

- Tariffs or custom duties: taxes on imported goods -> leave price paid to foreign producers

- Import quotas or embargoes (0 quota): restriction on quantity

- Hidden subsidies for exporters

- Export credit guarantees (insurance against irrecoverable debts for overseas sales)

- Financial help

- Administrative assistance

- Import restrictions:

- Complex import regulations

- Special safety standards demanded

- Government action to devalue the nation’s currency (reduce foreign exchange value)

The End

Finally

The Business, Technology and Finance CFAB study is more long-winded than I thought, and there is certainly overlap of information with the Accounting study. Apologies to the completely omission of Chapter 12 for now. Once again, please note that certain details might have been overlooked, and I welcome any feedback or corrections from fellow professionals. Happy studying~

A big shoutout to my sister's friend for providing her notes to aid in my studies 📓