Investing & Trading #1

A starter of my learning of investing and trading journey, where I reveal a unique occasion that sparked my interest and set me on a course of financial discovery. I'll share not only the 'why' behind my interest but also the 'how'—strategies, tools, and insights that promise to illuminate the path to financial mastery.

Why am I interested?

A cool way of earning money

Three years ago, I possessed zero knowledge of investing and trading. It was merely an online buzzword appearing in advertisements as a seemingly quick way to earn money. Simultaneously, it carried a sense of danger, with numerous stories circulating about individuals losing all their money through such activities. As a junior college student majoring in math and science, I didn't align myself with this subject matter.

My introduction to the world of investing and trading came at the end of 2022 when my mom introduced me to an online webinar program called Black Market by Piranha Profits. This exposure brought me to the surface of investing, and while I may have forgotten many details shared by Adam Khoo, the main host, and other speakers, a fundamental lesson remained deeply ingrained — the notion that savings in a bank would devalue with rising inflation, and investing in good stocks offered a way to build wealth over the long run. The webinars fascinated me with terms like 'REITS,' 'LTV ratio,' 'S&P 500,' 'intrinsic value,' and more.

Upon getting acquainted with REITS investment, stocks, and options trading, my mom asked if I was interested in delving deeper into investing and trading. My resounding 'yes' prompted her to invest in online courses, despite their cost. While we envisioned wealth-building through these skills, the reality didn't align with our expectations. Juggling high school studies at NUS High School, I found prioritizing sleep and relaxation more critical than immersing myself in investment and trading skills. My mom, too, became distracted, seeking advice from various gurus she deemed more diversified, which proved less effective than persistent practice. Limited funds posed another challenge, especially considering the relatively low ROI in the short term.

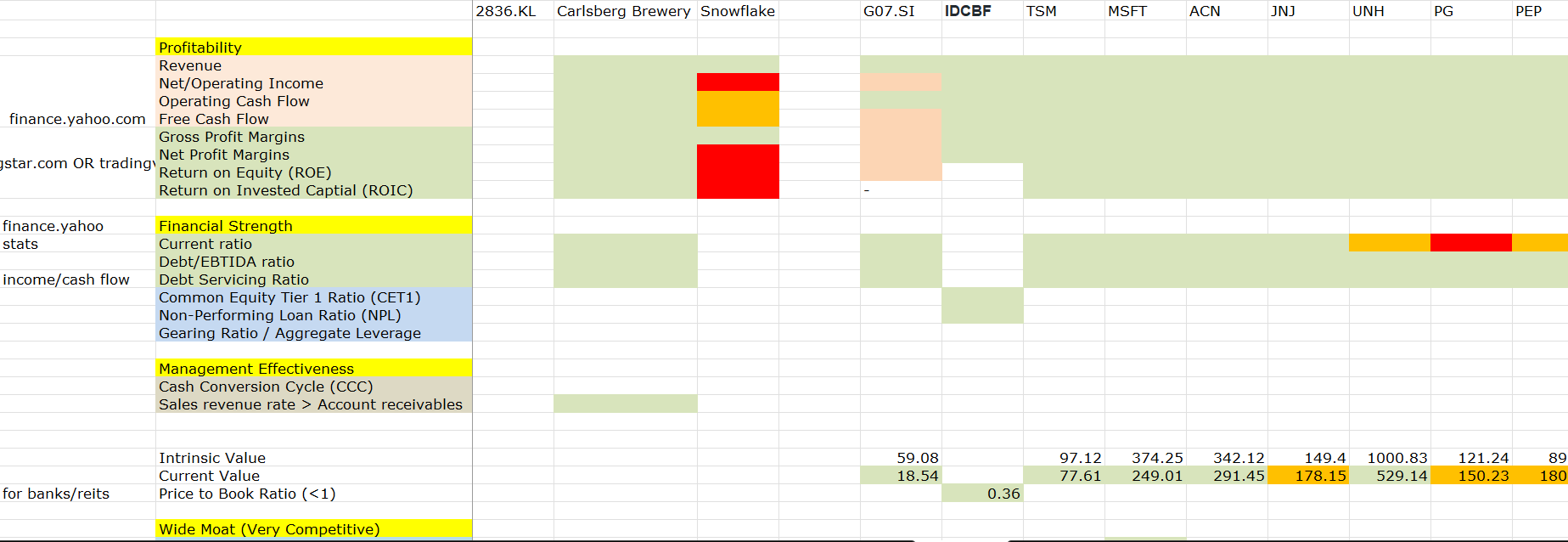

Nevertheless, I completed the courses before my 2023 school year commenced. I acquired valuable investing skills, from fundamental analysis to identify great businesses to stock valuation and technical analysis for timing buy entries. Despite meticulously noting down insights and creating Excel sheets to record evaluated stocks, it felt like 'talking military strategy on paper' (as the Chinese saying goes, 纸上谈兵) without actual funds to apply the knowledge.

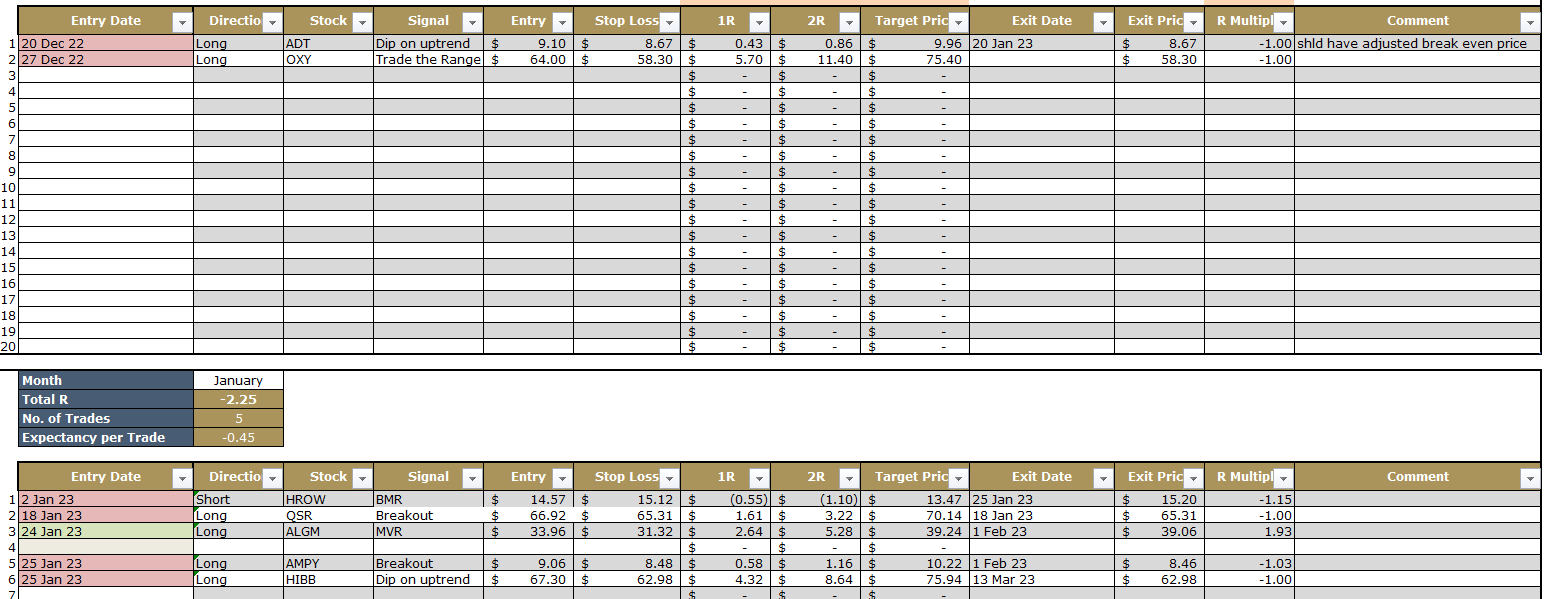

Moving on to trading, I experimented with fake money in early 2023. However, a few weeks into it, faced with losses and the discouraging sight of red numbers, I gave up. The challenges, combined with school workload, led me to abandon tracking my trading records and focus on academics.

Now, having recently graduated from high school, I find myself with ample time and no excuses to refrain from reengaging with investing and trading. It's the only financial-related hobby I'll embrace, marking the beginning of my journey to document investing and trading records in the coming years.

How am I learning it

2 methods that I'm using

It's not solely about acquiring knowledge but also about conditioning my mindset to endure the market's fluctuations and maintain long-term motivation. Therefore, I'll be dividing my approach into two main strategies.

- Learn: I am presently enrolled in Adam Khoo's investing and trading courses. In the investing course, I delve into the psychology of investing, fundamental analysis for identifying strong businesses, stock valuation, portfolio building, and information on relevant brokers. On the trading front, the courses cover technical analysis, position sizing, crafting a trading plan, and various techniques like breakout within base, explosive breakout, and Bollinger mean reversion.

It's insufficient to merely grasp the concepts without actual practice, especially in trading. For investments, I just need sufficient funds to purchase them at a discounted price during a bear market.

Therefore, the second approach involves:

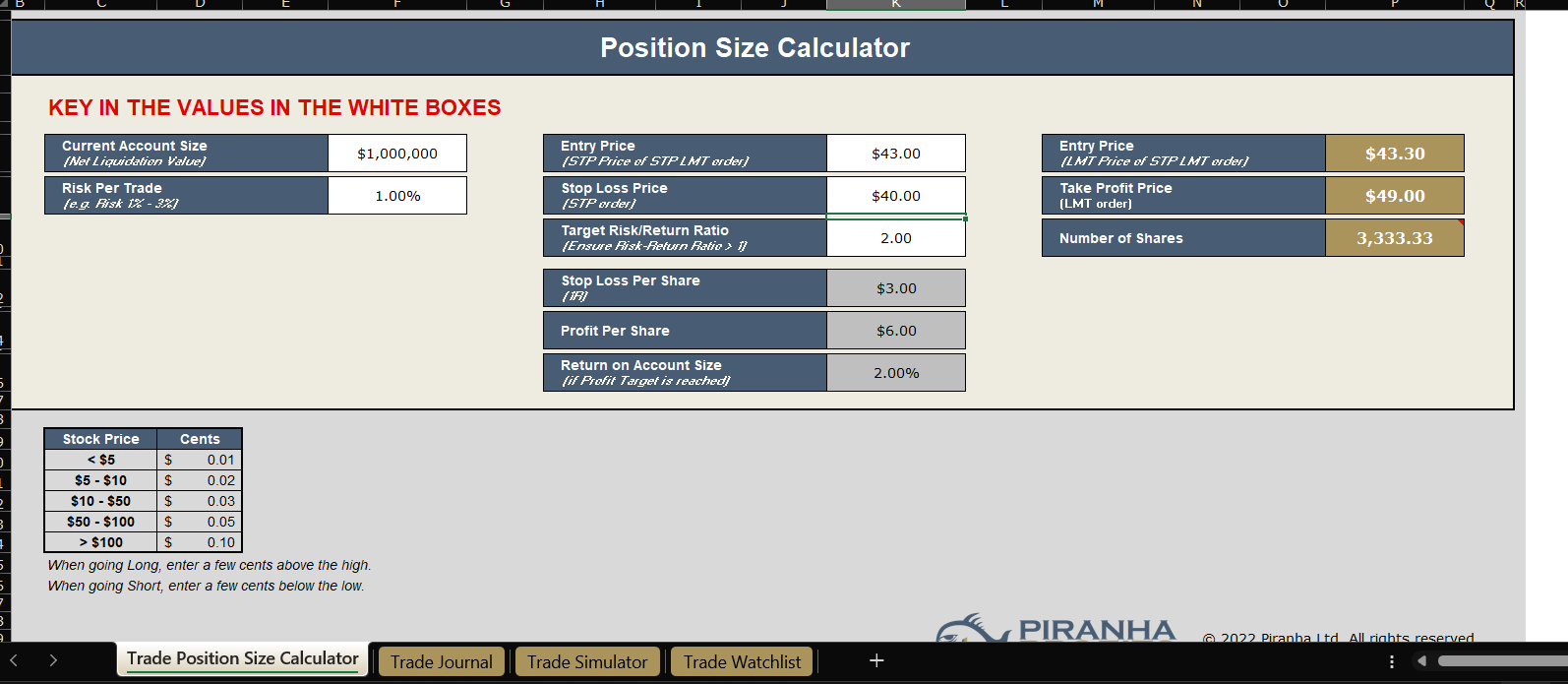

- Practice: I've opened my own IBKR account and am currently utilizing the paper trading function on the mobile app to monitor my success rate in trading. Additionally, through Adam Khoo's courses, I've obtained a trading tool in Excel format that enables me to maintain my trade watchlist and journal. This tool proves extremely useful, providing a systematic and straightforward approach to trading.

As I have a considerable amount of free time in the upcoming months, I have established distinctly clear goals for honing my trading skills (Read more on https://www.ooijianhui.com/goals-setting-for-2024/).

These will be my methods for learning investing and trading. Echoing Warren Buffett's words, "The stock market is a device for transferring money from the impatient to the patient." I place my trust in the influence of time to shape my psychology and skills in investing and trading, provided I diligently practice until they become integral parts of my habits and identity.

Stay tuned for more updates on my trading and investing journey

I'll be sharing tips and lessons from my experiences